US House Starts had a big fall as the struggle to again lift the debt ceiling to keep government running rages late into the night. All is not well in any case, and the last thing the US and the world need now, is a major war.

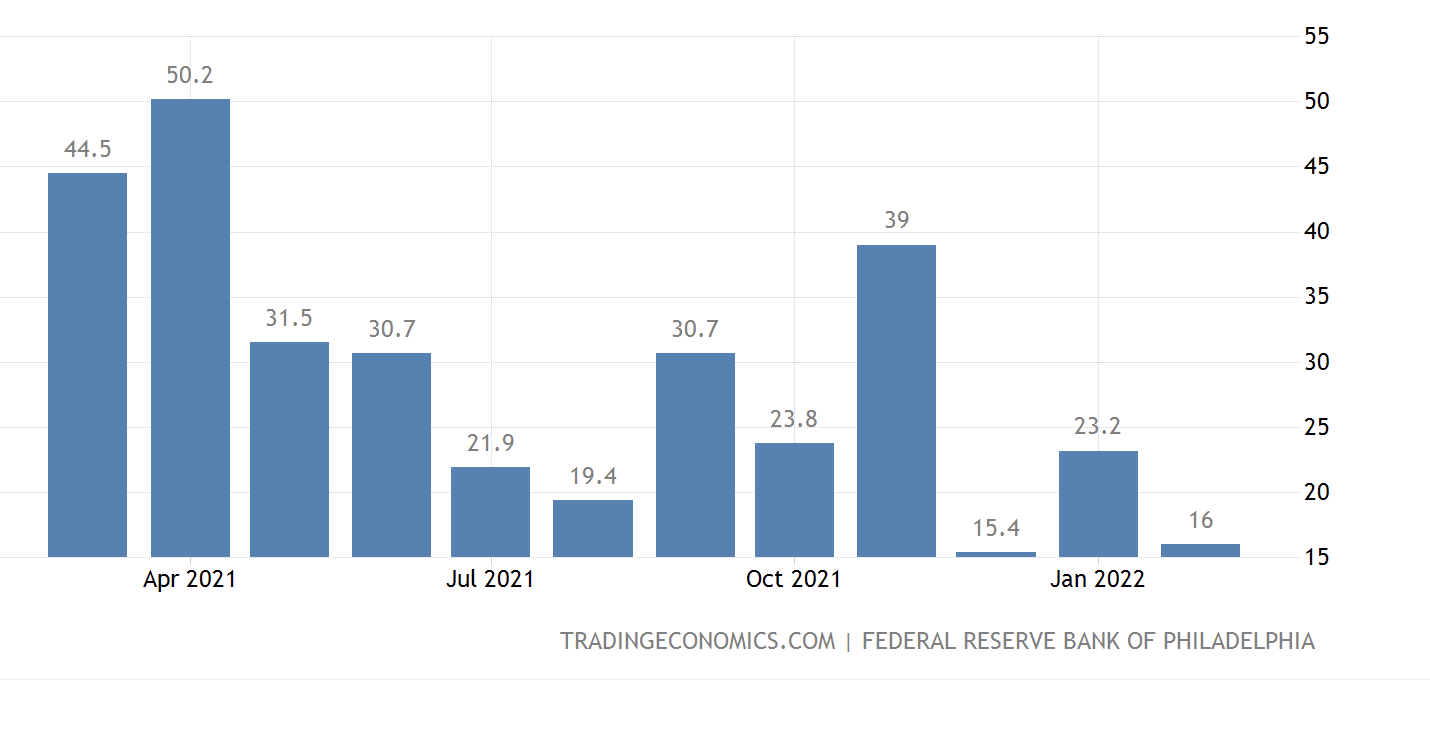

US philadelphia Fed factory Index struggles to stay positive

US stocks Fall, but still in range

We have really only seen a decline toward the bottom of the range of the past week so far. This is because we are all clinging to the idea that it will turn out to have only been a game of brinkmanship.

Not to repeat myself, but it really does need to be said, what we are hearing in our western mainstream media is not the vitally relevant Russian perspective. It is after all what Russia thinks that will decide whether military force is used.

Why is Putin/Russia making this bold and dangerous move?

Please do not think I am taking sides here, my only interest is for you to have an understanding as to the probability of real all out war. We can only get that answer by considering the Russian perspective.

In a nutshell

1. President Gorbachev brought down the Wall allowing East Germany to become part of Germany again and for it to become part of NATO too. On the proviso that NATO would not move even one more inch to the east.

2. A democratically elected pro-Russia Ukrainian government was overthrown by huge protests.

3. To protect its major Naval bases in Ukraine, vital in strategic terms, Russian forces annexed Crimea. Much of the population is Russian speaking.

