The weekender: Markets grapple with Year-end adjustments and regulatory rebalancing

As Christmas week wraps up, global stocks and the dollar dip from their year-long highs, feeling the weight of year-end adjustments and regulatory rebalancing. This minor pullback is a dance to the annual tune of the year-end funding premium—when borrowing costs soar as financial institutions tighten up for regulatory scrutiny.

Post-Global Financial Crisis regulations dictate strict capital standards, nudging banks to trim down risky assets like equities to beautify their balance sheets for the year-end audit. This scenario sets off a chain reaction: dealers sell off profitable equities in a controlled selloff or utilize structures like equity-implied funding trades. Here, a dealer offloads an equity or ETF, balancing it with a corresponding swap to neutralize risk, while cash risk owners step in to hold these assets and earn a premium over standard rates, like those of Treasury bills.

This end-of-year financial choreography boosts demand for US dollar funding and spikes borrowing costs. This year, it catalyzes a selloff of profitable heavyweight tech stocks, cooling the market fervour from a stellar performance. Financial institutions' strategic shrinkage of balance sheets, driven by a mix of compliance and cautious market play, sets a complex stage as 2025 approaches, blending regulatory rigour with financial strategy in the dynamic dance of global markets.

This week saw a trimming of gains for major US indices; the S&P 500 and Nasdaq 100 pared back earlier advances, while the Dow Jones Industrial Average fell by 0.9%. A market-based gauge tracking the "Magnificent Seven" prominent shares took a 2.1% hit. The Russell 2000 index of smaller companies also experienced a downturn, decreasing by 1.9%.

In the bond market, the yield on 10-year Treasuries ticked up by three basis points, reaching 4.61%. At the same time, the DXY is mutedly displaying its seasonal tendencies by softening as the year winds down. However, the substantial interest rate differential in the US and anticipations of a hawkish Federal Reserve in the first half of 2025 could stave off a more significant year-end rebalancing downturn in the dollar. This dynamic suggests that dollar bears might remain dormant until at least next summer.

Hence, this week highlighted vulnerabilities in funds connected to several major market themes that have been influential over the past three years. According to data from EPFR, these funds faced setbacks during the week ending December 25, underscoring a rough patch as the year draws to a close. This shake-up in funds and indices marks a cautious close to a dynamic trading year, with investors recalibrating their portfolios in response to evolving market and year-end regulatory and funding conditions.

As 2024 winds down, the financial markets, which have enjoyed a robust rally throughout the year, are now contending with some turbulent conditions independent of the typical year-end, quarter-end, and month-end rebalancing. The backdrop of rising US yields, driven by the Federal Reserve's cautious stance on the pace of rate cuts for 2025, signals a new phase of monetary policy following a modest 25 basis point cut this week. It's hardly surprising to see the Fed adopt a more reserved approach. US GDP growth maintains a healthy clip near 3%, core inflation remains persistently high, and immense uncertainty looms over fiscal policy.

A further escalation in bond yields, particularly if 10-year yields surge rapidly to 4.75% or higher, could significantly pressure equities at the index level.

Beyond domestic monetary policy, investors are also wrestling with the unpredictable nature of US trade policy under the incoming administration. While many might dismiss the President's bold threats as mere posturing, the reality could be far graver than during his first term in office. The debate intensifies around the potentially inflationary impact of new tariffs, which clearly point to higher inflation but lower economic growth due to increased protectionism. This scenario spells trouble for the financial markets but continues to bolster the US dollar, which has seen a remarkable 7% increase just this quarter. This strength in the dollar underscores the persistent influence of what's been dubbed the "Trump Trade," powering the greenback amidst global uncertainties.

Forex markets

We are mired in quiet year-end FX trading, and there's a noticeable tapering off in dollar buying. This slowdown often prompts a reassessment of positions ahead of the year's close, particularly after a strong run in the US markets, potentially leading to year-end rebalancing and sales of the dollar. Market indicators, particularly those tracking leveraged funds, suggest that positioning on EUR shorts is the most extended it has been since the aftermath of the Global Financial Crisis in 2010 and during the euro-zone debt crisis in 2012. This overstretched positioning signals a potential short squeeze risk for EUR/USD. However, the impact may be mitigated by current differentials, and heightened year-end dollar funding needs due to current equity position allocations.

Equity allocations went from $40 billion in and around the cycle lows for US shares in October of 2022 to some $330 billion as of the second week of December.

Additionally, we can't overlook the potential for increased JPY volatility as the year closes, which may prompt Japanese authorities to step in to prevent further yen depreciation, especially if traders take a run at the critical 160 level—a point that previously triggered intervention in July, leading to a downturn through the following months. The Ministry of Finance might act during these thinner trading conditions rather than waiting for the market fluctuations that could accompany President-elect Trump's entrance to office.

Despite potential year-end corrections and a possible reversal in US dollar strength, our outlook remains bullish on the dollar into the first quarter. Trump's tariff announcements might coincide with economic conditions that promote a divergence in monetary policy favouring the US dollar, further reinforcing this trend.

