The Gold market amid the financial crisis: An investor’s opportunity

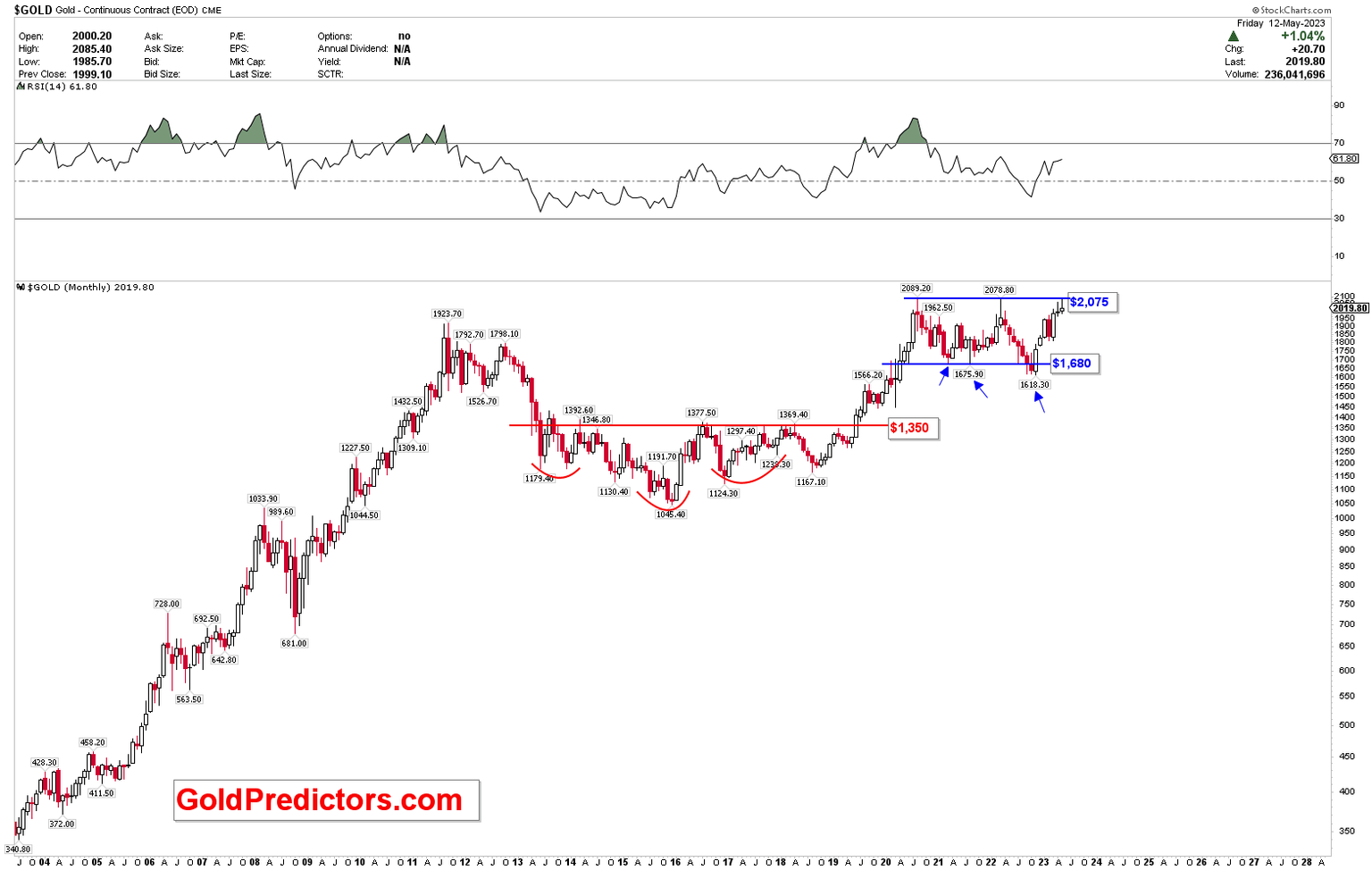

The gold market, a traditional safe haven, is again in the limelight as it reaps the benefits of the ongoing financial crisis. Recently, it has hit a solid resistance at the $2,075 region, an area that has been underlined as a crucial pivot on a long-term basis. While there was a brief surge above this pivot, likely to clear stop orders, the price quickly retraced, reinforcing the significance of this level.

