This is the new normal in US-China trade

- The US-China dispute has ended past trade practices.

- China is a powerful, developed economy, it cannot claim otherwise.

- Phase one is the new normal, a second agreement will take considerable time.

- Even the limited current deal has potential for a global economic rebound.

Whatever the future holds for the evolving US-China trade relationship, there is no going back to the model of the past thirty years.

China is a modern economy. Its decision to break with its own past and adopt capitalism was facilitated by the vast amounts of investment and expertise provided by the developed world. The phenomenal growth of China’s economy over the past generation has brought the mainland into the center of the global economy. Beijing can point to a success that the Communist rulers of the Soviet Union could never offer their people, an appreciably better life.

For Western governments, the trading relationship was based on the idea that if the Communist and largely isolationist Beijing regime could be integrated into the world economic system the political benefits would far outweigh the economic costs. It was an arrangement that exchanged cheap consumer goods for manufacturing jobs and technology, economic engagement for political opposition.

The world of 1989 and its considerations are gone. The Soviet Union and its empire are no more. China is a developed nation and has been for at least a decade.

American President Donald Trump’s trade war with China is a recognition of reality. China does not need preferential terms to lift its economy from poverty nor does access to inexpensive labor warrant the technology transfers it has long demanded.

A new relationship between the world’s two largest economies is beginning with this trade treaty. That is the best place to look for the shape of things to come.

According to the agreement, the US has ended proposed tariffs on $160 billion of Chinese imports that had been set to take effect on December 15th. These goods, largely consumer items, were the only remaining Chinese imports without tariffs. The US has also agreed to reduce some of its existing duties. In return, China has agreed to purchase large amounts of American agricultural products and has made new promises on protecting intellectual property, forced technology transfers, ownership and currency manipulation.

The specific terms of the deal have not been announced. According to reports, US Chief Trade Representative Robert Lighthizer has said he expects the 86-page agreement will be made public after signing.

Recently, China was reported to have approved for import a new strain of soybeans developed by a US firm. Genetically-modified agricultural products have been a source of disagreement between the countries. The US has argued that China is using the topic to create non-tariff barriers to American farm imports.

President Trump said on December 31st that "I will be signing our very large and comprehensive phase-one trade deal with China on January 15. The ceremony will take place at the White House. High-level representatives of China will be present. At a later date, I will be going to Beijing where talks will begin on Phase Two!"

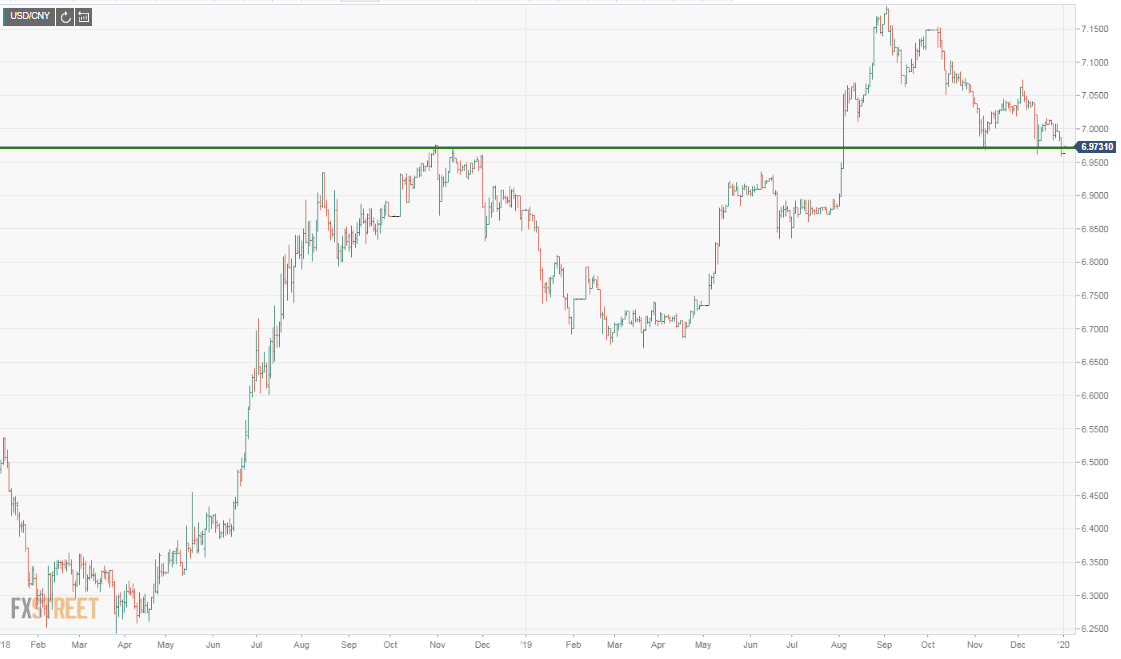

USD/CNY to drop after phase-one deal is signed

Once the accord is official and the text scrutinized, markets will begin looking for tangible indications that it is working. The most important initial test will be psychological. Has the agreement allayed the fears of a global slowdown and recession that have been building for two years? Will the deal move the US-China relationship from confrontation to cooperation?

