The weekender: America first

Markets

Stocks climbed in a holiday-thinned, shortened session on Friday, propelling major indexes to record highs as investors revelled in a month brimming with robust gains, fueled by a convincing post-election rally. The Dow Jones Industrial Average and the S&P 500 ascended by 0.4% and 0.6%, respectively, marking record closing highs, while the Nasdaq Composite surged by 0.8%, tantalizingly close to its peak. This surge followed a temporary pullback over the Thanksgiving holiday when the S&P 500 snapped a seven-session winning streak as the momentum pause likely caused some investors to cash in on profits. Nevertheless, the US benchmarks showcased their remarkable resilience even in the face of tariffs and tempered Fed rate cut expectations, buoyed by the promising outlook of an 'America First' administration. For November, the Dow and S&P 500 registered top-tier gains, climbing 7.5% and 5.7%, respectively. Meanwhile, the tech-heavy Nasdaq boasted its best monthly performance since May, with a 6.2% rise, underscoring the end to a dynamic market month with investors hoping for another festive one ahead.

On the economic front, U.S. data breezed in without a stir, confirming Q3 growth squarely at 2.8%, with PCE inflation aligning perfectly with forecasts. Yet, while October’s PCE inflation didn’t veer off course, its persistence is raising eyebrows. Core prices escalated by 2.8% over the past year, halting its descent since a June low of 2.6%. After a series of subdued readings through the early summer, inflation’s pulse has quickened, as evidenced by a 3-month annualized trend marching at 2.8%, fueled by recent monthly figures pushing past 3% annually. Does this brewing inflationary pressure signal a pause in the Federal Reserve's rate-cut trajectory in December? My take is not unless tariffs cause a more significant inflation ripple. Even with a 2.8% inflation clip, the real-fed funds rate remains stringently constrictive. However, should inflation anchor itself within a 2.5%-3% corridor, it might decelerate the easing tempo come 2025 or press for reevaluating the terminal rate to a loftier summit than previously anticipated.

Across “The Pond,” the economic signals are flashing a stark warning of 'stagflation lite,' teetering on the edge of full-blown stagnation after headline inflation surged back above target. This uptick should decisively quash any lingering expectations for a 50 basis point cut by the European Central Bank (ECB) in December, a scenario that even the ECB's staunchest hawks had begun to downplay earlier in the week. Despite this, the euro may find little comfort as the stagflation alarm rings and will soon echo loudly across currency markets.

November marked the second consecutive month that headline inflation has trended upward, with core inflation stubbornly fixed at 2.7% since September. During this period, the headline gauge briefly dipped below the target, offering a fleeting reprieve. Concurrently, Flash PMIs for November underscored growing economic malaise as the composite gauge slid back into contraction, hitting a 10-month low and cementing investor fears. Economic activity shows persistent signs of weakness, and although wage growth exceeded expectations in the third quarter, this might merely be inflation's last gasp amid subdued demand. Hence, the ECB will cut in December, but perhaps less aggressively than Euro bears hoped.

Forex markets

As detailed in our ongoing FX reports, we've been angling for a BoJ rate hike via short EURJPY for the past few weeks. Fortunately for that call, the yen continued its ascent on Friday, with USDJPY rallies swiftly sold off, leading the pair to wrap up the week around 149.70 and EUR/JPY at 158.36. The momentum for a BoJ rate hike as early as next month gained steam with the release of Tokyo's hotter-than-expected November CPI. I’m pricing rate hikes of 15 basis points for December and January, although the current market consensus is slightly more aggressive.

The stage is set for a significant policy divergence play, particularly if upcoming US NFP and CPI data bolster the likelihood of Fed rate cuts in December (from 65% to 80%) and January (from 17% to 50%). Such outcomes could thrust USD/JPY below the 147 mark( or lower) , possibly insulating Tokyo’s trade surplus from Trump's tariff glare. This pivot hinges on the BoJ's willingness to ramp up rate hikes—so staying alert to BoJ rhetoric is key, especially since the Tokyo inflation print was the last inflation data drop before the BoJ’s December 19 decision.