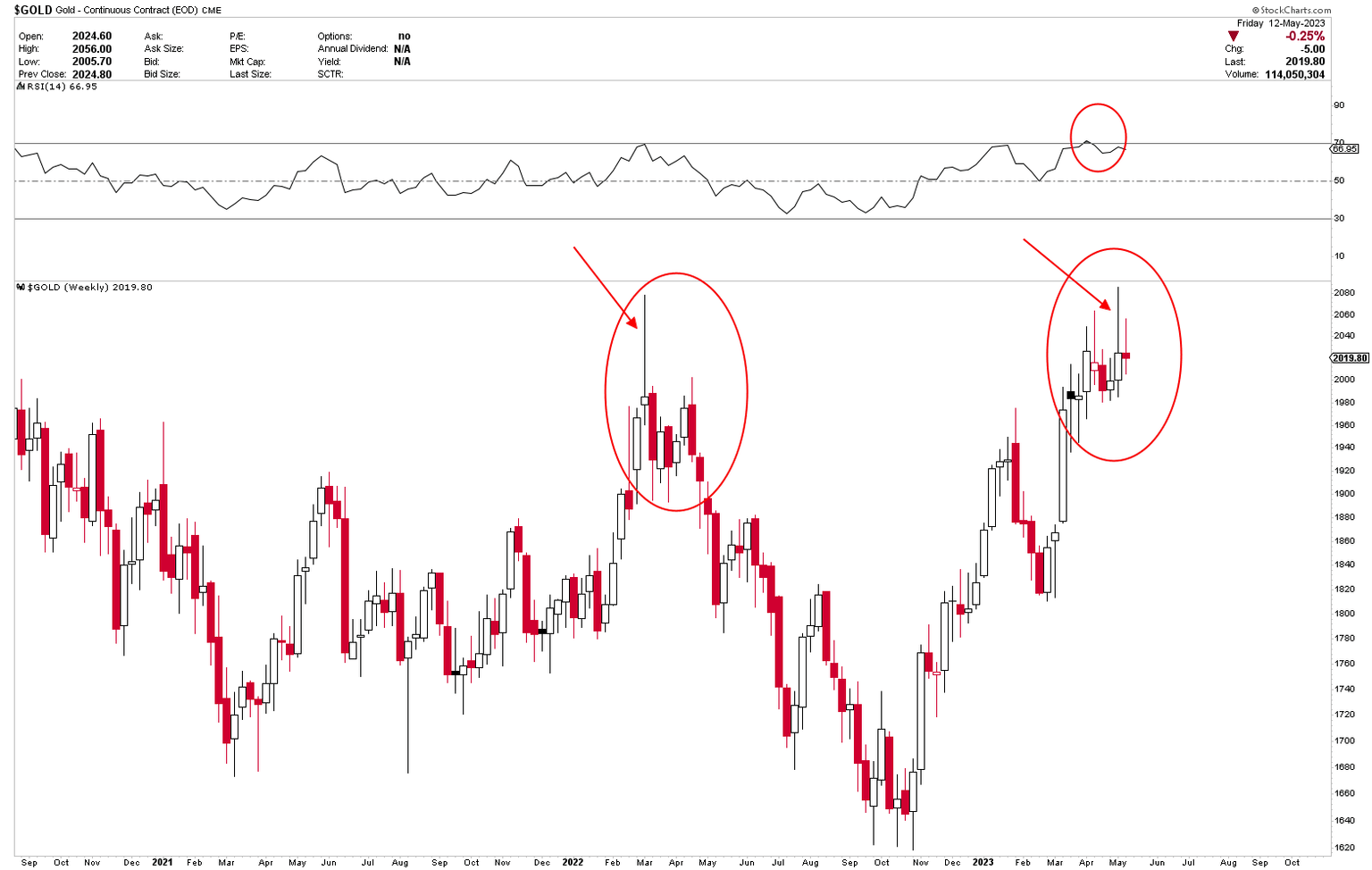

The $2,075 pivot and its significance

A glance at the weekly chart below illustrates the consistent pattern that emerges when the price reaches the $2,075 region. Time and time again, weekly wicks appear at this level, hinting at the battle between buyers and sellers. What is intriguing about the current situation, however, is the market condition. It suggests a forthcoming price retracement lower, presenting an opportune moment for investors to go long in the gold market.

Indeed, it appears that the price is set to ascend substantially from here. While CPI values are dipping, long-term inflation remains high, as evidenced by robust retail sales figures. Such persistent inflation concerns are likely to pressure the Federal Reserve to maintain higher interest rates. The Long Consolidation Phase and the Impending Breakout

Another point of consideration for investors is the unusually long consolidation phase, ranging between $1,680 and $2,075. Given the prevailing market uncertainty, it is increasingly plausible that the price could break higher from this phase.

