The US election and the impact on Europe and the UK

The outcome of the US election will impact financial markets around the globe in two ways.

Short term: Global financial markets could be hit by volatility if there is a surprise outcome. As we have mentioned, we think that financial markets are pricing for a Trump victory. Thus, a win for Harris could lead to a short term sell off in the dollar, gold and potentially in US stocks. This could also boost global equities, as Harris is seen to be less tempted to slap tariffs on imports. Chinese stocks could rally sharply, along with key European and UK firms.

Longer term: A win for Trump, could see the dollar pop higher, but we think a win for the former President could have a long-term impact on global financial markets due his plans for tariffs. A US system of import tariffs would reorder global trade flows and hurt global growth. Here are Trump’s election pledges regarding tariffs:

-

60% tariff on Chinese imports.

-

100% tariff on imported vehicles.

-

10% universal tariff applied to all other imports.

The economic impacts of these proposals have been analysed by economists at the LSE. They find that Trump’s proposed tariffs could reduce GDP in the US by 0.64% and reduce GDP in China by 0.68%. The economic impact on Europe would be milder, with a 0.11% reduction in growth in the EU. However, retaliatory tariffs on US-made goods could add to the downward pressure on global growth in the longer term.

The impact of a win for Trump on the EV market would be huge, since imported EVs account for approximately 30% of the US EV market. Although LSE economists expect German GDP to be impacted to the tune of -0.23%, its auto sector would be disproportionately impacted. The LSE argues that it may need targeted support to overcome the challenge of US tariffs. Not only do Trump’s proposed tariffs have an economic and corporate impact, but also a fiscal impact for countries like Germany, who may need to support sectors of their economy from future US trade barriers.

The impact on the UK

The US is the UK’s largest export market. 25% of all manufactured UK exports went to the US in 2023, which totaled more than £56bn. Thus, it is important to the UK export industry to maintain strong links with the US.

The FTSE 100 and the FTSE 250 are both internationally focused indices. The FTSE 100 derives 80% of its profits overseas. For the FTSE 250, it is more than 50%. Thus, as a medium-sized economy with outward looking equity markets, the UK is vulnerable to Trump’s isolationist and America First agenda.

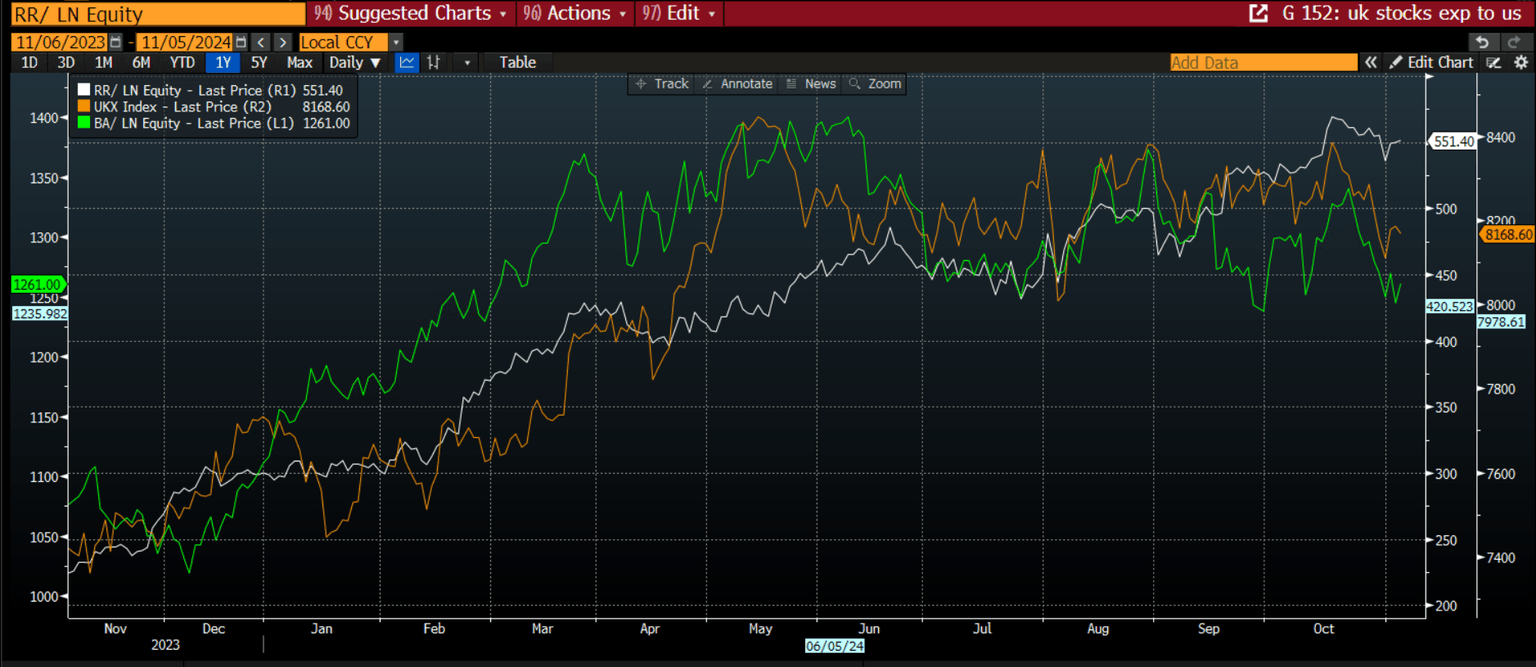

The UK listed companies with the most exposure to the US include BAE systems, which sells defense systems to the US government and Rolls Royce. The energy sector in the UK is also exposed to global growth trends, if Trump’s tariffs hit global growth, then this sector could also come under further downward pressure in the coming months. Rolls Royce is the best performer on the FTSE 100 so far this year, and its stock price is higher by 83%. After reaching a record high of £569.00 on 17th October, this stock has been trading sideways around £550.00. This suggests that investors are being cautious about adding to Rolls Royce longs due to US election risks.

UK's most exposed firms to the US and the FTSE 100

Source: XTB and Bloomberg

Cars and autos are also big UK exports to the US, and in 2022, the Land Rover Defender was the most popular car exported to the US. If Trump wins, this could dent the future profit outlook for Jaguar Land Rover. It is a private company, so its stock is not traded on the FTSE 100. However, tariffs on Jaguar Land Rover could still hurt the UK economy through job losses etc., as it will be hard for the UK car company to find another market to replace the US if tariffs hurt US demand for UK-made cars.

Harris: Don’t bank on her being pro-global trade

A win for Harris is likely to ameliorate global trade fears for now. However, the fact is a large economy like the US, which is growing faster than its peers and has much higher levels of productivity, is more likely to become an inward-looking economy under either President.

While Harris may not be as vocal as Trump on tariffs, the Biden administration has kept many of the tariffs imposed on China and elsewhere from Trump’s first term as President. Thus, Harris may not be as pro-global trade as some think. From the UK’s perspective, it may not be easy to get a post Brexit trade deal with the US if Harris wins today’s election.

To conclude, the outcome of the US election matters for the global economy and there will be short- and long-term consequences for financial markets.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.