The recent dip in USD/JPY has also been supported by a general softening of the US dollar, thanks to a serene US treasury landscape post-Trump’s strategic nomination of Scott Bessent as Treasury Secretary. Outside the yen's sphere, the dollar doesn't seem poised for a steep year-end drop, except for the typical corporate year-end selling. The main wild card is next week’s US nonfarm payrolls report for November. A lacklustre recovery from the hurricane effect drop in October will cement confidence in the Fed’s December cut and potentially recalibrate expectations for a more aggressive easing into next year.

Trading Trump noise

Having Trump in the White House is fascinating from a trader's perspective. The reality is that the most adept traders are akin to top-level superforecasters. They operate with a clarity that cuts through the noise—unlike the variability often seen among rookies. All are very smart, yet educational levels among these elite traders can vary widely; I've worked with some whose education didn't extend beyond high school who were phenomenal, while some Wharton grads struggled because trading success hinges not on formal education but on thinking in probabilities and tail risks.

That said, trading dynamics have drastically bifurcated, with algorithms dominating the scene at major banks, paving the way for a new era in the financial markets. This shift has allowed a select group of highly secretive trading firms—staffed not by traditional traders but by legions of engineers and coding specialists—to thrive. Firms like Citadel Securities, Susquehanna International Group, XTX Markets, and DRW have leveraged the electronification of financial markets to carve out significant market shares. These nimble and less regulated entities have reshaped Wall Street’s trading landscape, challenging the dominance of more established and heavily regulated banking institutions.

With Trump, the game becomes clearer. The tail risks are well-defined, and the probabilities are more straightforward to assess, allowing traders to act swiftly. When Trump tweets tariffs, it’s almost like a starter pistol for market movements, sending signals that are as impactful as "Truth Social" bombs echoing globally. This predictability in unpredictability makes it easier for seasoned traders to jump into action first and then strategize, knowing well where the ripples from these tweets will spread.

Last week marked the inaugural showdown between Donald Trump, his fervent social media barrage, and the global markets. With Canada and Mexico firmly in the crosshairs, the president-elect has brandished the threat of imposing hefty 25% tariffs on all imports from these nations. The aftermath was swift and stark—both the Canadian dollar and the Chinese renminbi felt immediate tremors. At the same time, the Mexican peso plummeted to its nadir in two years, highlighting the palpable tension and economic reverberations triggered by Trump's aggressive trade stance.

The rapid response of Mexican President Claudia Sheinbaum to President-elect Trump's tariff threats on Truth Social was bold and unmistakable. She warned of retaliation: "One tariff will come in response to another, and so on until we put shared companies at risk." This forceful stance certainly raised eyebrows across political and economic spectrums. However, the tensions appeared to ease after Sheinbaum and Trump engaged in what Trump described as a "wonderful" and "very productive" phone conversation. Following their discussion, President Sheinbaum confidently assured that "there will be no potential tariff war." While her optimism is noteworthy, the complexity of international trade and Trump's unpredictability suggests that outright dismissing the risk of a tariff war might be premature. As always, only time will tell the actual outcome of such geopolitical dances.

President Trump has yet to cast his tariff gaze directly at Europe, but given the continent's significant trade surplus with the U.S., it's almost inevitable that he will. In a poised counter, ECB President Christine Lagarde urged a negotiation strategy over retaliation, proposing that Europe bolster its imports from the U.S. to avert a trade war that would serve no one's interests and could throttle global economic growth. With a sharp critique, she posed a provocative question: "How do you make America great again if global demand is plummeting?" highlighting the paradox in pursuing aggressive trade policies that could harm global economic stability.

As Trump’s tariff sabre-rattling casts a long shadow over global trade, nations with trade surpluses are bracing for impact. The anxiety is palpable from China and Vietnam to Japan and Taiwan, and even within the EU, the tension is mounting. Trade wars are a dreaded prospect, particularly for those already trapped in economic skirmishes with China.

