The GBP/USD shift: Decoding the head and shoulders signal

The GBPUSD pair, often referred to as the "cable" in trading parlance, has been an emblem of currency trading for decades. This evergreen trading pair has recently flashed some intriguing signals, which could pave the way for a fresh narrative in its trading direction.

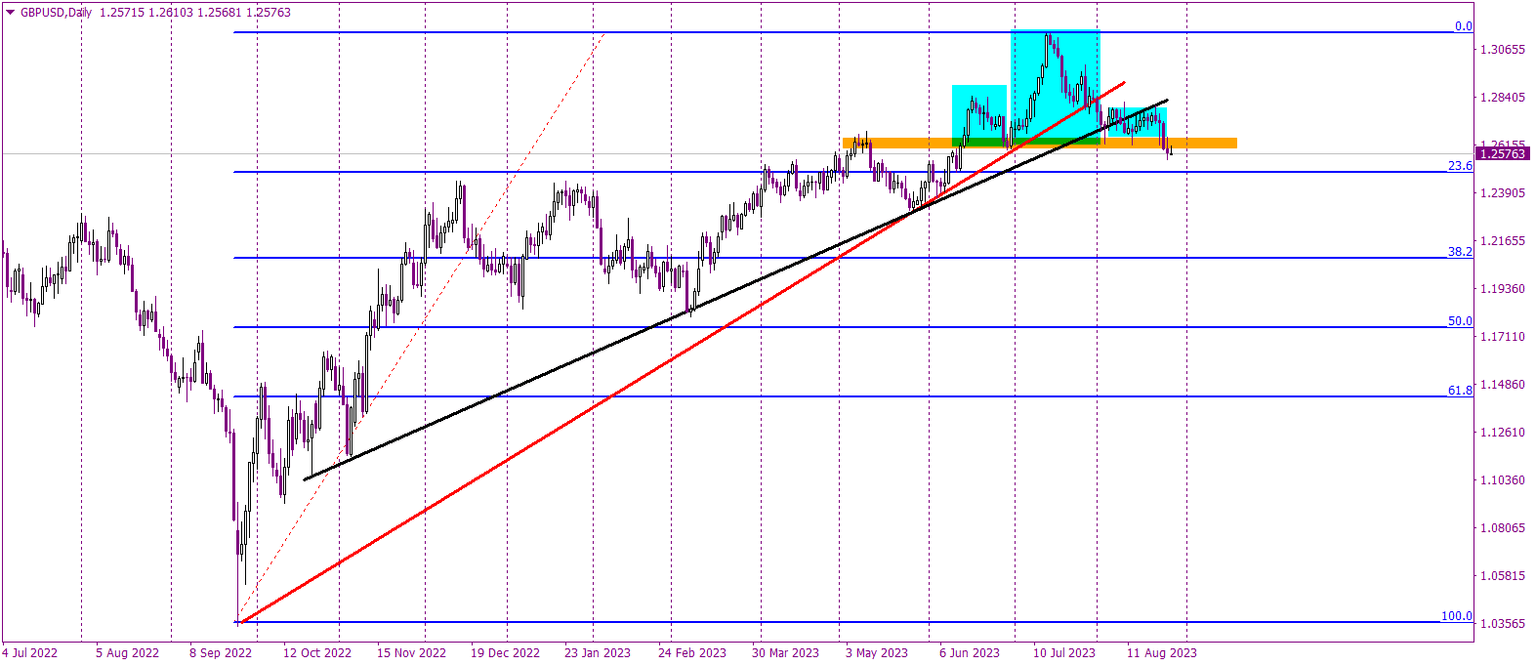

Over the last week, this pair has sketched out a classic head and shoulders formation, outlined conspicuously in blue. For those less versed in technical jargon, the head and shoulders pattern is a reliable indicator that a currency pair, or any tradable asset for that matter, may be about to take a bearish turn, effectively terminating its prior uptrend.

Lending further weight to this bearish prognosis is the recent breach below the neckline of the pattern. This neckline, depicted in an unmissable shade of orange, serves as a critical juncture in this formation. A successful close below it, which the cable managed to accomplish last week, often translates to a strong sell signal.

However, the bearish omens don't stop there. In tandem with the aforementioned developments, GBPUSD also slipped below two uptrend lines, colored in red and black. This dual breach accentuates the prevailing bearish sentiment and suggests that the bulls might be retreating for the time being.

But as with all market dynamics, there's always a flip side. While the current technical setup does advocate a bearish posture with a stay below the orange zone solidifying the sell signal, markets are known for their unpredictability. There remains the possibility of what technicians term a "false breakout." Should the price of the pair rally and position itself back above the orange territory, it would negate the bearish outlook and instead send a clarion call to the bulls. Such a move would indicate that the initial descent was a mere feint, and the actual trajectory might be northwards.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.