Chart of the week

Trump tariffs: No sustained inflation shocks according to goldman sachs

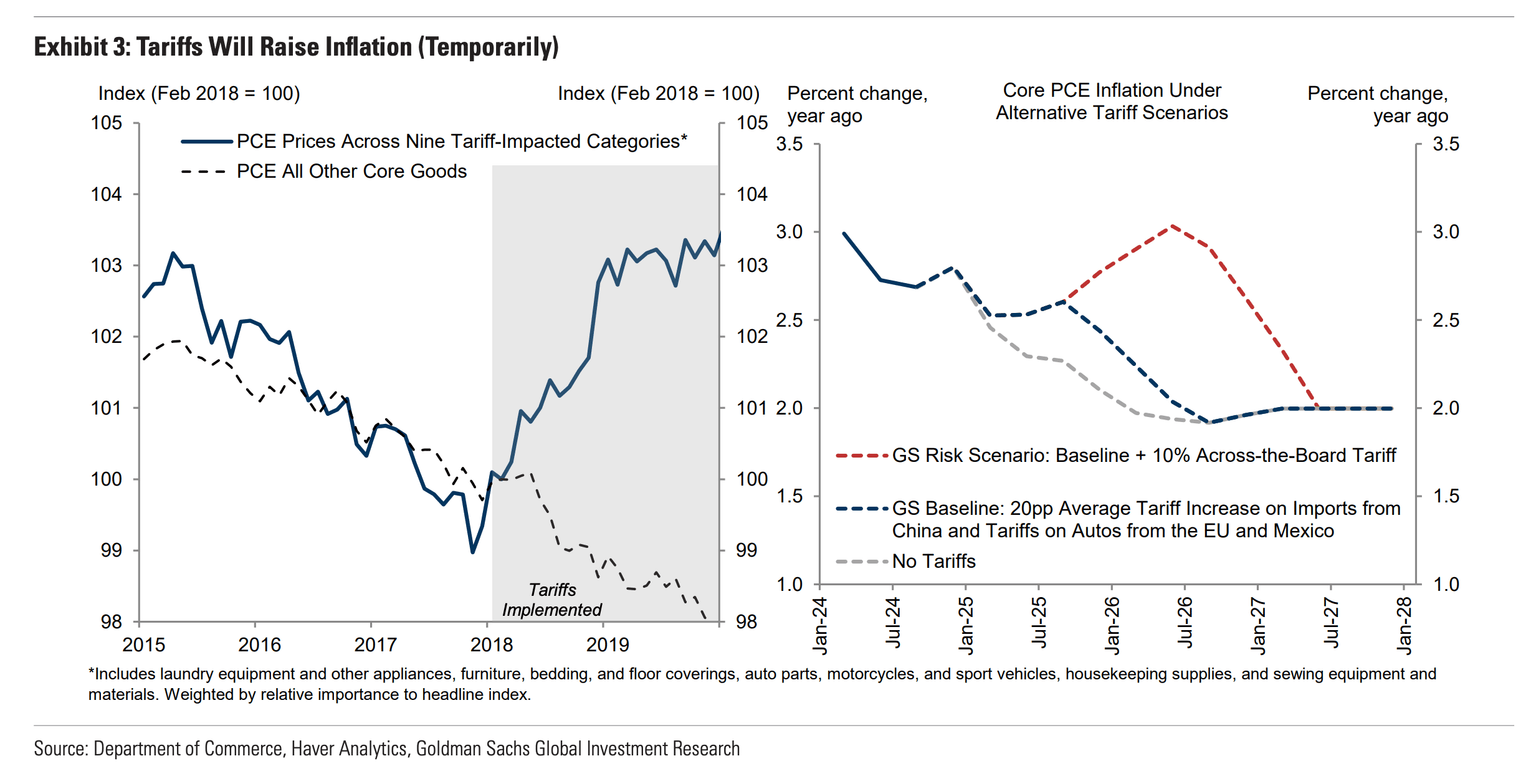

Interpreting Goldman Sachs' analysis in light of the recent University of Michigan release—which indicated an uptick in Americans' propensity to purchase durables ahead of tariffs—provides a nuanced perspective on consumer behaviour amidst trade tensions. This isn't merely a reactionary spike in spending due to fear of continued inflationary price hikes on affected goods; instead, it suggests a strategic adjustment to anticipated one-off price shocks, distinct from sustained inflationary pressure across a broad range of products year over year. In other words, it is a one-time price hit.

Goldman Sachs draws an interesting parallel to VAT increases observed in other economies, which historically have not left a lasting imprint on inflation or monetary policy. The visuals, comparing past events and Goldman’s projections for Trump’s second term, effectively encapsulate this dynamic effectively encapsulate this dynamic. Jan Hatzius of Goldman likens the tariff-induced pricing dynamics to transient VAT effects, suggesting they might stir immediate ripples without anchoring long-term inflationary expectations.

Furthermore, the analysis revisits the 2018-2019 trade war period when financial conditions tightened enough to prompt the Fed to ease policy—a historical footnote that, while not negating the broader concerns about trade tensions, argues against the notion that an impending trade war under Trump would obstruct further rate cuts the Fed might deem necessary.

Goldman Sachs acknowledges that tariffs are expected to raise inflation by as much as 0.4 percentage points next year. However, the crux of their argument is that any inflationary impact from tariffs will likely be ephemeral. From the Fed's perspective, the lessons from 2018-2019 underscore that the monetary policy risks posed by tariffs are at least two-sided. This suggests a balanced approach to future rate decisions amid ongoing trade uncertainties.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.