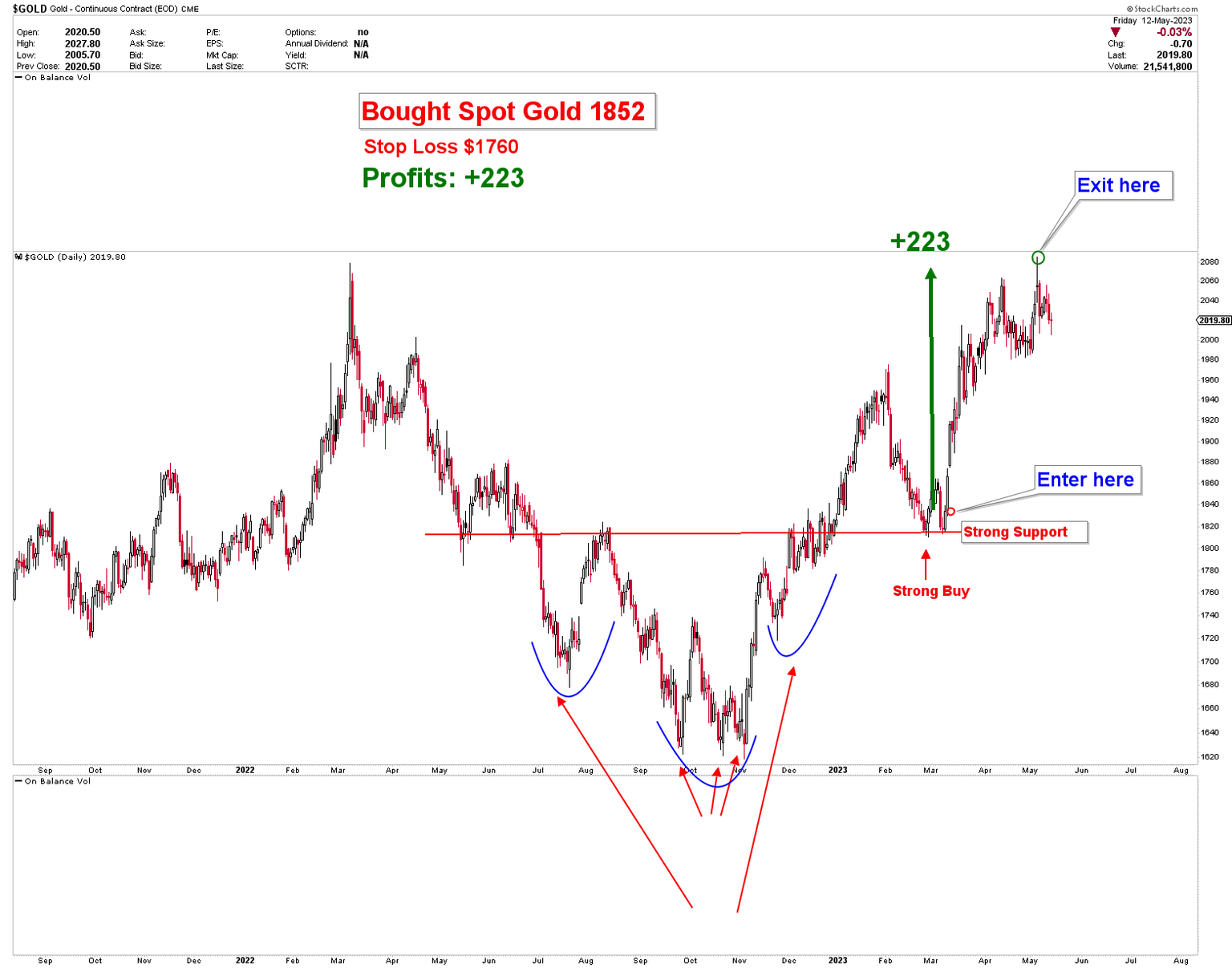

However, the pressing question for investors is how and where to engage with the gold market effectively. The chart below illustrates a successful trade executed in the $1,800 region, with an exit at the $2,075 level, where a price drop was anticipated. This strategic move yielded more than $200 per ounce, making it one of the most lucrative trades of 2023.

Looking forward: Identifying the next entry point

With the successful trade behind us, the focus now shifts to identifying the next entry point to buy in the gold market. The persistence of high long-term inflation and the ongoing financial crisis suggests that gold could potentially extend its gains, especially if it can break out from its current consolidation phase.

Given the resistance at the $2,075 level, any price retracement lower could be seen as a buying opportunity. However, investors should remain vigilant and flexible, considering the overall economic condition and other potential factors that could impact gold prices.

In conclusion, while the gold market has been affected by the financial crisis, its response presents unique opportunities for astute investors. The key is understanding and navigating market trends, carefully identifying buying opportunities, and executing trades at the right time. This approach could make gold a lucrative investment, even amid economic turbulence.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.