The squeeze

S&P 500 shook off both unemployment claims below expectations and 50bp ECB hike, and the formerly disastrous market breadth got a thorough revamp, leading me warn twice of more intraday upside. 3,945 then indeed failed, and the resulting entry to the European session together with outside markets left bulls in a good place to extend short-term gains (before attending to the bigger factors that make me to keep bearish medium-term outlook).

Summing up, the sectoral view is far from conclusive, cyclicals are lagging, and tech with semiconductors rally against the backdrop of yields having trouble to further retreat. Makes for a volatile mix on the opex day.

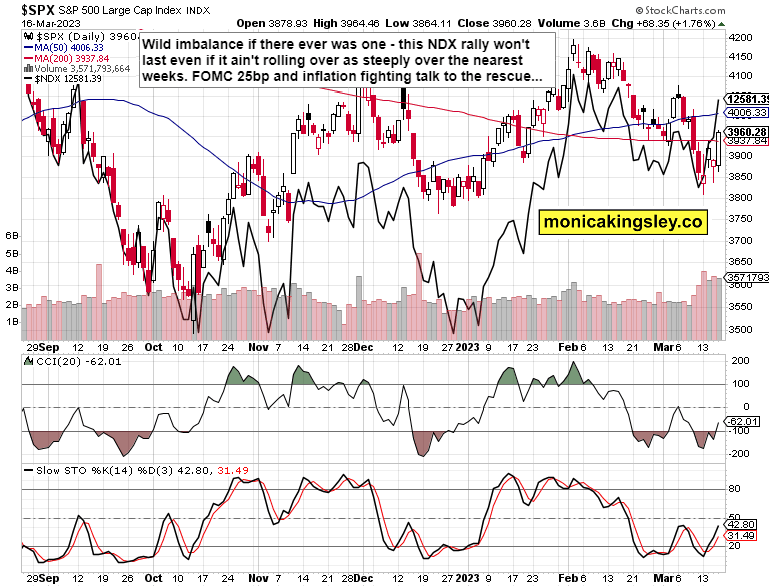

The bulls are fumbling premarket – it‘s a question of time when the imbalances of the daily rally help the bearish outlook take over irrespective of the liquidity thrown at the key problem enabling the banking system issues – risk-free rate of return making for deposit outflows, which in turn necessitate parking underwater Treasuries at the Fed. See chart courtesy of www.stockcharts.com to illustrate the S&P 500 internal imbalance (on top of reading the sectoral take within hyperlinks).

Gold and silver with miners are to benefit foremost, and I‘m not looking for any meaningful downswing (especially in gold), no matter the mineres performance. Copper is to keep outperforming crude oil – this laggard of the commodity space for months, is still in for some serious battles around $66, justifying my Nov 2022 calls that it‘s worth holding only as part of a portfolio / spread. It‘s clearly afraid of the worsening data leading to Q3 recession.

Keep enjoying the lively Twitter feed via keeping my tab open at all times – it‘s serving you all already in, coming on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer – I see Telegram as a necessity if you‘re serious about market commentary reliably shown to you), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on, so as to benefit from extra intraday calls.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.