The end of American exceptionalism?

-

As US economic data turns lower, the risks of a US economic contraction has increased.

-

There has been a major shift in US stock market leadership in this year.

-

The MSCI world index is dominated by US stocks, especially tech stocks.

-

As other indices play catch up, the regional concentration risk in global stock indices will reduce.

The weaker than expected ADP report on Wednesday has added pressure to the uncertain outlook for the US economy. This is another disappointing US economic data point. The ADP private sector payrolls report recorded 77k jobs for last month, nearly half the level economists had expected. This has added to the recent run of bad economic data in the US. It now looks like the US economy peaked in the middle of Q4 and has been trending lower since then. The Citi economic surprise index is at its lowest level since December.

The weak ADP report heaps pressure on the US NFP report for February, that is scheduled for released on Friday. The market is expecting a reading of 160k, a slight uptick from January, but still well below the 2024 average monthly rate. While ADP and NFP reports do not have a particularly strong positive correlation, the weakness in the private sector survey could send a chill down the spines of US bulls.

The question of US exceptionalism has come up a lot recently. Firstly, just how exceptional was the US anyway? Its stock market was exceptional in recent years, and outperformed global peers, but US stocks moved out of lockstep with the real US economy in 2024, as you can see below. This chart shows the US composite PMI survey and the S&P 500. This chart has been normalized to show how they move together, and as you can see, stocks outperformed as the US PMI was mostly flat.

US Composite PMI and S&P 500, normalized to show how they move together

Source: XTB and Bloomberg

The end of the Trump bump

Over the last two years we have witnessed US stock market exceptionalism, largely driven by the tech sector and not by US economic fundamentals. Now that the US tech sector is in a downtrend, US stocks are struggling. Since the start of the year, concentration risk has dramatically reduced in the S&P 500. It is no longer dominated by a few tech names or one sector: chips and semiconductors. The best performing sector on the S&P 500 so far in 2025 is transport, followed by the healthcare sector and then tobacco. This suggests that the investors are favouring defensive US stock market sectors as economic policy uncertainty, and tariffs knock sentiment.

The best performing stock on the S&P 500 so far this year is CVS Health, a chain of pharmacies, which is another sign that investors are favouring ‘low tech’ bricks and mortar consumer staples over high tech and the AI trade. In contrast to CVS, Tesla is the second weakest US stock so far this year and is down more than 30% YTD. Tesla’s change of fortune means that the stock is now back at November levels. The S&P 500 is the same, which suggests that the ‘Trump Bump’ is finally over.

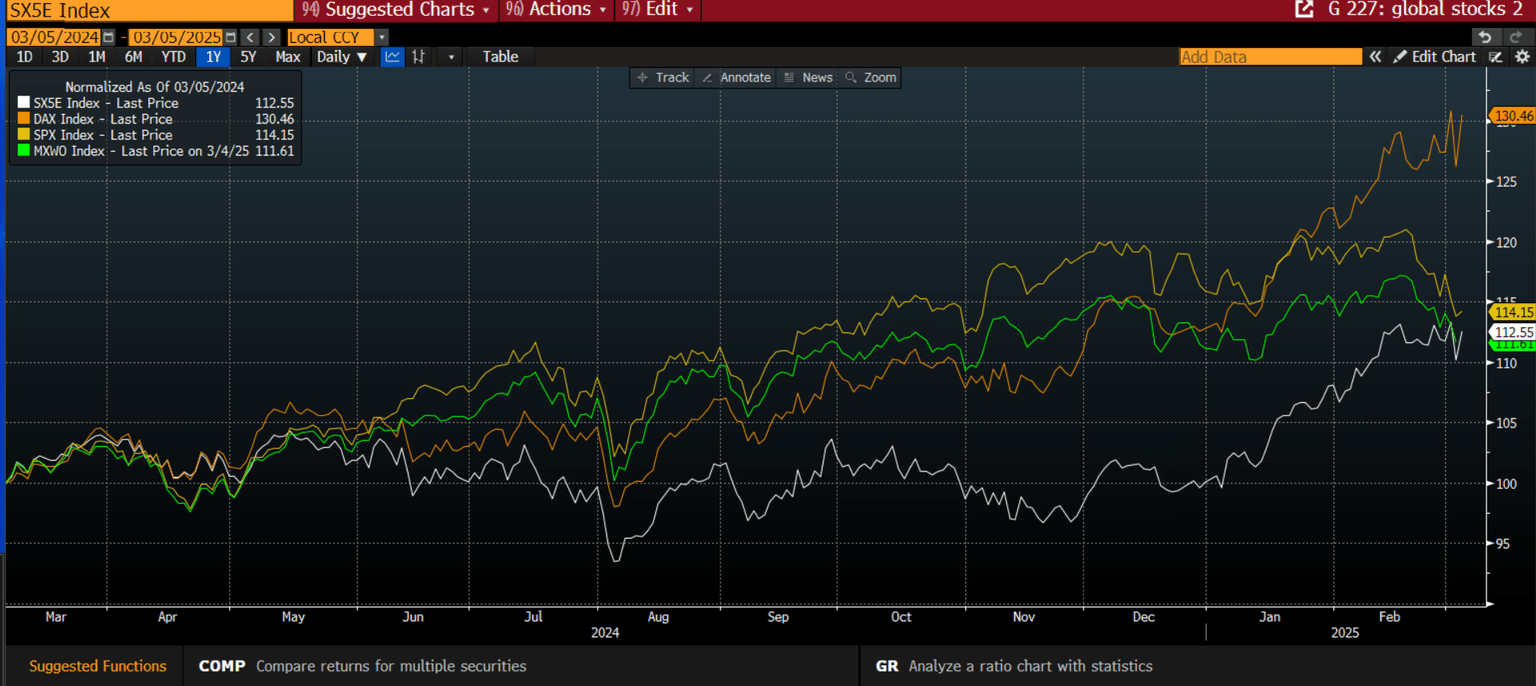

Concentration risks moderate

Regional concentration risks could also be declining now that other indices are playing catch up with the US stock indices. As you can see, European stocks including the Eurostoxx index, and the Dax have all outperformed the S&P 500 so far this year. The under performance of the US vs. other global indices, means that the MSCI world index, in future, may sea reduction in the US’s share in the MSCI world index. At the end of 2024, this stood at 74%, well above its long-term average of 57%. The Magnificent 7 alone contributed 40% to the returns of the MSCI world index over the last two years. This is not considered healthy, so some dilution in US stock market influence is to be welcomed.

S&P 500, Eurostoxx 50, Dax and the MSCI World Index, normalized to show how they move together

Source: XTB and Bloomberg

In the short term, the markets are waiting for a terrify update from President Trump later this afternoon, according to the US Commerce Secretary. The 25% tariff rates that were applied on Tuesday to Canada and Mexico, could be reduced, after Howard Lutnick hinted at a possible compromise and some exemptions. The market reaction and the ability for US stocks to recover, will depend on how far-ranging the exemptions will be.

The question now is, will President Trump persist with his unconventional economic policies, or does he want the US to join in the global stock market rally? That’s the choice for the President, just over a month into his second term.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.