4. Fresh democratic elections delivered a very pro-West government. Which now wants to join NATO. There are reports of pro-Russian politicians having been arrested and dissenting TV stations being closed. And the West is enthusiastic about this expansion of NATO.

5. Not only is Russia annoyed to say the least and beginning to feel surrounded by NATO, but NATO forces in Ukraine would also isolate their major naval bases in Crimea.

Russia feels the West is going back on Gorbachev's agreement, that Ukraine has a large Russian population, and the West is attempting a major strategic under-mining long term of Russia's military capability.

It does not matter whether we agree. It does matter that we understand from the Russian perspective why they are doing this. And therefore why actual war is of a very high probability if the West refuses to rule out Ukraine NATO membership.

If the West is not going to acquiesce, then the sooner Russia secures a greater and significant buffer to Crimea through the taking of large-scale Ukrainian territory the better. Russia needs to act now before Ukraine does become part of NATO. Putin has repeatedly requested a NATO back down to avoid conflict. The West in response is ramping up its determination for Ukraine to be a member of NATO. This is only amplifying the Russian dilemma and is making war almost inevitable.

We all hope and pray for diplomatic resolution at the last moment, but this does not appear likely. Especially, when you consider what the Russian point of view is on all of this. They are feeling greatly threatened and a need to act now.

The moves so far seen in the likes of Stocks and Gold will prove to be mere hiccups compared to what will happen of Russia takes a shock and awe approach to invading Ukraine.

