A motion of censure backed by left-wing and far-right MPs is expected to bring down the Barnier government before the end of the week.

Motion of no confidence

On Monday, faced with the impossibility of passing the social security budget, and despite the many concessions made to the far right, French Prime Minister Michel Barnier decided to use Article 49.3 of the Constitution, which allows the government to force through legislation unless a motion of no confidence is passed.

The primary aim was to implement the social security budget. This decision opens up the possibility for members of parliament to table a motion of censure against Barnier's government. On Monday evening, the left-wing parties (124 MPs) and right-wing parties (Marine Le Pen's RN and Eric Ciotti's supporters, 140 MPs) decided to submit a motion of no confidence.

These motions of no confidence will be analysed and voted on in the National Assembly no earlier than the evening of Wednesday, 4 December. To bring down the government, a majority of the 577 MPs must support them. To obtain a majority, the left-wing parties must vote with the far-right RN on the same motion of censure. This would lead to the fall of the government.

At this stage, this is the most likely scenario, as Le Pen has indicated that her party is prepared to vote in favour of the motion of censure tabled by left-wing MPs. While a last-minute twist is still possible, all indications are that the government will have fallen by the end of the week, less than three months after its appointment. This will usher in a new period of political uncertainty.

What happens next?

There will be no dissolution of the National Assembly or early elections before July 2025, as the Constitution provides for a minimum period of one year between elections. Then, based on the forces present, President Emmanuel Macron will have to appoint a new prime minister. Two scenarios are possible: either a new government is appointed in December, or there is no new government until the end of 2024.

Given the challenges in appointing Barnier as prime minister, the likelihood of finding a replacement quickly is highly uncertain. With an extremely polarised National Assembly divided into three major camps – left, centre-right and extreme right – who are unable to reach a compromise, the risk of a new vote of no confidence for any new government is very high.

In any case, it is almost certain that there will not be a majority to pass a state budget or a social security budget before the end of the year. The last few weeks have shown that MPs and Senators are extremely divided on how to restore public finances and that a consensus is virtually impossible.

The recovery of public finances is in jeopardy

It seems unlikely that France will have a 2025 budget. However, this doesn’t imply a shutdown where France can’t meet its financial obligations. A provisional budget, likely mirroring the 2024 budget, will probably be implemented. Such a budget will not rectify the trajectory of public spending. The public deficit is expected to exceed 6% of GDP in 2024. The Barnier government had hoped to reduce it to 5% by 2025, but without a budget voted for in 2025, this target will not be met. The provisional budget will be slightly restrictive, as tax scales will not be adjusted for inflation, but will not contain any real savings measures.

As a result, it will not be enough to set the trajectory of French public finances in the desired direction and will not respect the commitments made by France to the European authorities. At a time when economic growth in France is slowing markedly, this is bad news. The public deficit will remain high, debt will continue to grow and the next government – whenever that may be – will have an even tougher task to put public finances right.

In short, the political situation will delay and likely complicate the recovery of public finances, but it will eventually occur. The only difference is that the starting point will be later.

French drama adds to Euro woes

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025. Notably, short-dated yield spreads have moved against EUR/USD as this French crisis comes to a head, pushing EUR/USD back below 1.05.

Seasonally the dollar is weak in December. Europe will remain a drag on EUR/USD into year-end. With both the French and German governments in limbo, any EUR/USD bounce will have to be driven by softer US data and a dovish 25bp rate cut from the Fed on 18 December. Overall, we have a year-end target for EUR/USD at 1.05, but see the risks skewed towards the 1.02/03 area.

Typically, EUR/CHF comes under pressure when European politics hit the headlines. We are a little surprised it is still trading above 0.93 and expect it to press 0.92 should it become clear that the Swiss National Bank cannot cut rates as deeply as the ECB next year.

French bond spreads already reflect a lot of pessimism

The 10y yield spread of French government bonds over their German peers widened to 88bp on Monday. Further widening looks likely as politics enters a new phase of elevated uncertainty.

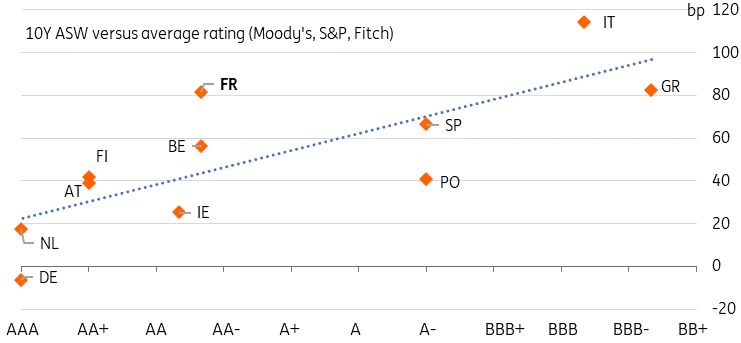

Looking at relative valuation across the entire eurozone bond spectrum, there are two key takeaways. First, the spillover to other markets has been limited. Italy, for instance, is still at spread levels closer to their tightest since 2021. Second, markets had been wary about the prospects of quickly solving French fiscal problems to begin with, reflecting an expectation of looming rating downgrades. Following the latest widening, French 10y spreads over swaps are more in line with an “A-“ rating rather than its current “AA-“ – three notches lower. In fact, French spreads are already well above Spain’s and now are on a par with those of Greece.

Investors already see France climbing down the ratings ladder

Source: Rating agencies, Refinitiv, ING

Government fragility was always part of the picture, even if not expected to come to a head quite so soon. Though it may take a while, a clearer picture going forward should allow spreads to recover from these stretched levels. However, France won’t be able to avoid a more lasting downgrade in its implied rating by the market, making the spread levels against Bunds seen before June’s elections seem quite distant.

Read the original analysis: The fall of Barnier’s government would be bad news for the French economy

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6400 amid weak Australian Q3 GDP and Chinese PMI

AUD/USD is under intense selling pressure, fast-approaching 0.6400 early Wednesday. The pair bears the brunt of weaker Australian Q3 GDP data, disappointing Chinese Caixin Services PMI and US-Sino trade worries. Focus shifts to more US data and Powell's speech.

USD/JPY consolidates the uptick to near 150.10

USD/JPY is back below 150.00 in Wednesday's Asian session, struggling to extend the latest leg higher as bets for a December BoJ rate hike underpin the the Japanese Yen. However, the downside remains capped amid increased haven demand for the US Dollar on growing tariff war fears.

Gold price remains confined in a familiar range; looks to Fed’s Powell for fresh impetus

Gold price continues its struggle to gain any meaningful traction on Wednesday. Bets for a less dovish Fed and an uptick in the US bond yields cap the precious metal. Geopolitical risks and trade war fears lend some support amid subdued USD demand.

Paul Atkins shows reluctance to replace SEC Chair Gary Gensler

Paul Atkins, regarded as a leading candidate to succeed Gary Gensler as Chairman of the Securities & Exchange Commission, has reportedly expressed a lack of enthusiasm for the position.

The fall of Barnier’s government would be bad news for the French economy

This French political stand-off is just one more negative for the euro. With the eurozone economy facing the threat of tariffs in 2025 and the region lacking any prospect of cohesive fiscal support, the potential fall of the French government merely adds to views that the ECB will have to do the heavy lifting in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.