The weekender: Will the US embark on a new cycle of exceptionalism?

Markets

Wall Street roared back to life on Friday, shaking off a jittery start to the new year and snapping a five-session losing streak. The day's trading bore the hallmark of the classic 'virtuous cycle' that defines modern market dynamics: traders unshackled from last year’s year-end balance sheet restrictions, aggressively bought into risk and sold volatility, setting the stage for a robust reaccumulation of exposure to start the year.

Tech stocks shone brightly, with Nvidia surging 4.3% and Super Micro Computer soaring nearly 8%, buoyed by ongoing investments in artificial intelligence. The sector was further electrified by Microsoft's announcement of a colossal $80 billion investment in AI-driven data centers for fiscal year 2025. This burgeoning "new tech epoch," underpinned by a Federal Reserve-engineered soft landing, promises to catapult the AI sector into unprecedented growth. Innovations like xAI’s Grok 3 and Meta’s Llama 4 LLMs, powered by massive 100k GPU clusters, are set to dramatically outperform existing benchmarks and fuel a competitive AI arms race.

Tesla also leapt nearly 7%, and travel heavyweight Airbnb climbed over 3%, contributing to a broad-based rally. The lacklustre Santa rally, a casualty of cautious year-end positioning amid substantial equity allocations, gave way to renewed enthusiasm as traders, starting with a clean slate, pivoted back to the enduring growth drivers that have sustained earnings and market ascents in recent years. This renewed vigour signals a potentially transformative year for markets, particularly within the technology sector.

Forex markets

As we dance into 2025, the EUR/USD is caught in a vortex of rising risk premiums, fuelled by a crescendo of protectionism and surging global energy costs. This financial epic is underpinned by a strong seasonal tailwind that traditionally propels the dollar upward in the nascent months of the year. As the U.S. stands on the precipice of a presidential inauguration on January 20th, the currency markets pulse with the potential for dramatic shifts. Current alignments don't yet scream of extremes, but the anticipation of a significant reversal in dollar fortitude is palpable—if Trump hesitates on his tariff triggers, a surge to the EUR/USD around 1.0500 could disrupt the market's consensus, though this narrative bucks the prevailing winds of trade.

The real drama of January won't question the dollar’s reign but rather what could temper its ascent. Immediate disruptions from U.S. labour data are unlikely; a gradual economic slowdown fits the Federal Reserve's narrative of careful rate adjustments. The spotlight, however, is on Trump’s inaugural rhetoric—his stance on protectionism and fiscal stimulus will be critical in shaping the dollar's trajectory as the year unfolds.