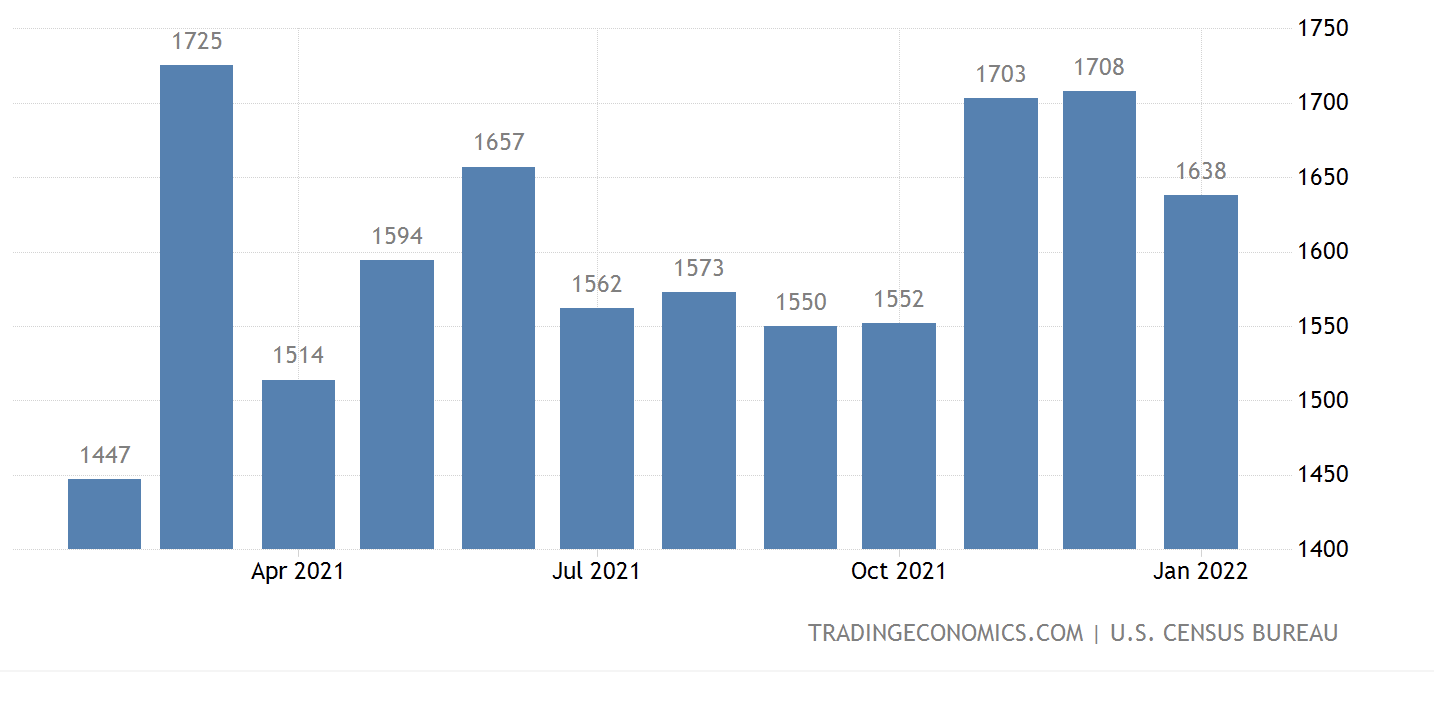

US new home starts

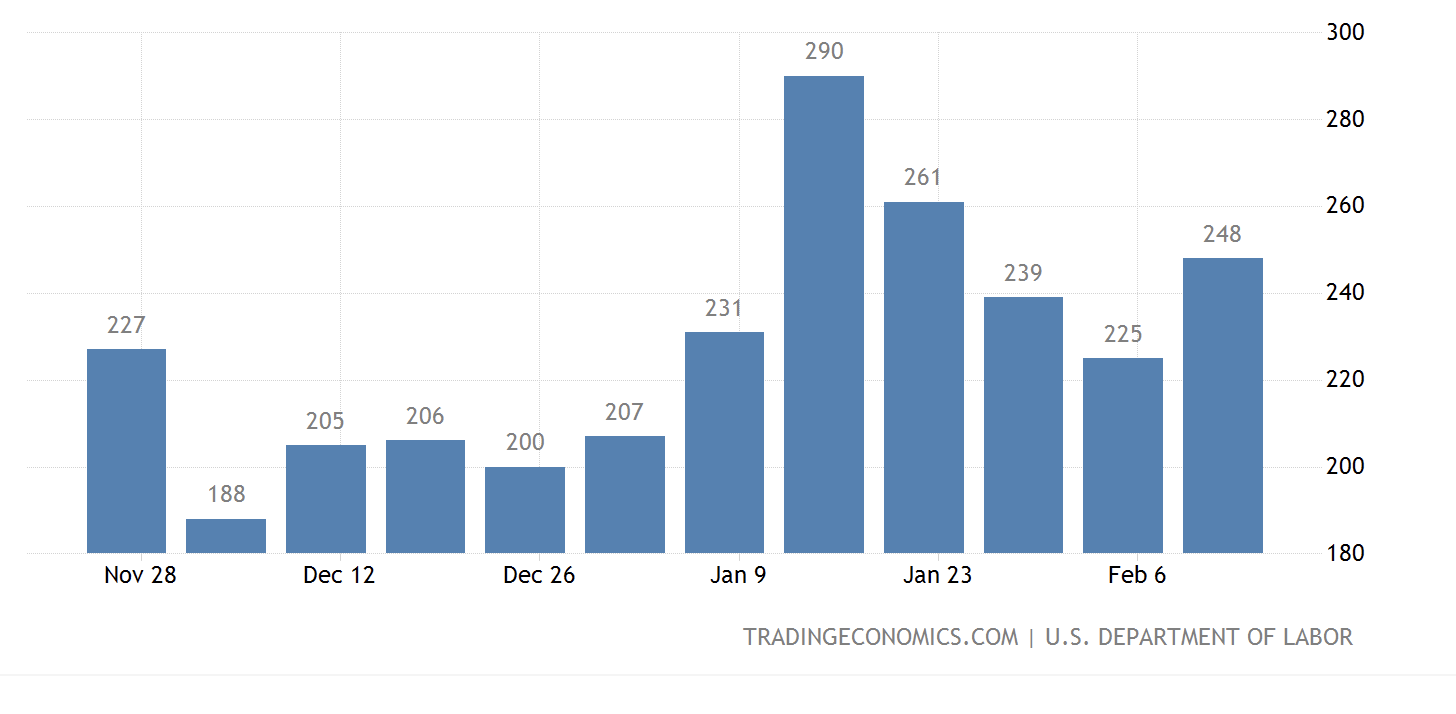

US jobless claims remain elevated

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates around 1.0900 as markets await US election exit polls

EUR/USD trades sideways near 1.0900 on Tuesday. The US Dollar ignores the upbeat ISM Services PMI data for October and stays under modest selling pressure as investors await exit polls to see who is closer to winning the US presidential election.

GBP/USD clings to modest gains near 1.3000, awaits US election result

GBP/USD trades marginally higher on the day at around 1.3000 after finding support near 1.2950 on a broadly subdued US Dollar. Traders eagerly await the outcome of the US presidential election, refraining from placing fresh bets on the major.

Gold extends consolidative phase as US election result looms

Gold attracts dip-buyers after touching a one-week low on Tuesday but remains below $2,750. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.3% as markets eye US election exit polls, limiting XAU/USD's upside.

Crypto markets brace for volatility in tight race between Trump and Harris

The US presidential election is one of the most significant events in the world. Due to the influence of the country’s political decisions, policies, and economic approaches, it can significantly impact crypto and global markets.

US election day – A traders’ guide

Election day volatility: Brace for potential wild market swings. Election days bring opportunities, but also risks. Unclear results can increase volatility further.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.