The morning after

Tuesday's opening bell in the Asian markets might as well have been a call for lifeboats, as traders, weary from bailing out from Monday's market tsunami, clung to hopes for calmer waters. Interestingly, the yen, which played the villain in yesterday's dramatic sell-off, might transform into today's hero, offering a potential lifeline amid the continuing volatility.

This wasn't just any market dip; Japan witnessed its second-largest stock plummet ever, sending shockwaves through global markets and whipping up a storm of volatility usually reserved for catastrophic events.

While it's easy to blame the usual suspect—the carry trade circus—a closer look reveals that there isn't just one villain in this story. Given the economic climate, the yen carry and other leveraged bets were indeed skating on thin ice. The Bank of Japan might have missed an opportunity to pre-signal a rate hike, and the Fed’s decision to hold rates steady didn’t exactly calm the waters. And let's not even start on the overinflated tech bubble on Wall Street—a ticking time bomb waiting to go off.

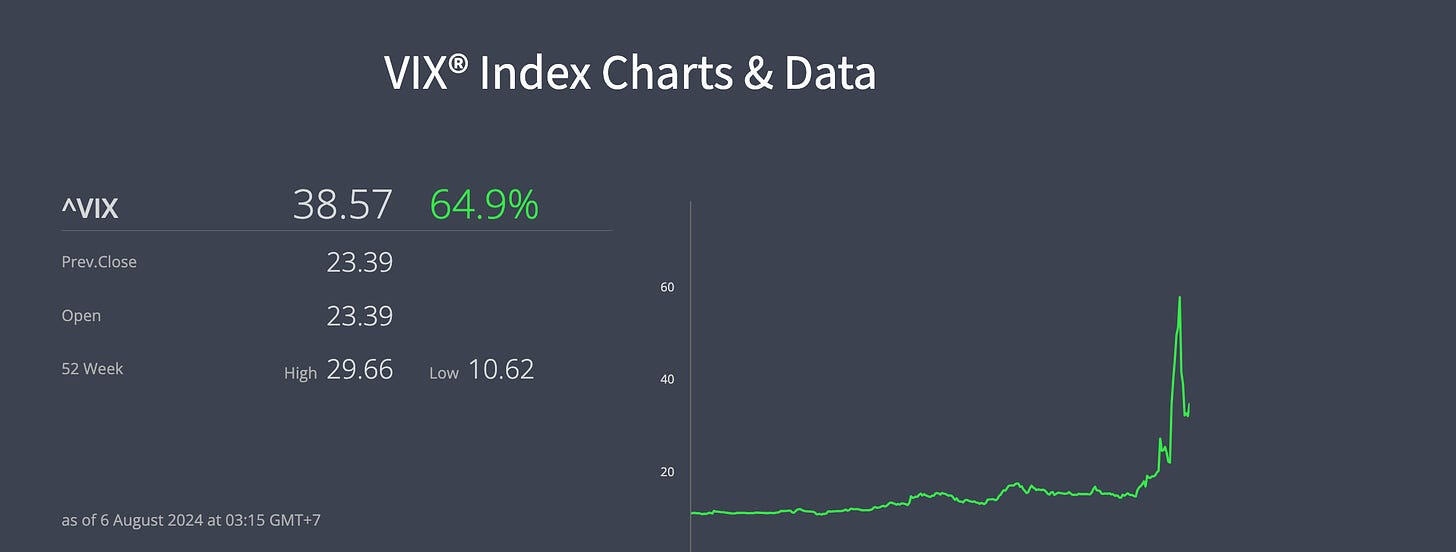

But honestly, we've witnessed the perfect storm of market dysfunctions, glaringly apparent during those wild VIX surges when the market's capacity to manage risk vanished. This was more than just a few bad calls or risky bets going south—imagine a game of hot potato with high-stakes assets, and suddenly, everyone's hands are full. The higher the VIX, the fewer takers there are for another toss, leading to a market scenario that's more about dodging than catching.

But let's set the record straight: the real drama isn't coming from the currency traders—those modern-day Wild West gunslingers—it's unfolding within U.S. equities, particularly the tech giants. To be even more specific, all eyes are on Nvidia's next move.

This morning’s S&P 500 Market-on-Close (MOC) orders suggest a less frenetic risk transition to Asia. It's likely too early to sound the all-clear—markets still have plenty of risk to unpack, especially with recession talk lurking—but today's robust US services data provided a glimmer of hope, reminding us that betting against the US consumer often ends, as well as challenging Joey Chestnut to a hot dog-eating contest.

A potential ray of hope for Tokyo stocks is the USD/JPY stabilizing around a more export-friendly 145 midpoint. This suggests that the recent turmoil might primarily have been a massive carry trade stop-loss event, a sort of financial Armageddon. This stabilization could signal the beginning of a recovery phase for the battered market.

That said, we should anticipate a shift back to a bleaker financial baseline for Asian FX. After all, how often does the ASEAN exporter bloc rally when the US is on the edge of an economic downturn? Yesterday was dominated by rallies in the Japanese yen and the Chinese renminbi, driven by a global stop-loss unwinding of leveraged positions. Today, however, could unfold differently as the markets continue to adjust to shifts in the US economic landscape.

Having navigated numerous market downturns, I can say that insights become clearer post-crisis. When you identify the cause and effect, the worst is often over, and the cleanup begins. Yet, each meltdown can still shock those who've never weathered a major downturn.

A defining trait of these self-perpetuating market crises is the vicious cycle where sell-offs amplify volatility, which in turn cripples the market's risk management abilities, feeding back into more declines. That's precisely our current scenario—a loop of rising volatility and shrinking risk capacity that challenges even the most seasoned traders. Just look at yesterday’s VIX surge; the fear gauge truly takes no prisoners.

As always with the market, take this to heart: Yesterday’s misery often turns into today’s punchline. The swift twists and turns of trading can transform what seemed like a dire situation into a fleeting memory, one that’s often laughed about in trading rooms the next day—assuming, of course, no one has snagged your chair by the time you arrive.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.