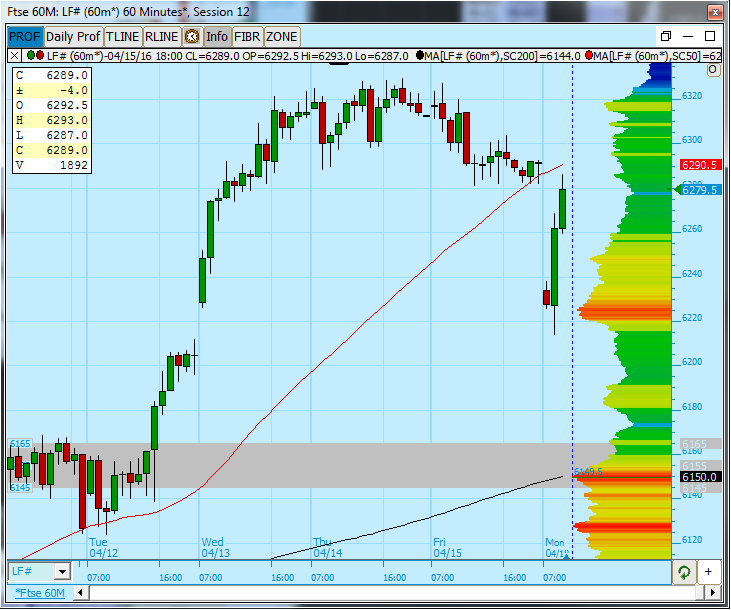

FTSE - Mind The Gap

FTSE opened weak this morning due to the overnight sell off in Oil which put pressure on all equity markets. On the cash open it was sitting just above Volume support in the 6220-5 region and was instantly sold. Most (myself included) would have been expecting and playing for a gap close from Tuesday at 6204 or 6212.5 depending on whether you used the day’s high or days close. It got so close but twice failed to fill it which of course leads to a lot of shorts in the hole. As you can see the move after was pretty straight line into Friday's gap where it has so far stalled. When a market gets so close to important levels but can't tag them it often leads to a violet move in the opposite direction as traders will be holding on looking for that level to trade. Keep this in mind in the future. Going forward I would only want to hold longs if we can hold above 6290.

Stoxx at key area

The Stoxx got to a key area last week before falling back slightly and of course today's gap has seen it lower still. So far though it has made a decent recovery but as we all know it's where the market closes that matters. I think going forward things are pretty simple; if we can get back above and stay above last week’s highs then the immediate term outlook is bullish, failure to hold above here and shorts seem the better play. Initial targets on shorts would be 2905-25 which was decent support throughout March.

Spoo weekly all about the trend lines baby

Hard to make a bear case for the Spoo on a weekly scenario at the moment (other than the obvious 'it's come too far too quickly' arguments). However the down trend from the all-time highs marks a key line in the sand for me. Any close back below here marks a false break in my book and we should then start to roll over finally. That's still a big 'if' at the moment but something to keep an eye on. 2026-34 still marks very key support below which will need to see a close below if we are to have a much more protracted pull back.

.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.