Germany is wrestling with its own challenges—economic stagnation at home, punitive tariffs on Chinese goods, and the recent collapse of its government in November. There's a silver lining, though, as there's talk of loosening the stringent debt brake.

France is also caught in a precarious situation, teetering on the brink of a governmental collapse amid a budget crisis, with its trade surplus with the U.S. adding fuel to the fire. However, amidst this chaos, Europe seems inclined to heed ECB President Christine Lagarde’s wise counsel to negotiate rather than retaliate. The continent is already murmuring about ramping up LNG imports from the U.S., a strategic move to smooth over frictions.

Adding to the strategic shifts, French President Macron has eased his 'buy-EU' policy, which previously excluded non-EU companies from contributing to Europe's defense industry upgrades—a significant pivot that not only aligns with NATO objectives but also opens up new avenues for U.S. firms, potentially easing some trade tensions.

Amid the swirling threats of tariffs and looming trade skirmishes, brace for an intensified wave of uncertainty that promises to jumble the Federal Reserve's monetary policy decisions—turning the trading landscape into an adrenaline-pumping rollercoaster ride for market players.

Chart of the week

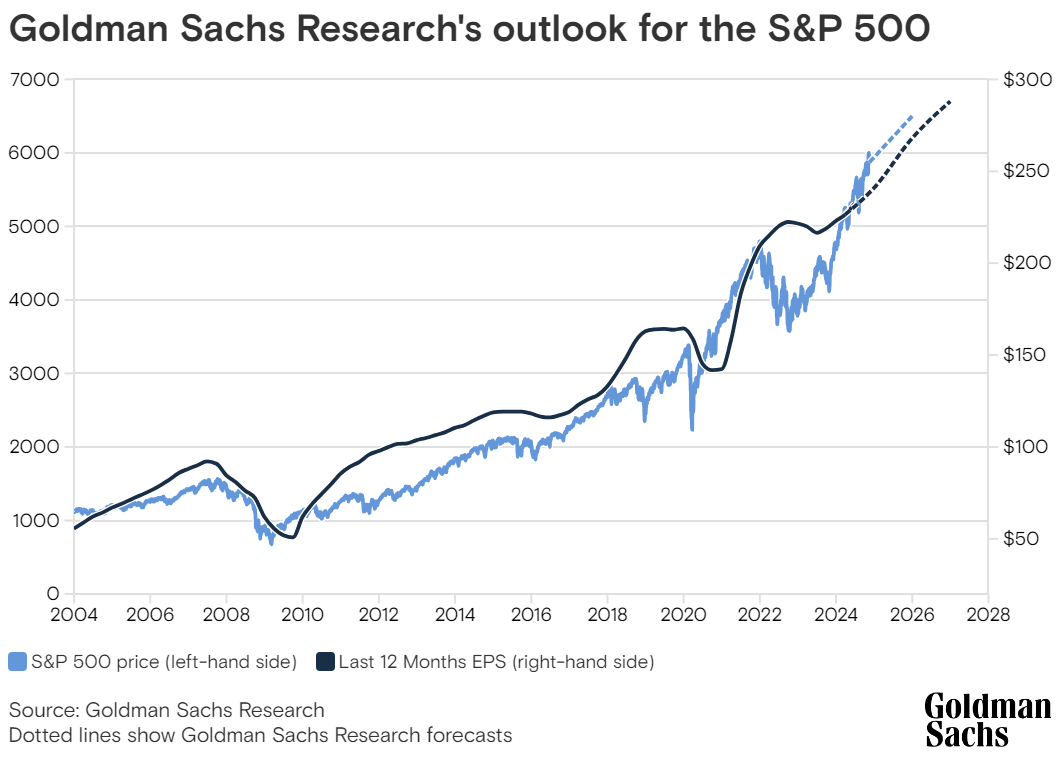

Goldman Sachs Research forecasts a continuation of the bullish trend for the S&P 500, predicting a third consecutive year of gains fueled by robust economic expansion and consistent earnings growth. David Kostin, the chief US equity strategist at Goldman Sachs, projects that the benchmark index of US equities will climb to 6,500 by the end of 2025. This represents a 9% price gain from its current level, with a total return of 10% when including dividends, as of November 26. Moreover, Kostin anticipates earnings will rise by 11% in 2025 and by 7% in 2026, underpinning the optimistic outlook for the market.

