The Fed is likely done hiking – What’s next?

Economic readings continue to point to a “soft landing” through the next few months, characterized by low and falling inflation and a resilient labor market. Consequently, the Fed raised interest rates for what is probably the last time during the current cycle. The concern for markets this week shifted to the sustainability of continued fiscal spending in a world where the unemployment rate remains below trend and the economy is not clearly in a recession.

Coupled with the policy shift from the Bank of Japan, which raised its upper bound for the 10Y JGB yield to 1.00%, the expectations for higher risk premium in longer maturity bonds could spill over to spread sectors and equities as higher term premium could push credit and equity risk premia higher.

1. Rebalancing of labor market

The Jobs to Workers gap continues to tighten, led by a decline of job openings of 2.5 million jobs since the middle of 2022, signaling the easing of the labor backlog since COVID. The number of unemployed has remained relatively stable and has not risen significantly.

2. Inflation expectations normalizing

Consumer inflation surveys and market-based measures have normalized – the inflation psychology remains anchored to trend inflation. Falling inflation expectations is an additional positive data point that gives the FOMC the ability to stop raising policy rates.

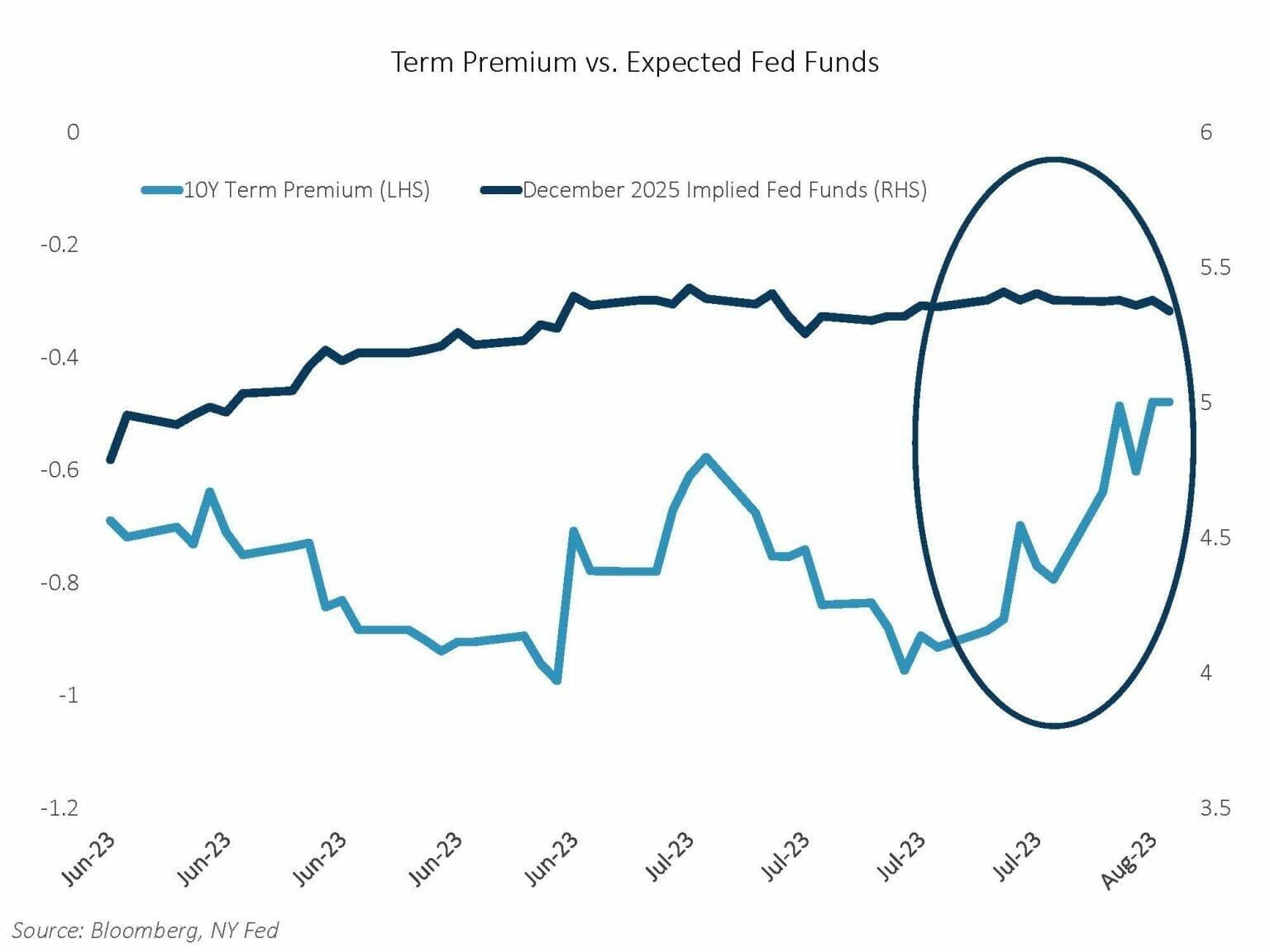

3. Bear steepening of the yield curve

In early August, market concern shifted to the sustainability of fiscal spending and increased Treasury issuance. The expected path of Fed Funds has remained largely stable since the July FOMC meeting, while term premium popped higher – signaling that investors are demanding more premium for taking on longer maturities. As a result, the long end of the US yield curve moved higher while the short end remained largely the same – a rare “bear steepening” of the yield curve.

4. Real interest rates could start to restrict economic growth

Real interest rates are the cost of capital for the US economy and have now closed the gap with US GDP. A negative GDP/Real Yield Gap has historically resulted in economic slowdowns, will this time be different?

5. Continue to favor MBS over corporates

We continue to underweight corporate bonds versus MBS. The MBS basis is the most elevated versus corporate bond spreads in over 15 years. For a sector that provides a quality, liquidity, and spread pickup, we believe MBS continues to provide a compelling opportunity.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.