The day after

S2N spotlight

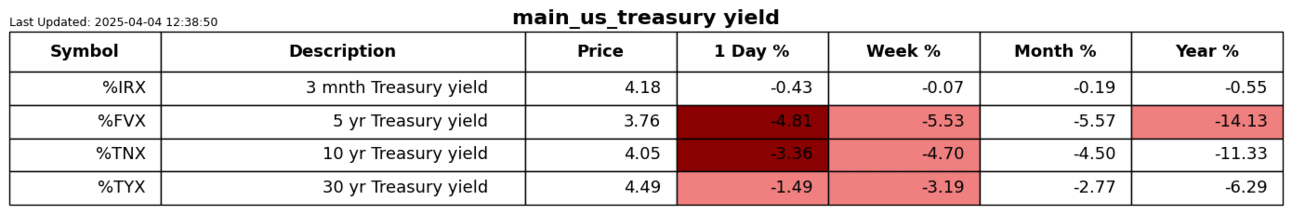

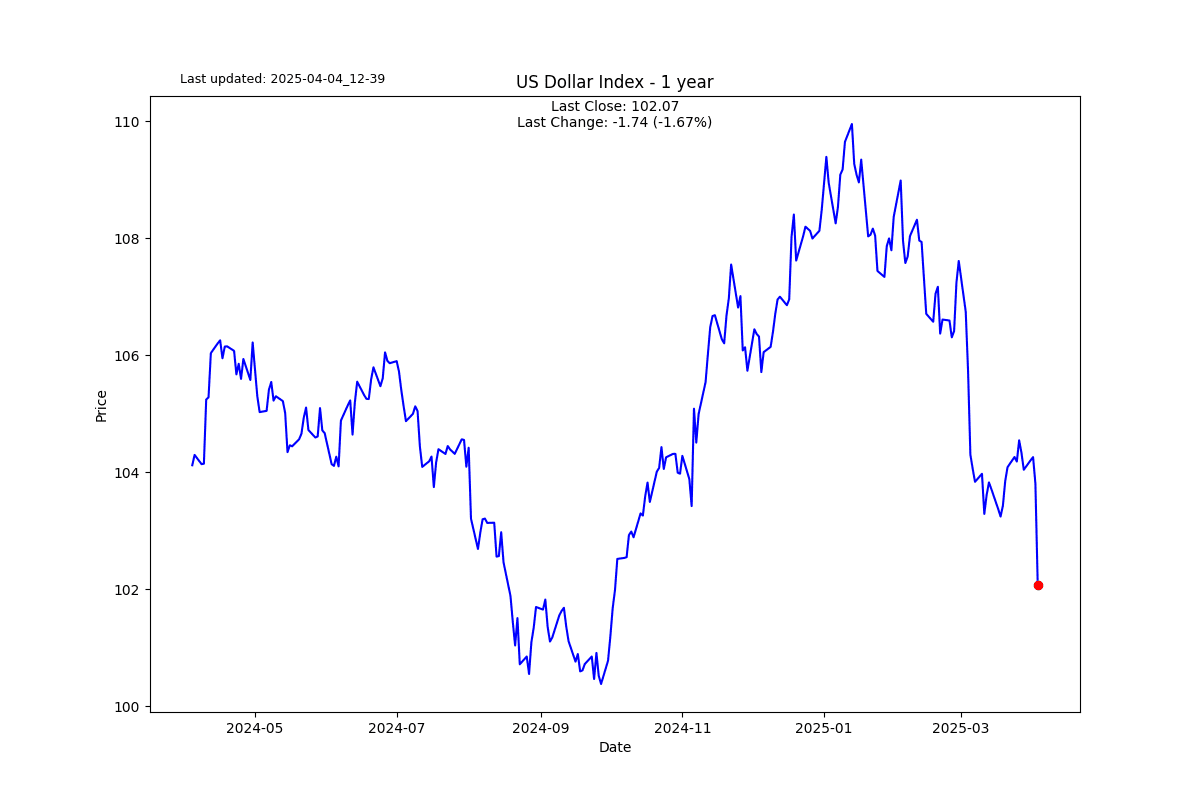

Yesterday was an epic day in the markets. Bond strength is what surprised me the most. The 10-year US bond yield is a fingernail away from having a 3 handle. It seems the consensus view for the minute is that global economies are going to stall and central banks will be cutting interest rates to re-ignite their engines, hence the interest in interest.