On the Chinese side, there should be two rapid changes both controlled by the government.

First, agricultural purchases from the US should make an immediate impact on global markets. Second, the yuan (USD/CNY) should drop conclusively below 6.9700 (where it is as of this writing, 1/2/20), which was the top from the start of the trade dispute until this past August, when the People’s Bank of China permitted it to sink beyond seven to the US dollar as the trade-war rhetoric escalated.

FXStreet

In the US, the most telltale signs of the effect of the trade war have been in the business sector. Sentiment in services and manufacturing has been declining for more than a year. That is where we will look for hints of improvement.

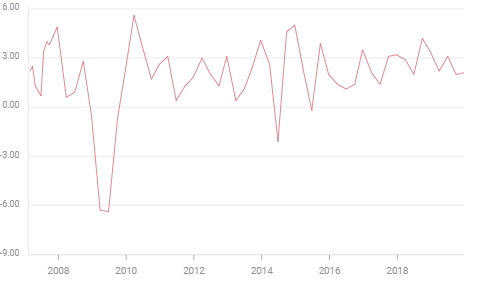

For the much smaller – but indicative – factory sector, the purchasing manager’s index from the Institute for Supply Management has been in contraction for five months, with December’s result an unexpected drop to 47.2 – 49.0 had been forecast – showing that the pending China trade deal as yet has had no positive impact on the outlook in manufacturing.

Manufacturing PMI

Services have fallen from a 2019 high of 59.7 in February to 53.9 in November. For both sectors, component indexes in employment and new business have also dropped sharply in 2019.

Business investment has collapsed in the second half of the year. The Durable Goods category – Non-Defense Capital Goods Ex-Aircraft – a commonly-used proxy for business spending, has slipped from an average 0.35% monthly gain in the first half of 2019 to a barely discernable 0.02% in the five months from July through November – and that includes a gain of 1.1% in October, the first positive month in three, and 0.1% in November.

Nondefense capital goods orders ex-aircraft

FXStreet

The retreat in business sentiment and investment have been a direct effect of the concerns, domestic and global, that a prolonged and deepening trade dispute between the US and China could throw the world economy into recession. Business executives have taken the sensible approach that it is better to wait for the result of the trade talks than to invest and see your new factory buried in a global downturn.

We shall see if this agreement has allayed recession fears and put manufacturing sentiment on a return to its optimistic potential of 2018. But sentiment is not sufficient, the deal needs to liberate the deferred business investment of the past year and to encourage expansion. That would be the second tell of a successful agreement.

The longer-term impact of the trade deal will be on economic growth in the two nations.

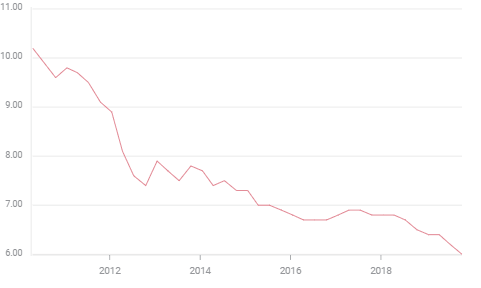

China’s third quarter’s GDP of 6% was the lowest of the post-Deng era. Long gone are the government pronouncements that 8% was the lowest acceptable growth rate. Fourth-quarter GDP will be reported on January 17th.

China GDP, Y/Y

FXStreet

In the US, GDP has slipped from 3.1% in the first quarter to an average of 2.05% over the next six months and is tracking at 2.3% in the Atlanta Fed’s estimate for the fourth quarter.

US GDP, Annualized

The decline in economic activity is largely due to the near halt in business investment. The US consumer, propelled by a buoyant job market and rising wages, has been the main support of the economy in the last three quarters. While household spending shows no signs of retreat and optimism is reflected in strong reading in the Michigan and Conference Board Surveys a prolonged recession in manufacturing and exports could eventually infect the overall economy.

The relationship between the US and China will be evolving for many years. We will soon know if this first step has encouraged the taking of many more.

The end of the US-China and Brexit USD-safety trade

This agreement will diminish and end the specific US dollar safety trade that the US-China dispute and Brexit had fostered at various times in 2019. With the Fed and most central banks on hold, currencies will return to economic comparisons for direction. In that, the US is likely to prosper. The ECB's new leader Christine Lagarde has spoken about the need for fiscal – not monetary – help for the European economy. We will see if she proves any more successful in obtaining such than her predecessors. If the trade deal is successful in reviving global growth, it could make her request superfluous. It will certainly make it a non-starter in European capitals.

The potential trade between China and the United States is enormous especially as the mainland’s middle classes expand. A resumption of robust growth in both economies could easily carry the globe and particularly the troubled eurozone to a successful recovery in 2020. At the least, a truce in the conflict will permit a modest increase in GDP and the longer the truce lasts the stronger its beneficial effect on the world economy.

In the end, it will be the decisions of individuals, business executives, investors and consumers that will determine the future of the relationship, not the specific terms of this or future trade agreements.

This article belongs to the 20 trading ideas for 2020 series. Check the full list of 2020 pieces.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.