The recession next time, US employers hang tough with jobs

- Nonfarm Payrolls add 372,000 in June, beating the 268,000 forecast. Unemployment rate remains at 3.6%.

- Average Hourly Earnings rise 5.1%, May revised up to 5.3%.

- Treasury yields rise, equities and the dollar are flat as recession fears fade.

American firms hired far more people than expected in June easing fears of an incipient recession, though the most popular GDP estimate remained negative in the second quarter.

Nonfarm Payrolls added 372,000 jobs, well ahead of the 268,000 consensus forecast from the Reuters Survey of analysts. Job creation has been trending down over the past year with the three-month moving average at 397,000 in June down from 580,000 in January and 564,000 last July.

The unemployment rate was unchanged at 3.6% as forecast, and the underemployment rate, which includes part-time workers who cannot find full-time jobs, dropped to 6.7% from 7.1% in May.

Unemployment rate

One reason job creation and the unemployment rate have stayed strong despite weak or non-existent economic growth comes from the household survey which calculates the unemployment rate. The labor force dropped by 353,000 workers and the participation rate fell to 62.2% in June from 62.3%. The combination of fewer people looking for jobs and a smaller percentage of available workers employed means a continuing labor shortage resulting in supply and product issues and continued upward pressure on wages as employers compete for scarce help.

Average Hourly Earnings, one of the three main compensation measures, rose 5.1% on the year, slightly better than the 5.0% prediction. The May result was revised to 5.3% from 5.2%. Earnings climbed 0.3% for the month as expected. Though the May adjustment was small, it demonstrated, like the participation rate, that the forces driving wage inflation, have not peaked. Markets will be watching at the end of the month for Personal Income and Real Disposable Income from the Bureau of Economic Analysis (BEA) for a gauge of inflation’s impact on consumer finances.

The Atlanta Fed GDPNow model, which has charted the economy’s potential descent into recession, improved after the NFP release. Estimated second quarter GDP rose to -1.2%, up from -1.9% on July 7 and -2.1% previously.

Markets

Markets were generally unmoved by the NFP report as results were mostly in line with expectations. Prior to the release there was speculation that the weak retail sales and real personal consumption expenditures numbers for May and the negative readings in manufacturing and services employment Purchasing Managers Indexes (PMI) were foretelling a poor payroll report.

The Dow closed down 46.40 points, -0.15% at 31,338.15 and the S&P 500 shed 3.24 points to 3,899.38, down 0.08%. The Nasdaq gained 13.96 points, 0.12% to finish at 11,635.31.

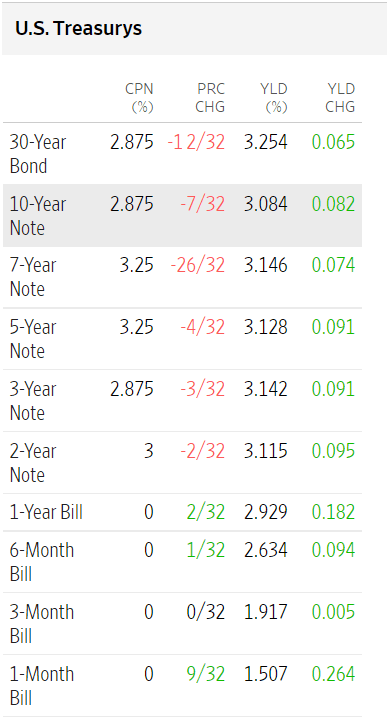

Treasury yields were stronger across the spectrum with all terms of two years or longer closing above 3.0%. The 2-10 Treasury spread remained inverted by 3.1 basis points.

Wall Street Journal

The dollar took a breather from its torrid recent gains, suffering small losses against the euro, sterling, Australian , New Zealand and Canadian dollars and posting minor increases versus the yen and the Swiss Franc.

West Texas intermediate (WTI) rose to $102.44, closing above $102.00 for the first time in four sessions. The North American crude standard has gained 4.9% since closing at $95.78 on Wednesday.

Another reason for the unexceptional market response to the NFP is that next week will see reports for consumer prices and retail sales in June, both have the potential for major market impact.

Job distribution

Education and health services jobs led the field with 96,000 new positions. Professional and business services added 74,000 employees followed by the leisure and hospitality sector with 67,000, health care, 57,000, and transportation and warehousing 36,000. Manufacturing employment rose 29,000, information technology added 25,000 and government jobs dropped 9,000.

Federal Reserve policy

The more than respectable job growth was a boon to the Fed, whose anti-inflation rate hikes could be curtailed or ended if the economy slips into recession or job creation crashes. June payrolls virtually guarantee a 75 basis point increase at the July 27 Federal Open Market Committee (FOMC) meeting. Treasury futures have the odds for a three-quarters of a point hike at 93.0%, with 7.0% favoring a full 1.0%.

Consumer inflation was 8.6% annually in May with core at 6.0%. The Personal Consumption Expenditures Price Index (PCE) registered 6.3% in the headline and 4.7% for the core in May.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637929140634115774.png&w=1536&q=95)