I am not ready to throw my stagflation thesis away. I still see inflation climbing. All I can see is what David Ricardo presented in his 1817 book, “On the Principles of Political Economy and Taxation.” Ricardo was the father of free trade and suggested countries should focus on what they are good at, and the efficiency is then shared through global trade.

I am not sure the US is the best place to manufacture things like Nike, which dropped a further 14% on the tariff news.

Adam Smith, in his famous 1776 work “The Wealth of Nations,” describes the process of making pins in a specialised way. He shows how a small group of workers can produce 1000s of pins a day by breaking up the tasks and focusing on their individual strengths, versus each person making the whole pin. Ricardo clearly built on these findings. This is the camp I am in, which is why I don’t like the mercantilist approach of heavy government involvement, i.e., tariffs. So my view is the US is likely to experience manufacturing inefficiency, which is inflationary. I also think as imported products become more expensive, Americans will purchase a lot more local products, which could mean more money chasing fewer goods, which is inflationary. So this scenario remains my base case.

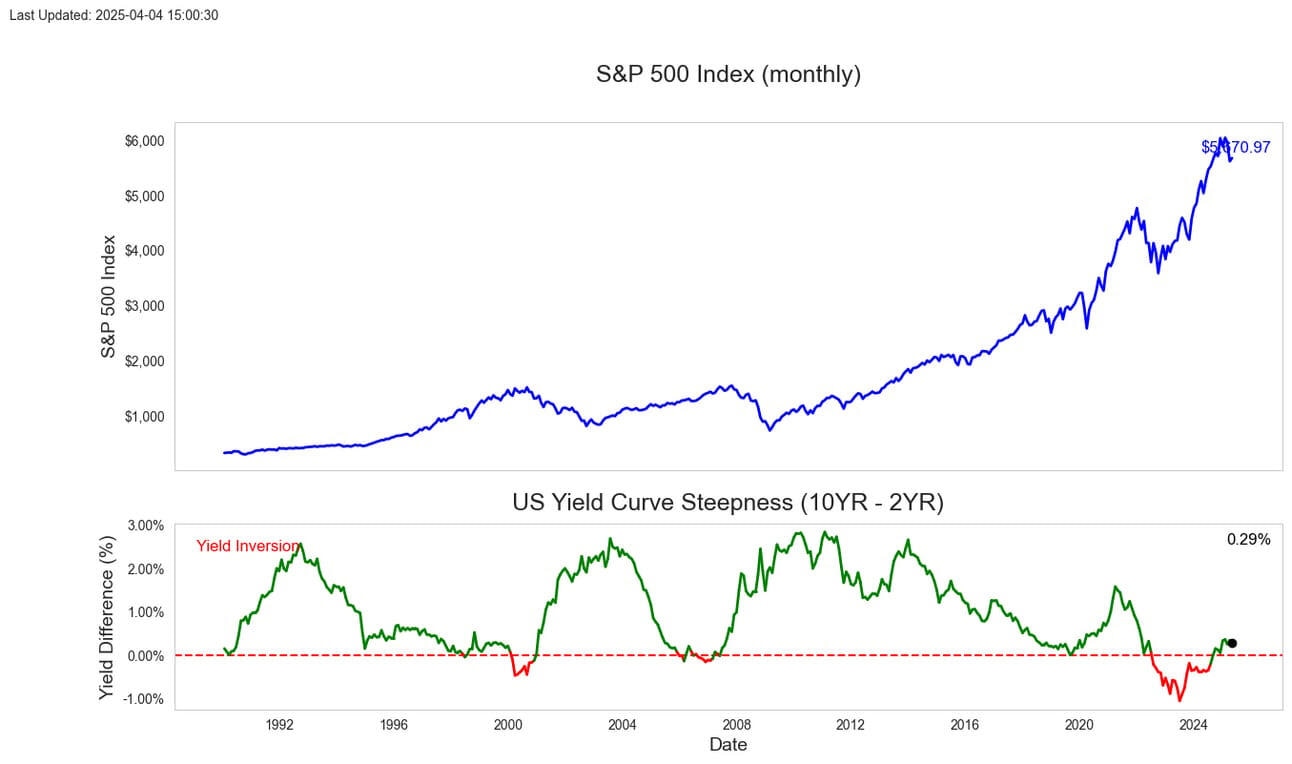

My yield steepener trade is still on, just sharing an update for your info.

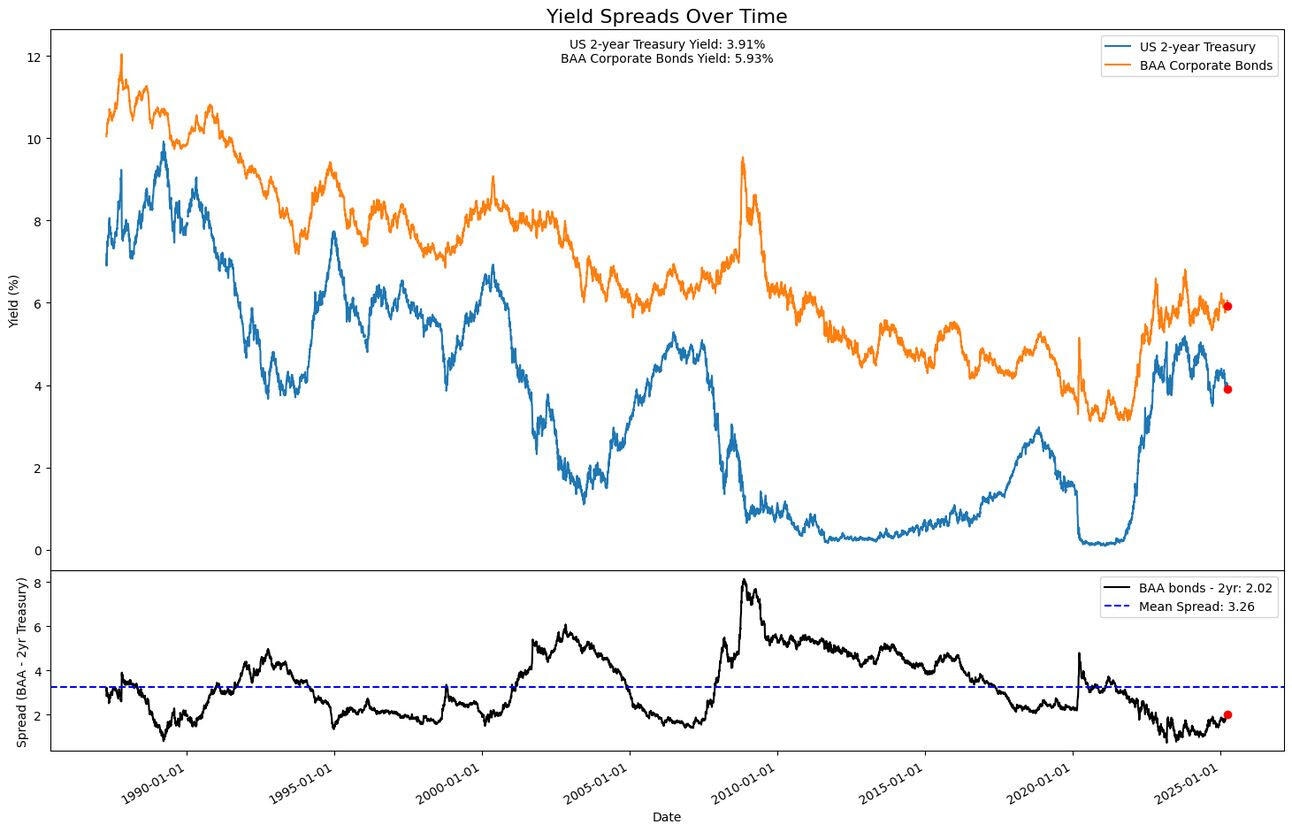

As is my yield spreader.

S2N observations

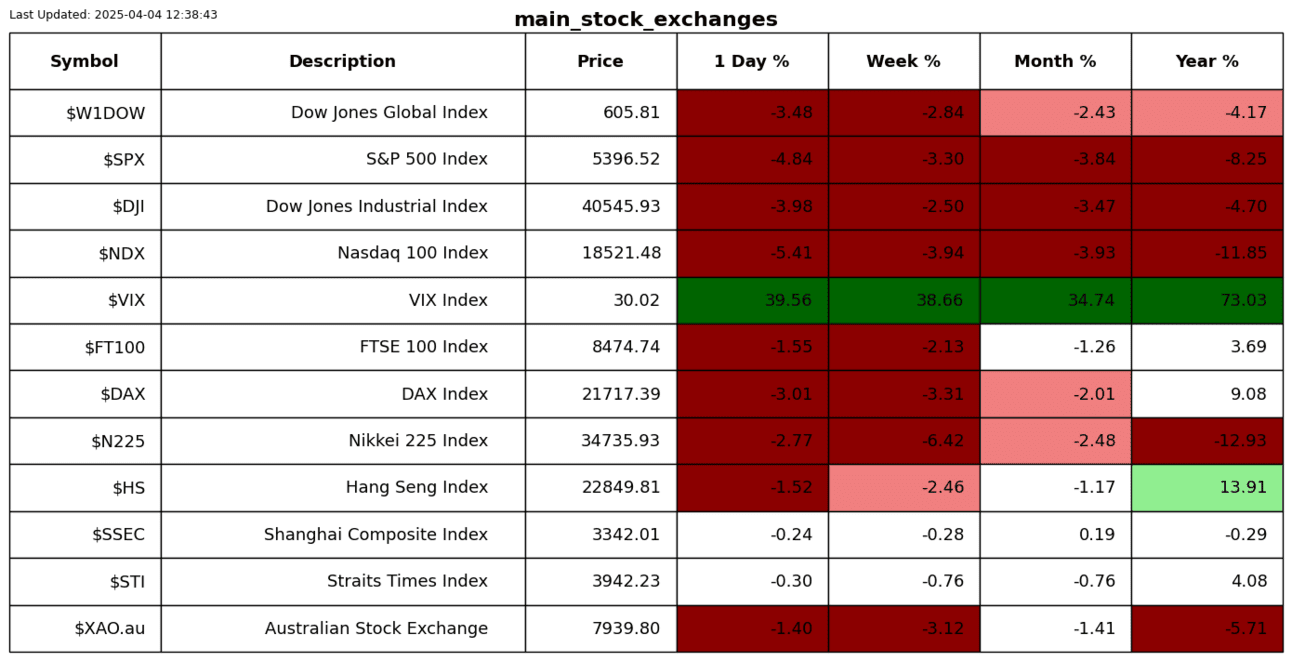

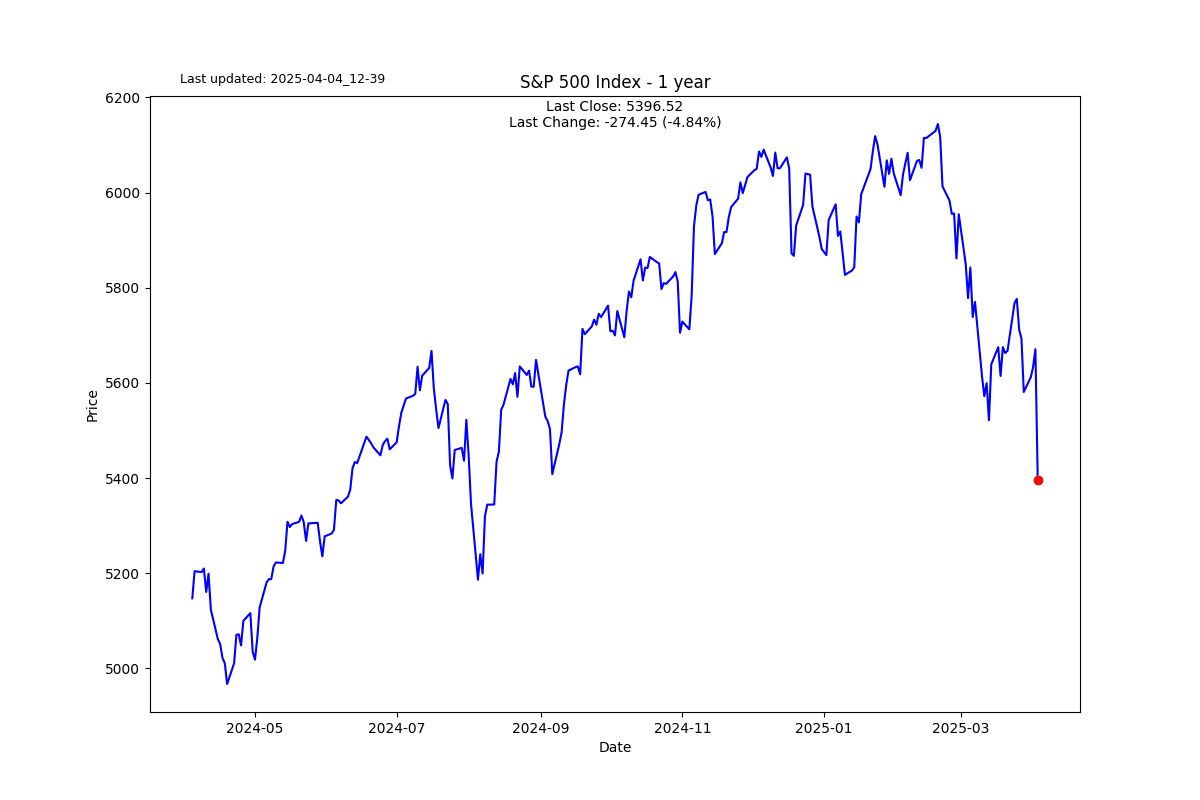

There have only been 34 times the S&P 500 has dropped -4.80% since 1950. The average returns over 1, 3, and 6 months have been favourable. Statistics can be pesky; don’t trade based on those numbers alone.

Believe it or not, Apple Inc. has been down 9% or more 39 times in its history.

S2N screener alert

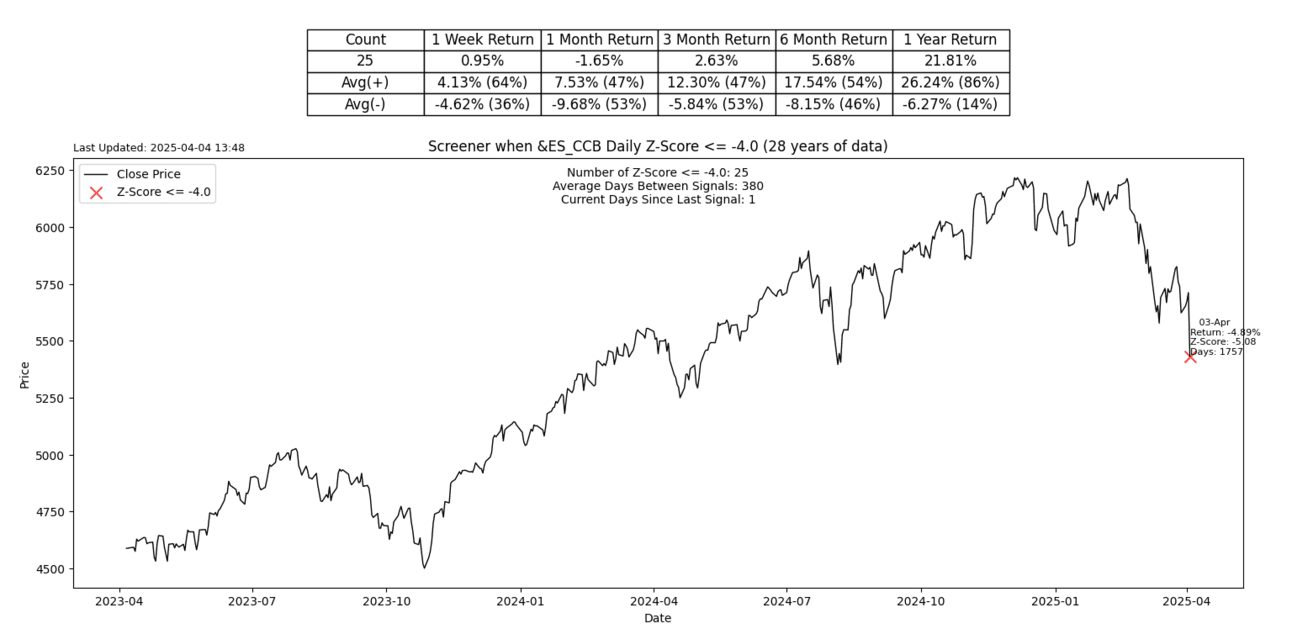

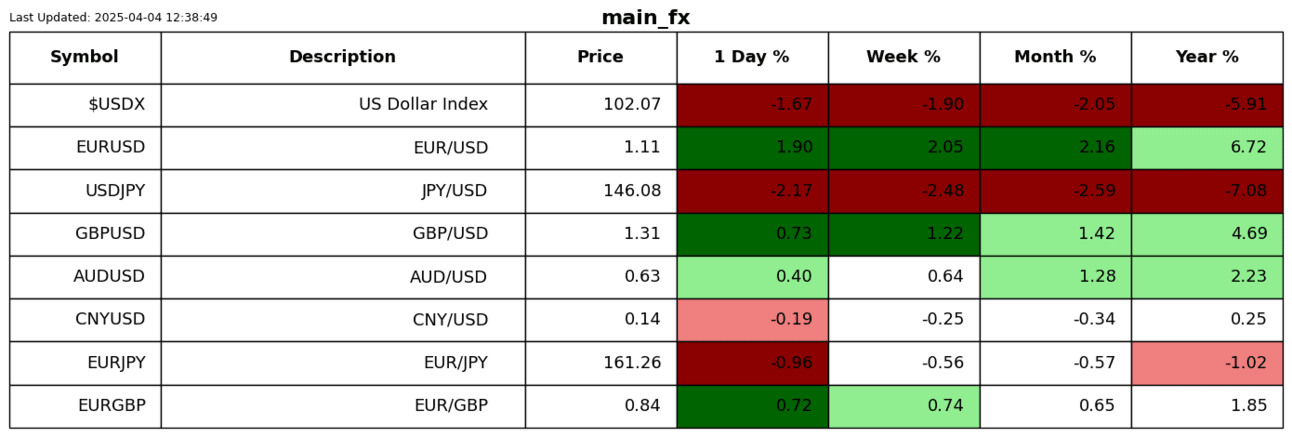

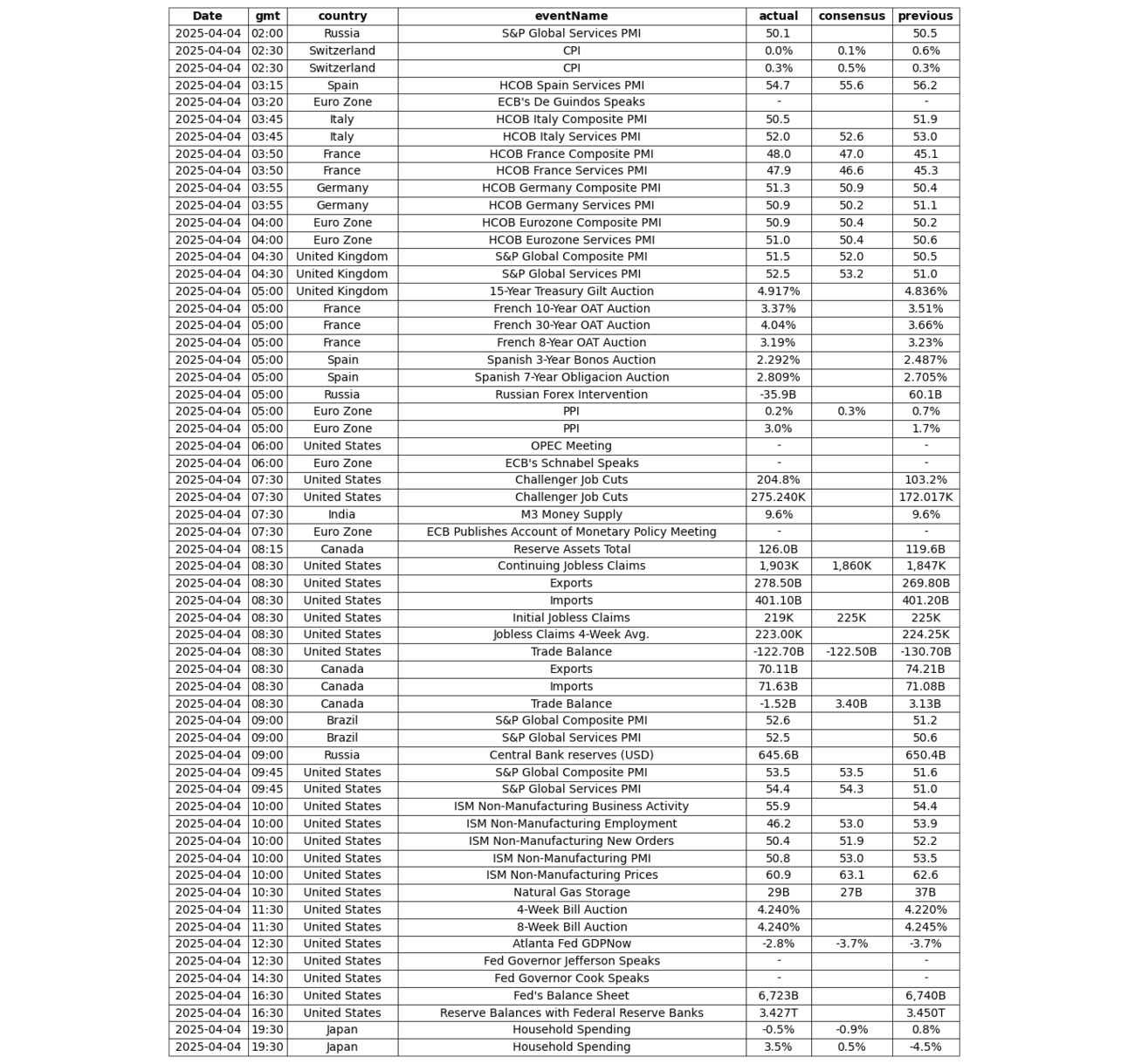

It is not often that I move my Z-score filter to 4, as my typical 3 is firing too many to include in this section. By the way, it was a massive day in the FX markets, with many 3 Z-scores.

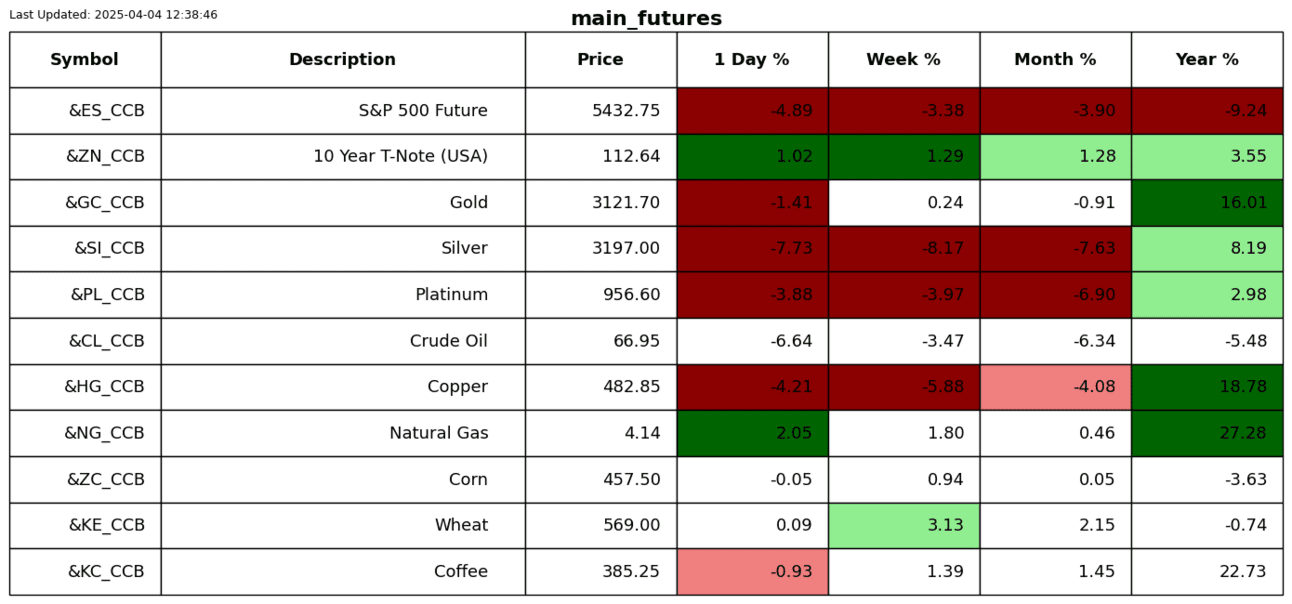

Silver futures got smashed with a negative Z-score of 7 and were also down 7%.

The S&P 500 emini future was down 5 sigma for an extremely rare move. The return was down nearly 5% as well.

What is interesting is that the S&P 500 Equal Weighted Index (SPEW) was down 4.36 sigmas.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.