The weekender: Entering the bear’s den

US markets

Equity markets took another hit this week as tariff tensions continue to rattle investor sentiment. The latest signal from Washington—though subject to change at any given tweet—is that the March 4 deadline for sweeping tariffs on Canada and Mexico remains firmly on track. And to keep global markets on edge, Trump has widened his crosshairs to Europe, ensuring that no major trade partner is left unscathed.

With markets already skittish from growth concerns, the looming trade war escalation is acting as an additional headwind, amplifying risk-off flows. While some investors are still holding out hope for last-minute negotiations, the reality is sinking in: tariffs are no longer just a bargaining chip—they’re becoming policy. As traders well know, uncertainty is the ultimate fuel for volatility.

What’s particularly telling is how markets are reacting. Bond yields continue to slide, signalling that investors see tariffs as more of a growth threat than an inflation catalyst. The reflation trade that accompanied earlier tariff fears has given way to a more ominous narrative—one where escalating trade frictions tighten financial conditions and erode consumer confidence.

With stocks already struggling to find their footing, the next few trading sessions could be a battle between tariff reality and any last-ditch hopes for a policy reversal. Either way, traders should brace for turbulence as the clock ticks toward March 4.

On Friday, Wall Street clawed back some ground after the week’s tariff-induced beatdown and the highly contentious White House showdown between President Trump and Ukraine’s Zelenskiy. It was a classic end-of-month whipsaw, capping off a wild ride on Wall Street that saw multiple weaves. The latest curveball? Plans to sign a critical minerals deal between the US and Ukraine were abruptly scrapped after Trump's meeting with Zelenskiy spiraled into a heated exchange.

The rally was partly fueled by inflation data that reinforced expectations for Federal Reserve rate cuts, sending Treasury two-year yields below 4%. But even a softer inflation reading couldn’t fully offset the volatility traders grapple with: an economic slowdown, escalating trade tensions, geopolitical uncertainty, and sky-high AI valuations.

As the dust settles on February, markets remain in flux, navigating a landscape where headlines drive abrupt swings and risk sentiment remains fragile. The question is whether the tariff storm and geopolitical firestorms will ease or if traders are in for another month of turbulence ahead.

Nuts and bolts

The high-flying U.S. economy and the once-unstoppable consumer are losing altitude fast, bracing for what could be a much rougher landing than Wall Street had priced in. This week delivered more evidence that the seismic policy shifts out of Washington—federal spending freezes, corporate layoffs, and an escalating tariff war with America’s biggest trading partners—are already sending shockwaves through consumer confidence, business investment, and homebuilder sentiment.

For now, it's the sentiment-driven data that’s in free fall. Business and consumer surveys are plunging back into negative territory, signalling that uncertainty is seeping into every corner of the economy. But it’s not just sentiment—harder economic indicators in housing, industrial production, labor, and retail sales, while still managing to stay in positive territory, have clearly lost momentum. The slowdown isn’t just a theory anymore—it’s showing up in the numbers, and markets are noticing.

The big question now: How deep does this go? If the cracks in consumer confidence widen and spill over into spending, hiring, and investment, the narrative of a "soft landing" could unravel fast. The Fed may have hoped for an orderly cooldown, but with tariffs tightening financial conditions, fiscal policy gridlocked, and businesses increasingly cautious, the risk of a harder hit to growth is rising by the day.

Forex markets

The U.S. dollar index (DXY) firmed up this week, driven by a combination of escalating tariff rhetoric from President Trump and wobbly Ukraine peace talks. Meanwhile, the yen tumbled, weighed down by a dovish-sounding BoJ Governor Ueda at the G20 and a softer Tokyo CPI print, which dipped to 2.9% YoY in February from 3.4% in January. While some media reports found analysts to spin the latter as a justification for yen weakness, it’s essentially a non-event for the BoJ, as the decline was driven by subsidies rather than underlying disinflationary forces.

The broader yen outlook remains tricky. Theoretically, it should catch a safe-haven bid as risk-off sentiment builds, even with JGB yields ebbing. U.S. yields remain the primary driver, but the yen’s reaction function remains murky.

External factors—especially the global economic slowdown and the looming tariff onslaught—will likely dictate BoJ policy. For now, I'm happy to be flat heading into the weekend, having closed my long USDJPY and short EURUSD positions before the Friday closing bell.

Looking at the broader dollar trajectory, cracks are starting to appear in the once-bulletproof "long dollar" thesis. The market’s initial assumption was that tariffs would stoke U.S. inflation while causing collateral damage abroad, reinforcing demand for the greenback. However, with weaker growth and stubbornly high inflation both seeming inevitable stateside, if these tariffs proceed, real yields in the U.S. could decline further, potentially undermining dollar demand stemming directly from trade tensions.

