Crude

Despite the fact that the dovish members of the OPEC (Saudi Arabia, UAE, Kuwait) signalled in advance they would not be willing to cut oil production to prop-up prices, the final decision of the cartel to leave production quota unchanged at 30 million barrels per day took the market by surprise, judging at least from its reaction.

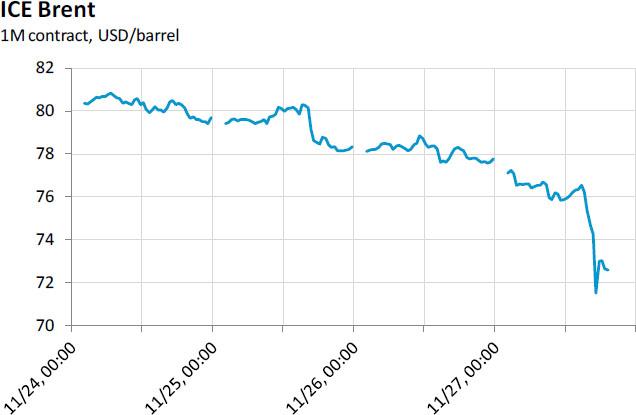

Oil price plunged by 6.65 % yesterday, i.e. by the most in more than 3 years, and price of the front-month contract on Brent (ICE) thus dipped to a new four-year low (71.12 USD/bbl). Maybe even more importantly, the sell-off also continued in longer-dated contracts (which should better reflect mood among oil producers) and the forward curve thus fell significantly across all maturities. For example, price of December 2017 contract on Brent (ICE) fell by 3.5 % and also volume of trades was significantly above average (in comparison with the most recent months). This in our view clearly reflects producers’ worries about future market balance (and oil prices).

As we already pointed out, yesterday’s reaction suggests that significant part of market was probably taken by surprise by OPEC’s decision. From this point of view, we think that high volatility is likely to persist in weeks to come. Moreover, one canot exclude further price declines, maybe even below a 70 USD/bbl level (which seems to be a natural target now).

Base Metals

Today in early trading, the copper price falls below 6500 USD/t and the three-month contract is therefore set to post price decline in the fifth consecutive session. All in all, copper will likely post the largest weekly loss since March.

Apart from an overall bearish mood in commodity markets related to plunge in oil prices, news that a strike at the World’s sixth largest copper mine in Peru ends is dragging prices down.

Chart of the day:

The oil price plunged by more than 6% after the OPEC decided not to cut its production quota yesterday.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.