Think ahead: US inflation and CEE data in focus

We’re looking for stronger GDP data and a 0.2% month-on-month core PCE deflator print in the US next week – which should keep current Fed rate cut expectations firmly in place. Across the CEE region, we’ll be keeping an eye out for Hungary’s upcoming central bank meeting alongside a flurry of data releases in Poland and the Czech Republic.

Think ahead in developed markets

United States

GDP (Thu): The advanced estimate of second quarter GDP growth and the June core personal consumer expenditure deflator will be the key data points to watch next week. Growth was a rather tepid 1.4% annualised in the first quarter, with consumer spending a subdued 1.5%. We are expecting a stronger outcome this time, closer to 2.5% versus the current consensus forecast of 1.7%, reflecting a better consumer spending story, rising inventories and slightly stronger investment readings. Nonetheless, there are challenges for the economy and we expect to see weaker growth in the second half of 2024, with the Federal Reserve cutting rates from September.

Inflation (Fri): The core PCE deflator is expected to come in at 0.2% month-on-month, with risks skewed towards the downside. The core CPI print was just 0.1% MoM, but some of the PPI inputs into the PCE deflator, such as portfolio fees and transport, favour 0.2%. Even so, this would be tracking at the run rate required to deliver 2% year-on-year inflation over time and should keep those interest rate cut expectations in place.

Think ahead for Central and Eastern Europe

Poland

Retail sales and construction (Mon): June industrial output data surprised to the upside, confirming that Poland’s economy is continuing its recovery. Data on June retail sales and construction output (both released on Monday) will complete the overall picture of the country's economic developments in the second quarter of this year. We forecast that real sales of goods expanded by 5.1% YoY last month, while construction activity declined by 6.0% YoY. All in all, we estimate that industrial output increased slightly in the second quarter after five consecutive quarters of annual declines, retail sales performance was broadly similar to the first quarter of the year and the scale of decline in construction output eased. That fits into our scenario of a continued economic recovery in Poland. We estimate GDP growth in the second quarter of 2024 at 3.0% YoY vs. 2.0% YoY in the first quarter. Some leading indicators point to easing economic conditions in the third quarter of this year, but we still see Poland’s economy expanding by 3% this year after 0.2% growth in 2023.

Hungary

NBH meeting (Tue): The second half of the year brought a new playbook, with a pause also introduced as an option. We expect Hungary's central bank to leave rates unchanged at the July meeting, but the latest communication suggests that further rate cuts seem inevitable. As a result, we are lowering our 2024 terminal rate call by 50bp to 6.50%.

Wages (Wed): The pace of wage growth has been gradually decelerating since the beginning of the year, albeit at a slower rate than many business surveys had indicated. This time, however, we expect a more pronounced slowdown to 12.5% YoY in May, mainly due to seasonal factors. As the start of summer approaches, seasonal hiring is expected to pick up, which usually tends to push down wage outflows to some extent.

Unemployment rate (Fri): Despite a recession in 2023, the labour market remains resilient as companies tend to hold on to workers in a structurally tight labour market. Industry is also adapting by reducing working hours rather than headcount, which bodes well for employment prospects. In addition, the pick-up in seasonal hiring poses a downside risk to the unemployment rate.

Czech Republic

Business confidence (Wed): Czech business confidence likely weakened in July, reflecting the mediocre industry performance of recent months. It seems that the industrial activity of the Czech Republic's main trading partners has also lost steam, which will trickle down to lukewarm new orders and put a lid on business expectations.

Consumer confidence (Wed): Czech consumers are generally better off, especially in terms of buoyant real income and soft consumer prices. The labour market is also still in good condition. However, the perception of the recovery still being fragile and perhaps showing some cracks could affect the consumer’s mood.

Key events in developed markets next week

Source: Refinitiv, ING

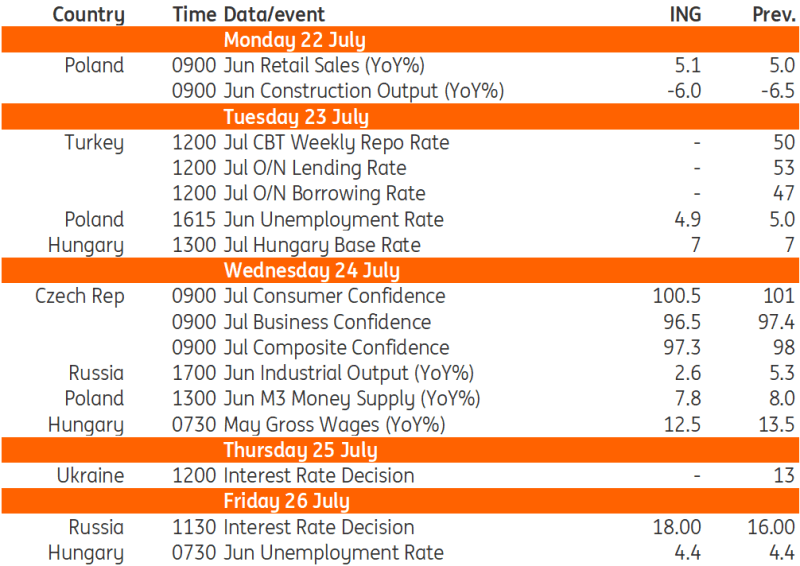

Key events in EMEA next week

Source: Refinitiv, ING

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.