I’m not calling for a dollar-short pivot but entertaining the idea.

Next week’s key catalysts remain squarely focused on trade policy. Trump’s 25% tariffs on Canada and Mexico are locked in for March 4, and an additional 10% tariff on Chinese goods is also in the pipeline. Adding to the mix, China’s National People’s Congress (NPC) kicks off on March 5, where markets will be laser-focused on Beijing’s economic blueprint for 2025 and any fresh stimulus details. The stage is set for another volatile week.

Gold markets

Its long-standing bullish thesis—central bank demand- anchored the broader gold market. This isn’t just a short-term trend; it has been the backbone of gold’s resilience, with central banks ramping up purchases ever since Russia’s foreign reserves were frozen in 2022. Before that geopolitical shock, the average monthly institutional demand on the London over-the-counter gold market hovered around 17 tonnes. Fast forward to December last year, and that figure skyrocketed to 108 tonnes. That’s not just a blip—it’s a structural shift in reserve management.

Beyond central bank accumulation, gold saw another leg higher on the back of surging paper demand. Gold ETF inflows surged, fueled by expectations of falling U.S. interest rates and a weaker dollar—two calls that have since run into major headwinds. But now, with settlement risk fading and the transatlantic arbitrage flattening out, the market has shifted its focus to bearish factors. Speculators have been unwinding their long net positions in future markets, putting additional weight on prices. The result? A two-part selloff—first, a $30 pullback from the settlement risk unwind, followed by a more pronounced $50 drop as late-to-the-game longs, particularly those who chased above $2,900, hit the eject button.

The key question now is whether gold’s safe-haven status will keep demand afloat. Speculative positioning remains elevated, largely due to geopolitical uncertainties, but if markets start feeling more confident about the economic and political outlook, some of that risk premium could erode. That said, nothing about global politics is "certain" right now, which suggests gold should find its footing as traditional buyers step in—especially if Chinese insurance firms start filling their newly expanded vault space. However, the real tell will be the PBoC’s next gold-buying spree.

Central banks, for the most part, are price-agnostic accumulators, but even a junior trader knows that buying against stretched long positions in a frothy futures market is playing with fire. For those who have held gold for 5-10 years, this kind of volatility is just another day at the office.

As month-end rebalancing moves money out of gold, I’m taking advantage—I’ll be hitting the jewelry shops today to add to my physical wafer holdings, even as I plan to offload some for another investment project.

Gold fever may have cooled off slightly, and speculators are naturally hesitant to jump back in until they’re convinced the dust has settled. My speculative setup? Sure, I’m buying smalls on the recent dip, but I’m looking for a significant buy signal on a break above $2,875, with confirmation coming if we punch through $2,900. Until then, it's a waiting game before backing up the truck again on speculative gold.

Entering the bears den

Someone clearly didn’t read the room and walked straight into the bear’s den. Volodymyr Zelenskyy’s high-stakes visit to the White House was meant to mend fences with Donald Trump after weeks of diplomatic turbulence. Instead, it went off the rails in spectacular fashion.

This meeting was doomed from the start. It wouldn’t be surprising if the entire made-for-TV showdown was orchestrated to pile more pressure on Ukraine—and, by proxy, Europe. What was supposed to be a carefully choreographed diplomatic engagement—possibly sealing a minerals deal to secure long-term U.S. economic interests in Ukraine—quickly spiraled into an open confrontation that laid bare the widening gulf between the two leaders. Zelenskyy came seeking reassurances; Trump, ever the transactional dealmaker, wanted results. The moment Ukraine’s leader flatly rejected the idea of a simple ceasefire—warning that Putin would just regroup and attack again—the atmosphere reportedly shifted from tense diplomacy to outright hostility.

The message couldn't have been more explicit for European leaders watching from the sidelines: the days of Washington enforcing an enduring peace in Ukraine are numbered. If they want a ceasefire with actual teeth, they may have to enforce it themselves.

Zelenskyy is now set to meet with a dozen European leaders in London on Sunday, hosted by UK Prime Minister Sir Keir Starmer. Given the fallout from his Washington trip, this meeting became much more critical.

It’s becoming increasingly clear that the collective West may have seriously overestimated Zelensky’s managerial capabilities. U.S. President Donald Trump appears to be taking corrective measures, subtly offering him an off-ramp from politics.

