The April employment report delivered a mixed bag of results. Job creation fell short of expectations, unemployment figures rose, and wage growth remained subdued. This data sets a potentially dovish tone for the upcoming statements from key Federal Reserve officials. The expectation of a softer stance on monetary policy could give US dollar bears a reason to rally. However, the currency might see some consolidation in the short term, especially with pivotal US inflation data on the horizon next week. Furthermore, unexpected currency movements in Asia and evolving market sentiments are shaping a complex backdrop for the dollar.

The fundamentals impacting the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory. This development has led investors to expect a potentially dovish pivot from the Federal Reserve. If the Fed adopts a more cautious approach, it could reduce the likelihood of near-term interest rate hikes, thereby pressuring the dollar downwards.

Moreover, international factors also play a crucial role. The surprising underperformance of the Yuan, despite China's efforts to curb excessive currency weakness and promote growth through supportive policies, reflects the complex interplay of global economic forces. This situation illustrates the nuanced dynamics influencing the dollar. The market's response to these developments, including a recalibration of rate-cut expectations previously priced in, underscores the sensitivity of the US dollar to domestic economic shifts and international monetary flows.

Technical outlook

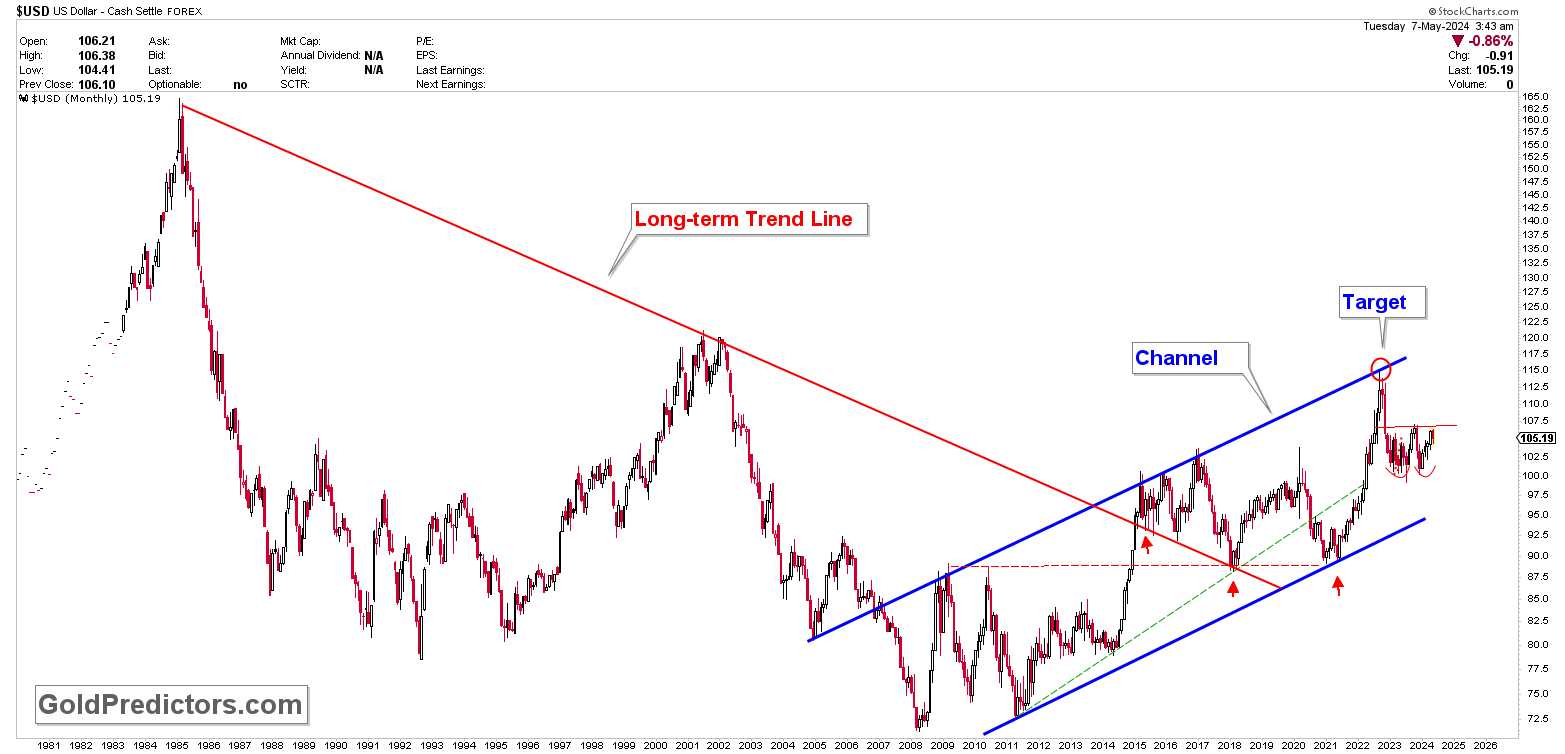

From a technical perspective, the US dollar presents an interesting scenario. Analysis of the monthly chart indicates that the dollar is trending upward within a defined channel, suggesting a continuation of its recent ascent. Despite breaking a long-term bearish trend line, the currency's trajectory points to sustained growth until a clear top formation is confirmed. Last week's drop, aligning with the neckline of a double-bottom pattern, appears to be a normal retracement within a larger bullish context. This pattern suggests that while the dollar may face short-term pullbacks, its fundamental upward trend is likely to persist in the medium term, barring significant economic upheavals.

Conclusion

In summary, while the US dollar faces potential headwinds from a softer Federal Reserve stance and mixed economic signals at home and abroad, the technical indicators suggest a continuing upward movement. The interplay of dovish policy expectations, influenced by domestic labor market trends, and international currency dynamics will be crucial in shaping the dollar's path forward. Investors and market watchers may stay alert to unfolding economic data and the Fed's communicative cues, which will be instrumental in setting the market tone for the coming months. As the landscape evolves, the dollar's journey remains a focal point of interest amidst a backdrop of global economic uncertainty.

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.