The Eurozone economy is bottoming out

The eurozone escaped a technical recession and a number of indicators suggest the economy is now bottoming out. While the recovery is likely to be weak, it is still too soon to give the all-clear on inflation. The ECB is expected to cut rates from June onwards, but more cautiously than the market is currently anticipating.

More subdued recovery, more stubborn inflation

The two questions stirring debate regarding the eurozone outlook are whether the economy has now seen the worst of it, and how rapidly inflation will return to the 2% target. Most international institutions are convinced that growth will be stronger than in 2023, while the markets are betting that inflation will subside rapidly and will allow the European Central Bank (ECB) to cut interest rates significantly throughout the year. While we agree with the direction for both growth (up) and inflation and rates (down), we believe that the economic recovery will be more subdued, while inflation (although declining) is unlikely to trigger aggressive monetary easing.

Near term stagnation

After a contraction in the third quarter, eurozone GDP stagnated in the fourth quarter, narrowly avoiding a technical recession. The first indicators for January are mixed. The composite PMI indicator rose in January, but remained below the 50 boom-or-bust level. The economic sentiment indicator from the European Commission saw a significant progression in December, but was unable to continue its ascent in January. And in Germany, where the more restrictive budget is not helping to get the economy out of the doldrums, the important Ifo indicator fell to the lowest level since the pandemic. No surprise that the eurocoin indicator, a monthly gauge of GDP growth, declined to -0.56% last month. January’s sentiment data might have been negatively affected by the spreading unrest in the Middle East and incidents in the Red Sea.

Poor carry-over effect

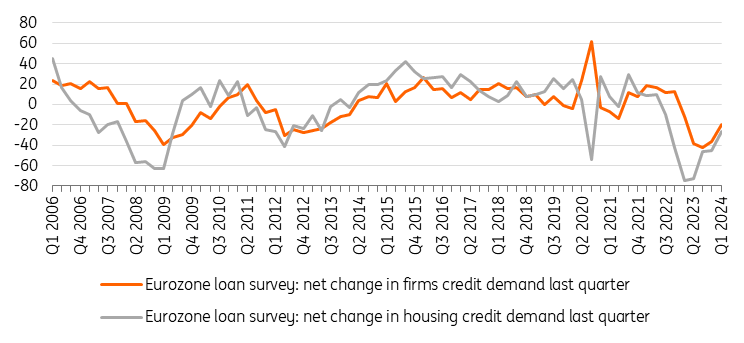

While first quarter GDP growth is probably going to hover around 0%, we still believe that a gradual recovery is going to set in from the second quarter onwards. Despite geopolitical events, energy prices remain at relatively low levels. The mild winter has kept a lid on gas prices. At the same time, eurozone unemployment stood at the historical low level of 6.4% in December. The decline in mortgage rates might bring back some life in residential construction, while the inventory correction in manufacturing will likely have run its course by the summer. In the Bank Lending Survey, the downtrend in credit demand seems to be reversing.

The bottom line is that even though the expansion will gradually gain momentum over the course of the year, the poor carry-over effect is likely to limit GDP growth to only 0.4% this year after last year’s 0.5%. In 2025, we see a pick-up to 1.4%.

Downtrend in credit demand is coming to an end

Source: LSEG Datastream

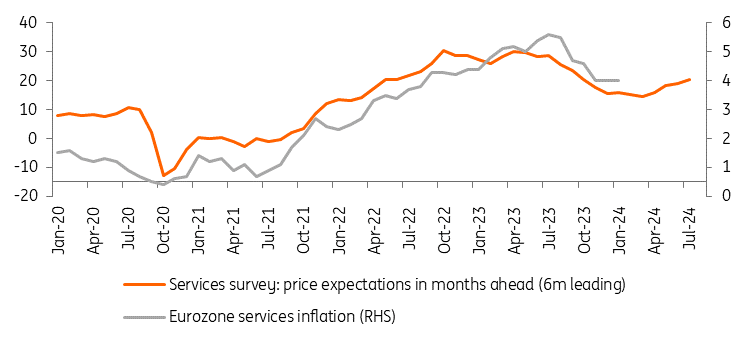

The inflation battle is not yet won

Headline inflation fell back to 2.8% in January, from 2.9% in December. The good news is that at the current level of energy prices, there is not much of a hump to be expected in the second quarter. However, the decline in core inflation, now at 3.3%, is likely too slow for the ECB. Services inflation remains stuck at 4% and with higher wages, the risk is that the disinflation trend slows. Let’s not forget that in both the PMI survey and the European Commission’s economic sentiment survey, selling price expectations have now already been rising for several months in a row (for services, even five consecutive months), reversing a downtrend that started in the middle of 2022. We still think that the inflation trend remains downwards, with average headline inflation for 2024 likely to come in at 2.5%. For core inflation, we still expect at 2.7% on average this year.

Services inflation remains sticky

Source: LSEG Datastream

A cautious ECB

With the relatively tight labour market, the risk is that wage growth remains too high for comfort. And that this is not absorbed in profit margins if the economy emerges from its soft patch. We therefore remain convinced that the ECB is going to tread carefully. ECB President Christine Lagarde clearly stated that the disinflation process would have to advance further for the central bank to be sure that it is sustainable. This led her to conclude that a rate cut before summer remains unlikely. We think June is still likely for a first 25bp rate cut. But thereafter, the ECB is likely to reduce interest rates only gradually. While the market already anticipates short rates at 2.5% by the end of this year, we only see that level in the second quarter of 2025.

Read the original analysis: The Eurozone economy is bottoming out

Author

Peter Vanden Houte

ING Economic and Financial Analysis

Peter Vanden Houte is Chief Economist Belgium, Eurozone and has been working with ING in various research functions for the last 20 years. He is also chairman of the “economic commission” at the Belgian Employers Federation.