Goldman Sachs Research aligns corporate revenue growth directly with nominal GDP expansion, posting a 5% sales increase for the S&P 500. This projection matches their economists' expectations for a 2.5% real GDP growth and a cooling of inflation to 2.4% by next year's end.

Their earnings per share (EPS) forecasts for the S&P 500 for 2025 and 2026 stand at $268 and $288, respectively, mirroring the median top-down consensus estimates. However, these figures fall short of the bottom-up consensus, which predicts higher earnings of $274 and $308 based on individual company analyses by equity analysts.

Looking ahead, Goldman Sachs Research envisions sustained economic and earnings growth, with bond yields holding steady at current levels. Nonetheless, the landscape of 2025 carries potential risks, including the implementation of broad tariffs and rising bond yields. Conversely, a more favourable fiscal policy or a dovish shift by the Federal Reserve could amplify returns.

For a deeper dive, revisit Goldman Sachs Research's prior analysis of the U.S. economic landscape anticipated for 2025.

Tweet of the week

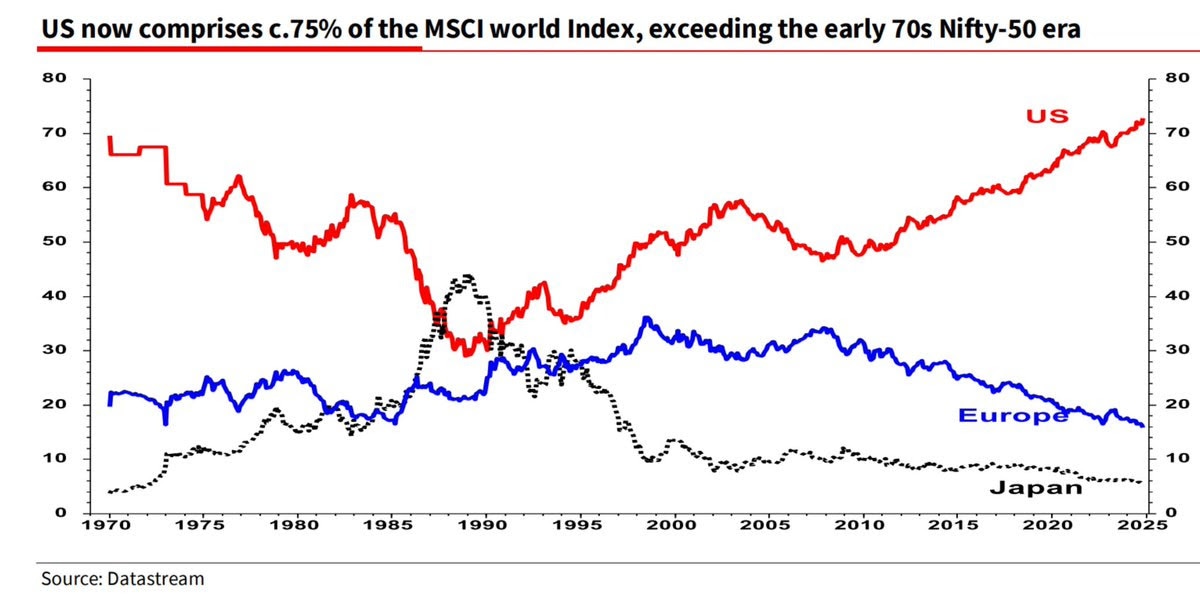

Albert Edwards @albertedwards99

This is getting silly. US share of the MSCI world index is c75%, with investors citing TINA. But old hands will remember the late 1980s when Japan was c50% of the world index. Japanese companies, especially banks, dominated the world. No one could conceive it would end, but it did.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.