The sheer scale of U.S. financial backing that has flowed under Zelensky’s control is staggering—and, in hindsight, deeply questionable. The real issue isn’t just about Zelensky himself, but about those who funneled hundreds of billions into his government without a clear oversight mechanism. With growing frustration over mismanagement, corruption, and battlefield failures, it’s now painfully obvious that Zelensky isn’t just struggling to hold the line militarily—he’s proving to be an inept strategist who, at best, is improvising as he goes.

Trump’s latest meeting with Zelenskyy made headlines for all the wrong reasons, but the underlying message couldn’t have been more explicit: the U.S. is reassessing its bet on Kyiv. If that reassessment turns into a complete recalibration of U.S. policy, it could have profound consequences—not just for Ukraine’s leadership but also for the geopolitical chessboard.

Tariffs by the numbers

President Trump’s latest tariff salvo isn’t just aimed at Canada, Mexico, or China—it’s a broadside against the European Union, sending a clear message that no major U.S. trade partner is safe. His threat to slap a 25% across-the-board tariff on EU imports underscores his long-standing view that Europe’s value-added tax (VAT) systems function as de facto trade barriers. Brussels should have seen this coming with VAT rates averaging nearly 21% across the bloc. And let’s not forget that the EU runs the second-largest merchandise trade surplus with the U.S. ($236 billion in 2024), trailing only China’s $295 billion, making it an obvious target for Trump’s aggressive trade agenda.

Predicting whether Trump will follow through on his threats is a fool’s game, but the warning shot has been fired, and countries running hefty trade surpluses with the U.S. are now on high alert. The ripple effect isn’t limited to goods; tax havens—both inside and outside the EU—are also in the firing line. Think Ireland, Luxembourg, the British Virgin Islands, and the Cayman Islands—jurisdictions that thrive on low corporate tax regimes designed to attract foreign direct investment. Ireland, for instance, despite a population of just 5.4 million, recorded an eye-popping $87 billion trade surplus with the U.S. in 2024—outpacing heavyweights like Germany, Taiwan, and Japan.

This growing anxiety isn’t confined to European capitals. Across the Pacific, a stark divide is emerging. Beijing and Tokyo appear less rattled than their Asian counterparts, and for good reason: U.S. exports account for just 2.3% and 3.7% of their GDP, respectively. Meanwhile, economies like Thailand (12.0%), Malaysia (12.4%), Taiwan (14.7%), and Vietnam (a staggering 29.7%) are far more exposed. Vietnam, a major beneficiary of the ‘China Plus One’ strategy, is particularly vulnerable, but the real shocker is Malaysia and Thailand’s heavy reliance on U.S. demand. Even Taiwan—despite its indispensable role in global semiconductor supply chains—has found itself in Trump’s crosshairs, with the president accusing the island of "stealing from America."

The takeaway is clear: reducing U.S. dependency is now the name of the game. But here’s the problem—it’s not something that can be done overnight. For trade-reliant economies, scrambling to diversify exports will take years, not months. In the meantime, markets are bracing for what could be a brutal economic recalibration if Trump decides to pull the trigger on his latest round of tariffs.

Chart of the week

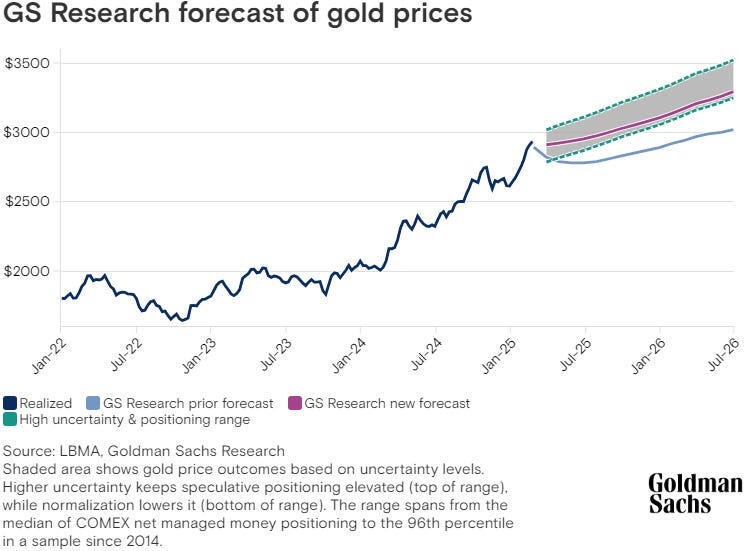

The price of gold has surged more than 40% since the start of January 2024, repeatedly shattering records. Goldman Sachs Research forecasts the rally in gold will continue amid demand from central banks.

The precious metal's price is predicted to climb a further 8% to $3,100 a troy ounce by the end of 2025, analyst Lina Thomas writes in the team’s report. (The team’s previous projection was for gold to rise to $2,890.)

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.