The Euro’s upside surge may soon take a breather

The euro has emerged as one of the strongest currencies in the G10 group this year, driven largely by a sharp weakening in the US dollar amid growing uncertainties around President Trump’s tariff policies. Year to date, the US Dollar Index (DXY) has dropped 9%, falling from a high near 110 to just above 98, while the EUR/USD pair has surged more than 10% to as high as 1.1573, reaching a multi-year high.

European assets have been increasingly favoured by investors, with the euro being perceived as a haven currency amid tariff-driven market volatility. European stock markets, particularly Germany’s DAX, have also significantly outperformed their US counterparts. Optimism surrounding the EU’s accommodative fiscal stance and Germany’s landmark debt reform has further boosted sentiment towards the bloc’s economic prospects. By contrast, the Trump administration’s efforts to rein in government spending and reduce the deficit have prompted capital outflows from US assets. (Let’s not get into the controversy over the “Big, Beautiful Bill” and the drama surrounding it.)

However, there are now some early signs of a potential reversal, as trade negotiations appear to be progressing between the US and key partners, especially China and the EU. At this juncture, it is questionable whether the US dollar will continue its sharp decline against the euro—unless the Federal Reserve moves to cut interest rates more aggressively. Yet this seems unlikely in the near term, given that the US economy has not shown clear signs of sharp deterioration. The Fed is therefore expected to maintain a cautious stance on rate reductions.

Meanwhile, the European Central Bank cut interest rates by a further 25 basis points yesterday and is expected to continue its easing cycle throughout the remainder of the year. Although the ECB has maintained its meeting-by-meeting approach, markets anticipate the bank will remain accommodative, especially after recent cooler-than-expected inflation data and a downgrade to growth projections. These factors are likely to limit the euro’s upside potential, at least for the time being.

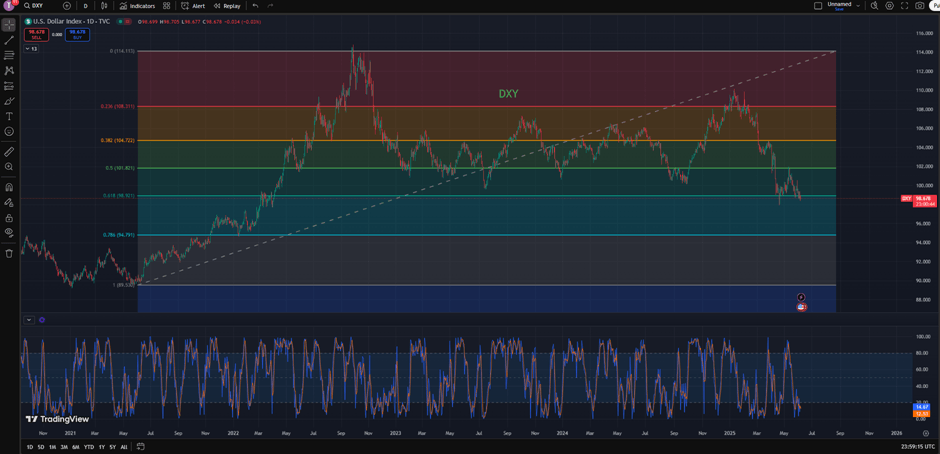

The US Dollar index tests key support

Source: TradingView as of 6 Jun 2025

The DXY is nearing a critical support level at the April low of 98, which also coincides with the 61.8% Fibonacci retracement level (drawn from the low in June 2021 to the high in September 2022). The Stochastic oscillator has entered oversold territory, indicating a potential for a technical rebound. The index may form a double-bottom at this level. The medium-term resistance lies around the 50.0% Fibonacci level, near 102. Should trade tensions ease further, we could see the DXY rebound to above 104 in the second half of the year.

Conversely, a decisive breakdown below 98 could lead to further losses, although that risk appears limited at this point.

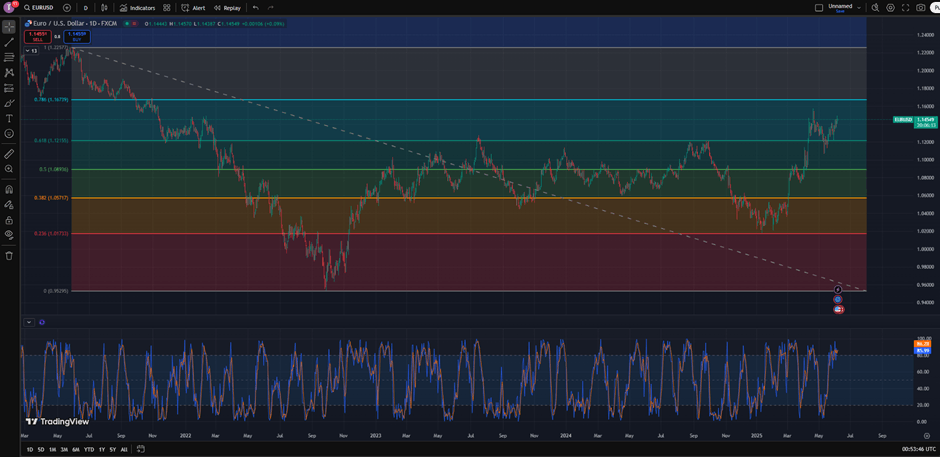

The Euro faces pivotal resistance

Source: TradingView as of 6 Jun 2025

Inversely mirroring the DXY, the EUR/USD pair has rallied strongly and may be forming a double-top pattern. The pair is now approaching pivotal resistance around 1.17, which corresponds to the 78.6% Fibonacci retracement level. The more immediate resistance lies near 1.1570, the April high. The Stochastic oscillator has entered overbought territory, suggesting a potential near-term pullback.

Key support in the near term is located around the recent low of 1.12, which also aligns with the 61.8% Fibonacci retracement. A break below this level could open the door for further downside towards 1.09, the 50.0% Fibonacci level.

On the flipside, the pair will likely accelerate its uptrend once it successfully breaks through the key resistance at 1.17.

Author

Tina Teng

Independent Analyst

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals.