The ECB takes a dovish hike

Heading into the ECB rate meeting this week markets had started to increase expectations for an ECB rate hike after a Reuters source piece explained that ECB inflation projections were moving higher. These expectations were met with the ECB hiking by 25 basis points to 4%. However, this hike was taken as a ‘dovish hike’ due to the communications by the ECB.

Christine Lagarde mentioned in the press conference after the decision that recent economic indicators are pointing towards a weaker third quarter for the eurozone. Now this isn’t really that surprising given the recent weak run of economic data we’ve seen in the Eurozone. Eurozone GDP growth was below forecast on Sep 7, the industrial production for July was well below forecast at -2.2%, and there has been a string of weak PMI prints from late August.

ECB reaches peak rate

The key line that got investors’ attention was the ECB statement line which said ‘key ECB interest rates have reached levels that maintain for a sufficiently long duration will make a substantial contribution to the timely return of inflation to target’. Therefore, this is an indication that the ECB has probably reached terminal rates for now. In the press conference, Christine Lagarde said she is not saying that we are currently at peak rates, but you sense that was just so she wasn’t being pinned down on definite timescales, the reaction in the euro was unequivocal as it sold off heavily.

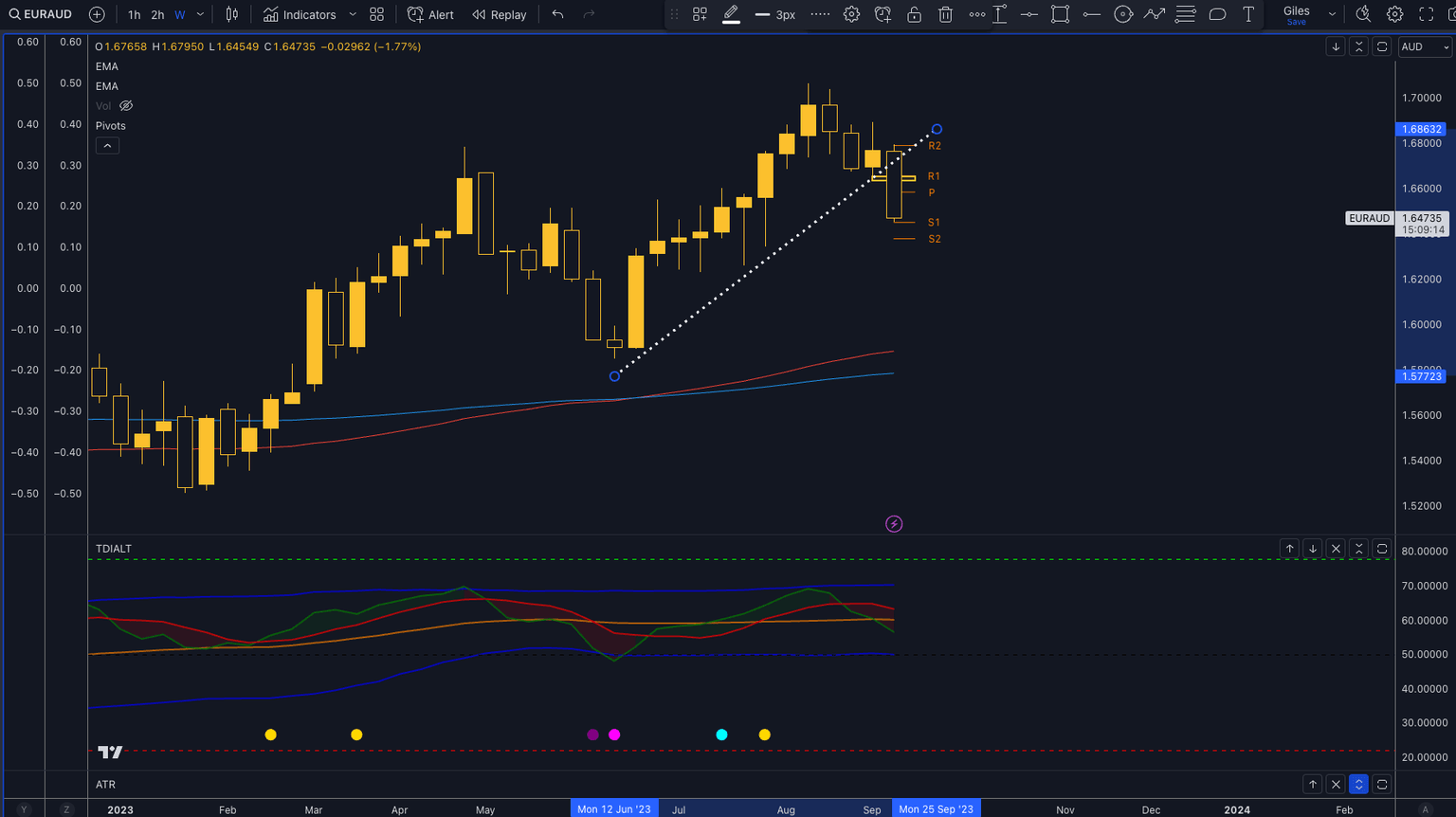

From here, we need to look for a continued slowing growth outlook for the Eurozone, and falling inflation to really affirm the peak rate position for the ECB. Looking ahead to next week, we have the final inflation reading, which is unlikely to show any surprises, and the next lot of PMI Prince on Friday. A further slowdown in the PMI prints next week will further cement that call. This has opened up a EUR sell bias for now with the EUR expected to fall against strengthening currencies, like the AUD.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.