Pluto 90 US Mercury: Major change in trend US stocks, T-Bonds and US Dollar

10/25 Recap: - The S&P opened with an 9 handle gap up and continued 3 handles higher into a 9:30 AM high. From that high, the S&P declined 20 handles into an 9:42 AM low of the day. From that low, the S&P rallied 32 handles into a 1:13 PM high. From that high, the S&P pulled back 6 handles into a 2:04 PM low. From that low, the S&P rallied 7 handles a 2;35 PM new high for the day and a new all-time high. From that high, the S&P declined 11 handles into a 3:56 PM low. From that low, the S&P bounced 4 handles into the close.

10//25 – The major indices had a moderately strong up day with the following closes: The DJIA + 64.13; S&P 500 + 21.58; and the Nasdaq Composite + 136.51. The DJIA made a new all-time high at 35.787.04; The S&P 500 made a new all-time high at 4572.62.

Looking ahead – We were not afforded a good entry pattern on Friday. So, we are in the pass sidelines mode, probably until the end of this week.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

5. A. 10/29 AC – Venus Greatest Elongation East. Major change in trend Cattle, Copper, Cotton, Sugar, Wheat.5.

B. 10/29 AC – Pluto 90 US Mercury. Major change in trend US Stocks, T-Bonds, US Dollar.

C. 10/29 AC – Geo Mars enters Scorpio. Important change in trend Cocoa, Hogs, and T-Bonds.

Stock market key dates

Fibonacci – 10/29.

Astro – 10/29 AC.

Please see below the S&P 500 10 minute chart.

Support - 4550, Resistance – 4590.

Please see below the S&P 500 Daily chart.

Support - 4540, Resistance – 4580.

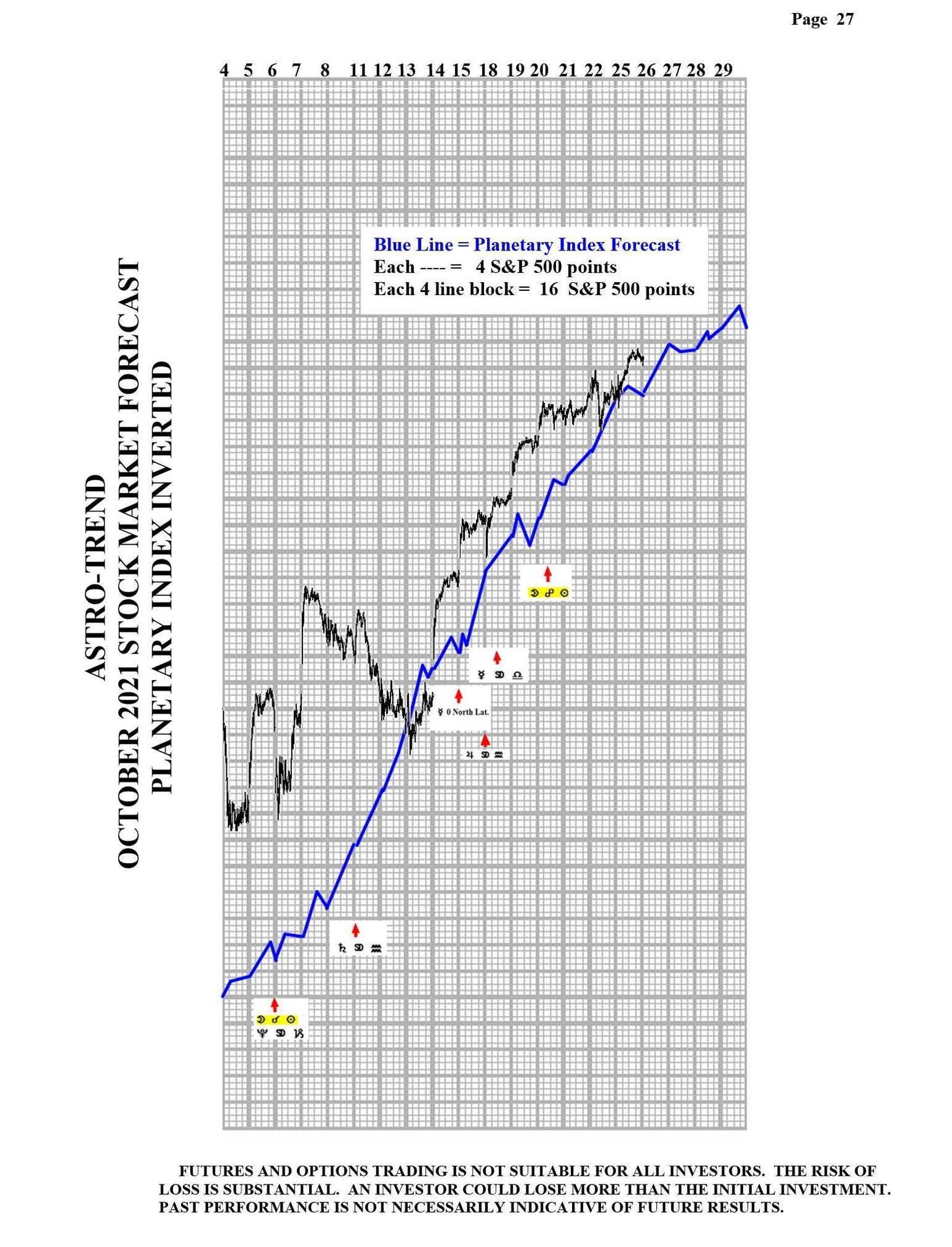

Please see below the Planetary Index charts with S&P 500 10 minute bars for results.

As of 10/22, I am dropping the charts marked Pages 26 and 28.

Author

Norm Winski

Independent Analyst

www.astro-trend.com