The economic outlook has just become more uncertain

The economic and financial landscape has changed dramatically over the past week due to the current banking crisis that is leading to an elevated level of volatility in financial markets. We are explicitly assuming that authorities will take the necessary steps in coming weeks and months to stave off another global financial crisis à la 2008. After all, authorities proved remarkably adept in 2008 and again in 2020 with implementation of policies and programs that alleviated tensions, at least in part, in financial markets.

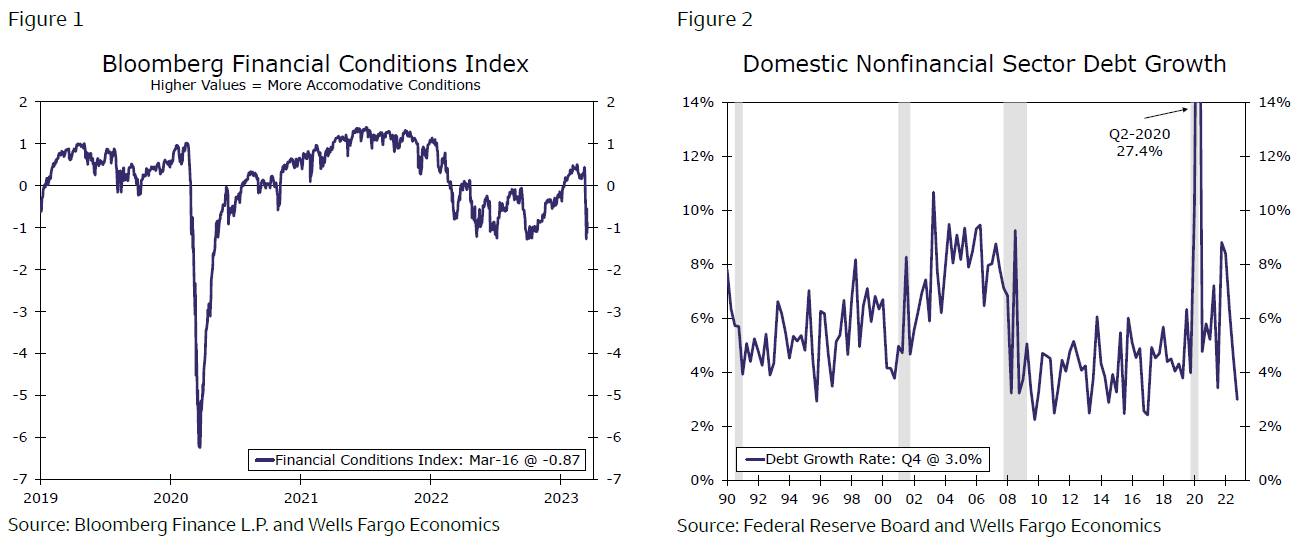

That said, there likely will be lasting economic consequences, because financial market conditions have tightened considerably over the past week. Lingering uncertainty likely will keep credit spreads wider in coming weeks and months, and many banks likely will tighten lending standards, at least in the near term. In our view, credit growth to the non-financial sector likely will downshift, which will exert headwinds on U.S. GDP growth in coming quarters.

We forecast that businesses will pare back fixed investment spending in coming quarters and that they will also start to rein in their hiring plans as well. A vicious circle will start to take hold in which tighter financial conditions lead to slower growth, which begets further financial tightening, leading to even slower growth, etc. We look for U.S. real GDP to contract 1.2% later this year and into early 2024.

In our view, the recent volatility in financial markets that has clouded the economic outlook will lead the FOMC to pause its tightening cycle at its next regularly scheduled policy meeting on March 22. But if, as we assume, financial markets stabilize in coming weeks, then we look for the Committee to hike rates by 25 bps at its May 3 meeting and by another 25 bps on June 14. We then look for the FOMC to remain on hold until Q4-2023. We forecast the Committee will begin an easing cycle starting at the end of this year as the pace of economic contraction deepens and as inflation recedes.

This forecast is predicated on our assumption that authorities will use their toolkit to contain the current crisis. However, if authorities are unable or unwilling to use those tools, then tensions in financial markets could become even more acute, which would have more dire economic consequences than outlined herein.

The Economic Outlook Has Just Become More Uncertain

Up until a week ago, our outlook for the U.S. economy was more or less constructive, at least by the standards of 2007-2009 and 2020. Yes, the economy has an inflation problem, which has led the FOMC to tighten monetary policy aggressively over the past year. In our view, this monetary tightening in conjunction with the eroding effects of inflation on real income growth would lead to a modest U.S. recession in 2023. In our U.S. Economic Outlook in February, we forecasted that the peak-to-trough decline in real GDP would amount to only 0.9% between Q2-2023 and Q1-2024. To put that number into perspective, note that U.S. real GDP contracted 3.8% during the Q4-2007 to Q2-2009 downturn and by nearly 10% in early 2020. In short, we anticipated that the U.S. economy would experience a recession this year, but it would be much less severe than the past two economic downturns.

The economic and financial landscape has changed dramatically over the past week due to the recent banking crisis in the United States and the associated turmoil in financial markets. The situation is very fluid at present, and the uncertainty associated with our economic outlook has risen markedly. Every forecast is based on a set of underlying assumptions, which often are implicit. But in uncertain times, it becomes a forecaster's duty to make some of their most important assumptions explicit.

In that regard, we are explicitly assuming that authorities will take the necessary steps in coming weeks and months to stave off another global financial crisis à la 2008. It is difficult to determine at this time exactly what concrete steps will be required. Much will depend on the course of events in coming days and weeks. But authorities, especially the U.S. Federal Reserve, proved remarkably adept in 2008 and again in 2020 with implementation of policies and programs that alleviated tensions, at least in part, in financial markets. These measures helped to cushion the blow to real economic activity during those episodes. We assume that authorities will use the tools they have developed in recent years, and perhaps new ones, to contain the current crisis.

But recent developments undoubtedly will have lasting consequences, even if authorities are successful in containing the current crisis. Financial market conditions have tightened considerably over the past week (Figure 1). Equity prices have fallen and credit spreads have widened. Volatility in financial markets may eventually subside, but lingering uncertainty likely will keep credit spreads wider in coming weeks and months. Many banks likely will tighten lending standards, at least in the near term. Bank regulations may be tightened. In short, credit growth to the non-financial sector, which has slowed in recent quarters, likely will downshift further in coming months (Figure 2). Tighter financial conditions and slower credit growth will exert headwinds on U.S. GDP growth in coming quarters.

Author

Wells Fargo Research Team

Wells Fargo