The Powell testimony is likely to control sentiment

Outlook: The big data release is existing home sales today and new home sales tomorrow. These are not market-movers in FX, although the press is warning that once again, big investment houses are picking up houses to rent out. This smells bad, mostly because giant corporations make lousy landlords, as we saw in the great housing disruption following 2008-09. This time it’s not the cheap foreclosures they are after, but an expectation of endlessly higher housing prices that will allow endlessly higher rents. It won’t be long before we get some critical academic treatment of the role of rents and rentiers. It’s not pretty. Gittler at BDSwiss has a cute description—“The US housing market has gone full Bitcoin.” He cites one nugget—housing prices in Phoenix AZ are up over 10% in just the last 30 days.

The Powell testimony today is likely to control sentiment. Technically he is speaking to the House Select Subcommittee on the Covid Crisis. His opening remarks have already been released and according to those who have seen them, he repeats the comments from the last FOMC. The only issue is whether any House members ask questions he could fumble. But Powell is a competent guy and tends not to fumble nor to obfuscate. Powell will stay true to form and downplay both inflation and the scary idea of accelerated tapering/hikes. The WSJ has his back today, too, with a well-illustrated article on how inflation fades when the base effect is removed by looking at current data vs. pre-pandemic data.

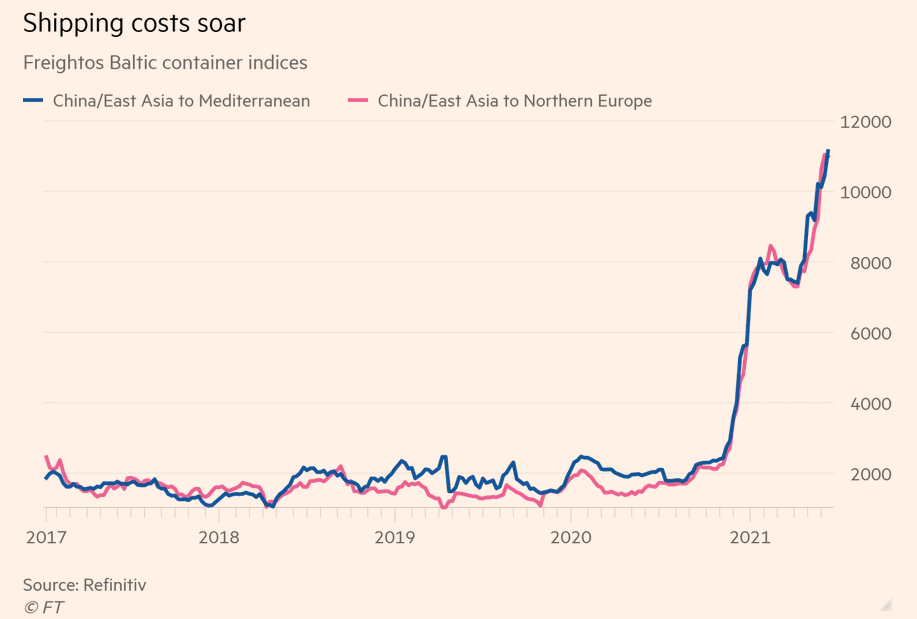

The quest worldwide to fix fragile and frayed supply chains is a big deal. Various countries, including the US and Japan, plan to invest heavily in chip production, for example. But China still has a largely controlling role. The FT reports a Covid outbreak in a shipping port last month forced a lockdown and that, together with surging new demand, has led to gigantic increases in shipping costs. See the chart. “… the cost of sending a 40-ft container on Asia to North Europe route recently topped $11,000 for the first time, up from about $8,500 in mid-May and $2,000 last October, according to Freightos.”

Shipping costs are, of course, a contributor to overall inflation, but is likely to be one of those inflexible that gets fixed fast. Shipping logistics experts are scrambling to reroute ships and one says we will get back to pre-Covid supply chain reliability in 6 to 9 months.

The problem facing economists and chartists alik this morning is how to predict the response to a less-hawkish Fed. We still have two important regional Feds, Dallas Kaplan, and St. Louis Bullard, promoting the idea of accelerated tapering/hikes. The rules of Fed management specifically call for each regional and Board Fed to be allowed to speak his own mind, the only exception being the period immediately preceding an Open Market Committee meeting. In other words, Powell does not have the ability to rein in maverick Feds, even if he wanted to.

The implication for the dollar is that its meteoric rise is ending. But a stop-and-reverse move like we just had in the euro is vanishingly rare. We complain that breaking norms like the Bollinger bands and standard error channel leaves us without guidance, but at the same time, we can’t expect prices to fall back into their old channels as though the breakouts were just dismissible aberrations. They are not dismissible. Most breakouts are, indeed, false, meaning they fade away and the previous move reasserts itself. But not when the breakout is as big as this. It’s a judgment, but we’d say this is not a false breakout—but we won’t know for some time and certainly not today and maybe not this week.

If the breakout is real, we expect the euro to resume its down move, and then we are looking for a test of the previous low, 1.1722 from March 30—despite being oversold. We had something similar in Jan-Feb. Other currencies are trickier, especially sterling and the AUD/CAD. The BoE is expected to say dovish on the grounds the extension of the lockdown calls for prudence, but you never know. As for the AUD and CAD, they are expected to be leaders in exiting extreme QE. Why would they not benefit from rising rates?

One nagging worry—the delta variants get a grip in the US and we get another wave of Covid. There is no appetite for a lockdown anywhere, let alone the states where low vaccination rates prevail. This cuts into recovery and raises the risk of prolonging ultra-easy conditions. Do we get risk-off and dollar buying as a result, or risk-off and get out of dollars because the growth/reflation trajectory is damaged? Nobody knows the answer to that one.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat