Think ahead: CEE region in focus

Our take on what a quieter week ahead could bring for markets across Central and Eastern Europe.

Think ahead for central and Eastern Europe

Hungary

Current account (Mon): Based on high frequency data, we see a significant deterioration in the current account surplus in the third quarter, mainly via the goods balance. Nevertheless, the year has turned out much better than expected, and the current account surplus will be well above 2% of GDP in 2024 as a whole.

PMI (Thu): This is still a very unpredictable number, but in general we think it will continue to hover around the 50 mark. This time it will probably be a bit lower due to increasing uncertainty about external demand.

Czech Republic

Business and consumer confidence, (Mon): Czech consumers’ mood likely improved, as is usually the case in December, with most spenders feeling better when letting their savings flow toward a bit of happiness for their loved ones. Meanwhile, confidence in industry likely softened in the same month, correcting the previous gain.

PMI (Thu): The doom in European industry sees no end, while recent price spikes in the electricity market show that some pressing issues are deeply rooted, with a proper cure being anything but simple.This will also be reflected in a softer manufacturing PMI for December.

GDP (Fri): We don’t expect any surprises from the final GDP estimate for the third quarter of 2024. Household spending should be confirmed as a primary driver of the current economic rebound, while fixed investment may prove the main drag.

Turkey

The Central Bank of Turkey's communication suggested that we are nearing a gradual rate-cutting cycle, implying a December move as a real possibility. The revised guidance also tied rate cuts to both realised and expected inflation, implying that the bank will closely watch ex-ante and ex-post real rates. We expect a 250bp cut from the bank this month, though we do not rule out a smaller move given the higher than expected November inflation reading, which implies continuing challenges to disinflation efforts. In December, we expect the downtrend in annual inflation to continue from 47.1% a month ago to 44.8% (with 1.4% month-on-month).

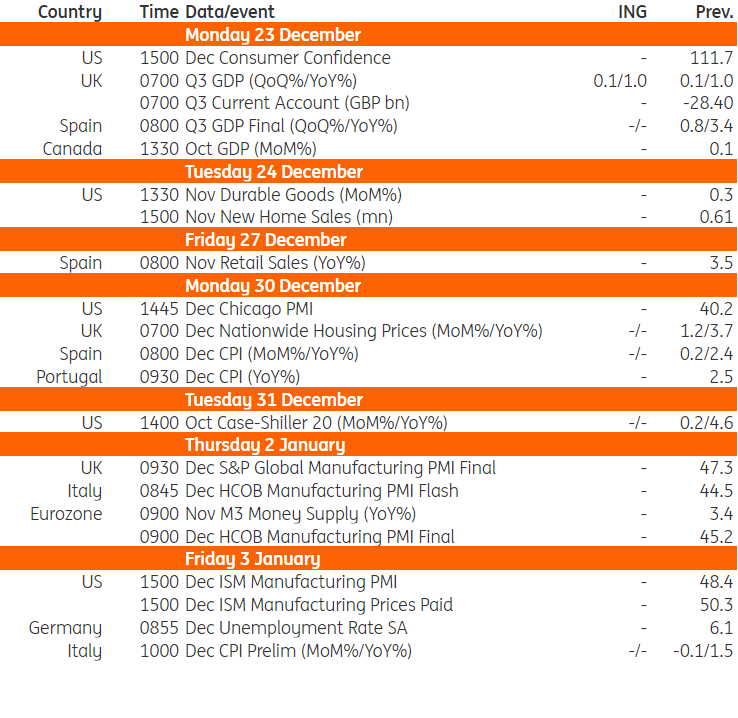

Key events in developed markets next week

Source: Refinitiv, ING

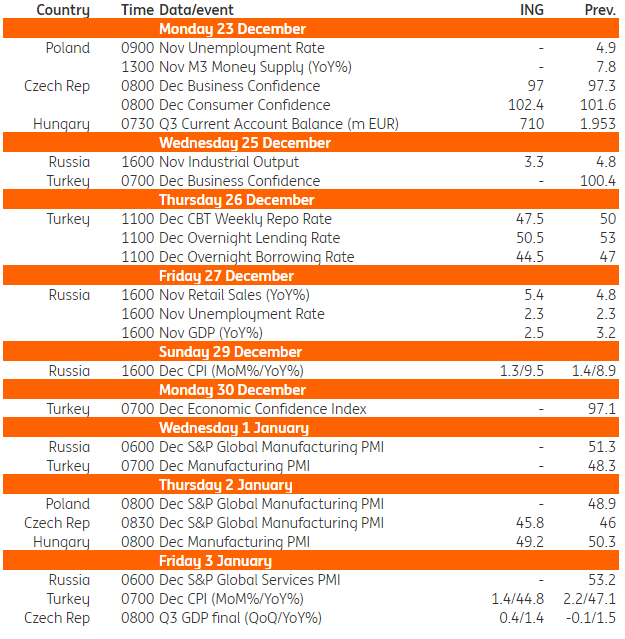

Key events in EMEA next week

Source: Refinitiv, ING

Read the original analysis: Think ahead: CEE region in focus

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.