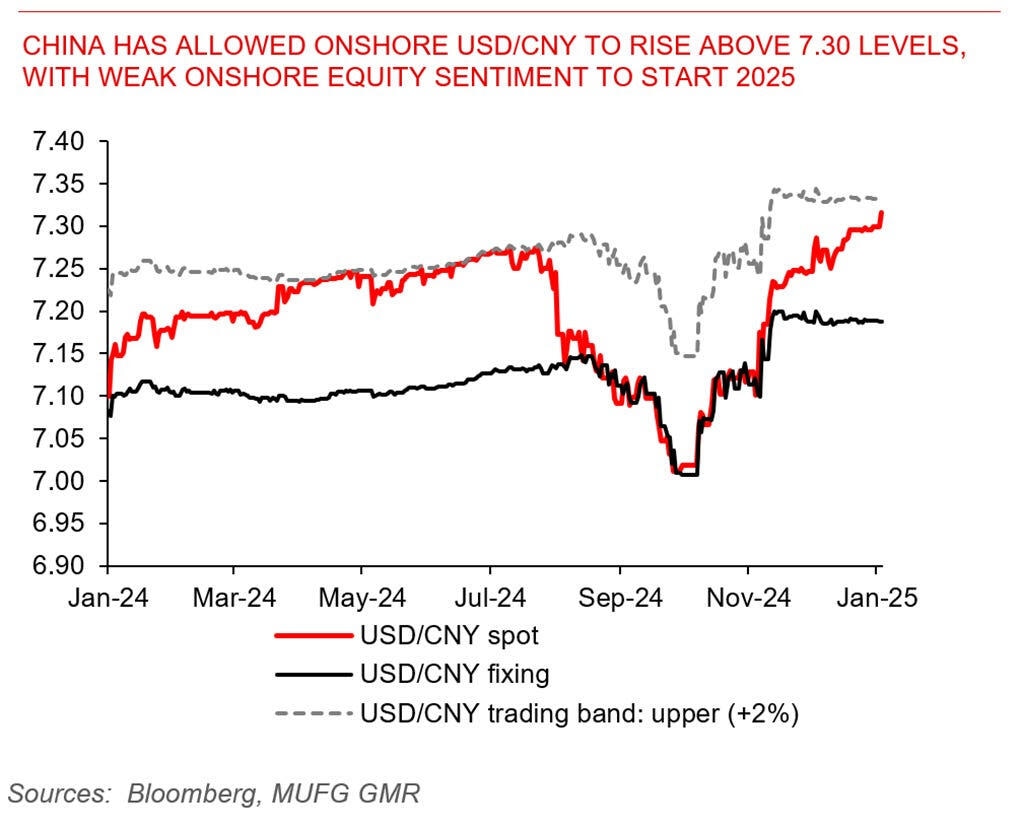

Yet, amid this global financial theatre, a subplot unfolds with China's economic maneuvering. As President Xi Jinping reiterates his commitment to bolster China's economy, the recent yuan depreciation suggests intense underlying economic pressures. The slip past the key 7.3 per dollar threshold signals a potential easing of China's staunch defence of its currency, possibly heralding a new strategy of allowing the yuan to weaken to buffer against economic headwinds and the looming spectre of a trade war.

This currency saga is further complicated by potential Trump administration tariffs targeting not just China but also Mexico, Canada, and possibly Vietnam right out of the gate. These tariffs would cast other ASEAN regional currencies as potential collateral damage in the impending trade battles. Yet, the enigma extends to Japan—could it, too, find itself in the crosshairs of U.S. trade policies? The implications for the yen are profound, especially given Japan's delicate economic balancing act.

Last year, labour unions in Japan had a reason to celebrate as they secured the most substantial wage increases in over thirty years. This signalled what many hoped would be a pivotal shift in the Bank of Japan's protracted battle to foster wage growth and spur domestic consumption. Yet, as 2024 drew to a close, it became glaringly apparent that these wage hikes were failing to keep pace with inflation—a situation worsened by China's ongoing exportation of deflation.

In a telling move at the end of the year, the BOJ held interest rates steady at a mere 0.25%, vividly illustrating Japan's ongoing economic fragility.

The BOJ's hesitation to increase interest rates is a strategic attempt to curb any potential yen appreciation, which had previously sent shockwaves through financial markets and unsettled the political landscape when rate hikes were attempted.

As we stand on the cusp of Donald Trump’s re-entry into the White House, the spectre of stringent tariff impositions on Japanese—and potentially South Korean—exports looms. Suppose the yen were to weaken beyond 160 and head to 170 against the dollar. In that case, it might provoke the Trump administration to extend harsh trade measures previously reserved for the countries with the most egregious trade surpluses. This looming threat adds a profound layer of geopolitical tension, poised to shake the foundations of the region's currency markets, casting a shadow of uncertainty over Asia's economic landscape as Trump's trade policies begin to take shape.

Oil markets

As 2025 begins, oil prices are climbing, fueled by robust demand optimism and complex geopolitical undercurrents. Notably, the geopolitical landscape is charged with potential volatility. Last month, reports surfaced that the U.S. was weighing options for a potential strike on Iranian nuclear facilities should Tehran accelerate its nuclear ambitions before January 20. This development injects a layer of uncertainty into the oil markets, with potential repercussions for global supply.

On the trading floors of Asia, optimism prevails; oil prices have surged as traders anticipate stronger economic growth and heightened demand for oil. The fourth quarter's stagnation somewhat tempers this positive sentiment. Oil prices oscillated within a narrow band, constrained by lingering concerns over demand in major economies like China and the specter of global oversupply.

Amid these market dynamics, Chinese President Xi Jinping’s New Year’s address promised proactive measures to bolster China’s economic growth in 2025, targeting an official growth rate of 5% for the previous year. However, I urge caution, recommending a hefty pinch of skepticism when digesting official data from China.

However, the real momentum in the spot market was driven by fresh data from the Energy Information Administration (EIA). According to the EIA, U.S. oil demand soared to 21.01 million barrels per day in October 2024, marking the highest consumption rate since the pandemic began and a significant jump from the previous month. This surge indicates a robust recovery and a strong underpinning for future oil demand.

Adding to the complexity is the impending Arctic blast that will sweep the U.S., potentially marking the coldest January in over a decade. This severe weather is expected to escalate heating oil demand dramatically, straining supplies and pushing prices higher. As market liquidity normalizes next week, this bullish sentiment will face its true test, potentially validating the early-year price rally fueled by a flurry of short covering from trades entered below $74- per barrel in Brent.

As we move deeper into January, the interplay of escalating demand, geopolitical risks, and severe weather conditions will likely continue to shape the oil market's short-term trajectory, offering a volatile but potentially lucrative landscape for traders plotting a more bearish medium-term Oil landscape.

Chart of the week

China has let the Yuan weaken

As 2025 begins, Asian currencies and risk assets are under pressure due to the looming threat of U.S. tariffs under Trump's administration. This has particularly impacted China, where onshore equity markets dropped over 5%, and the yuan slipped past the significant 7.30 level against the dollar. This breach signals possible further monetary easing by China in response to weak manufacturing data and increased risk aversion, which has driven Chinese bond yields down to 1.60%.

This downturn in China has influenced other Asian markets, weakening currencies like the Singapore dollar, Malaysian ringgit, and Thai baht, which are closely dependent on China's trade.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.