- EUR/USD has broken a key layer of resistance in its plight for higher grounds.

- The charts are offering something for both the bears and bulls at this juncture, however.

Last week, the euro was the top performer as the US dollar deteriorated over the concerns related to skyrocketing coronavirus cases in the U.

A deteriorating economic outlook backdrop for the US, pertaining to the high levels on unemployment and consumer confidence which shrunk again in July, is weighing on the US dollar.

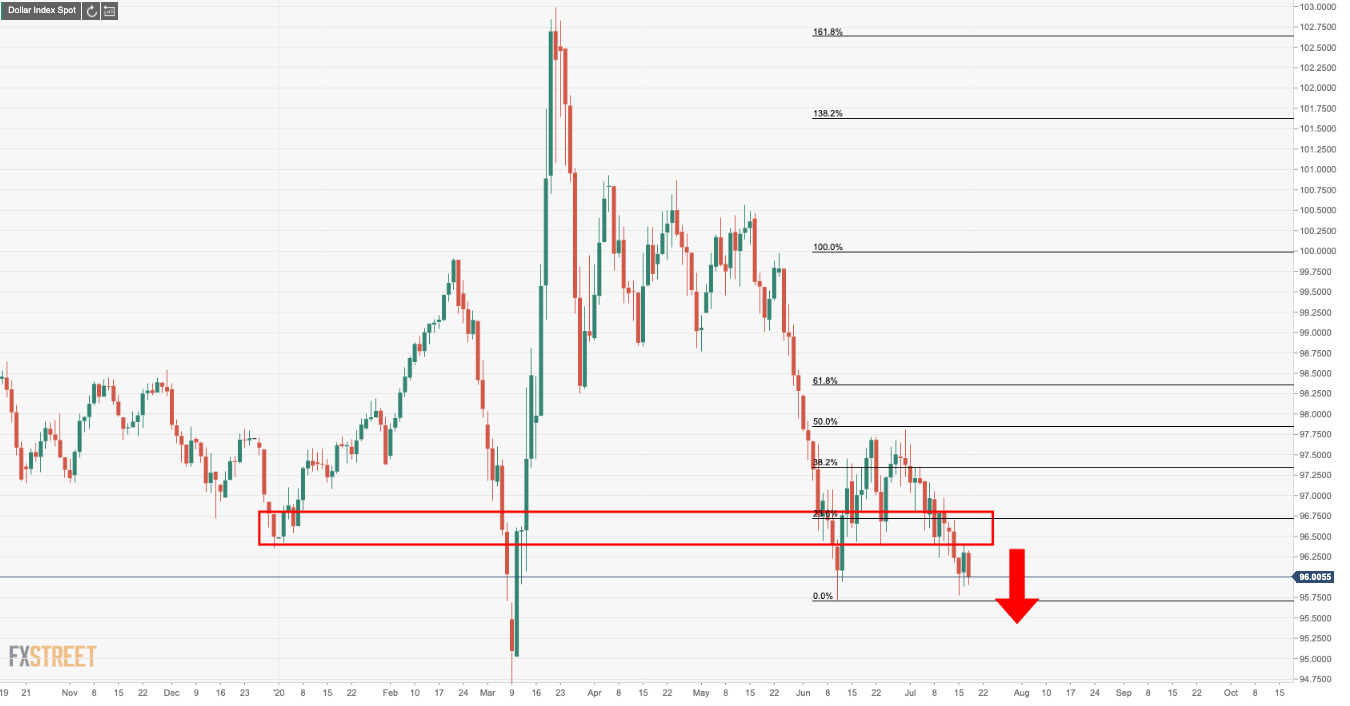

US dollar crumbles

This has given rise to a bid in the euro as the DXY crumbles away:

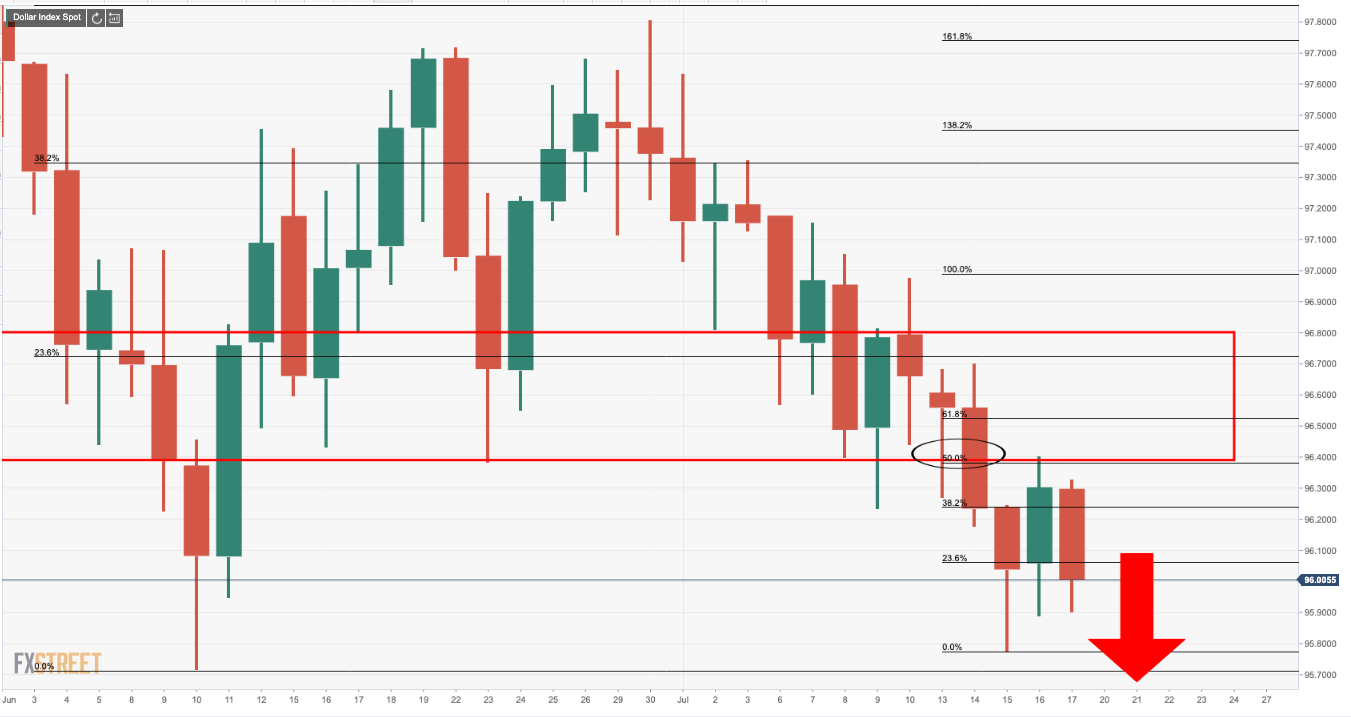

DXY completed a 50% mean reversion of prior daily bearish impulse:

EUR/USD enters back into the barroom brawl

Meanwhile, the open for the EU/USD, however, pertaining to the weekend news that there has been no deal struck at the EU summit, could prove to be slightly painful for longs that have held in-the-money-positions over the weekend.

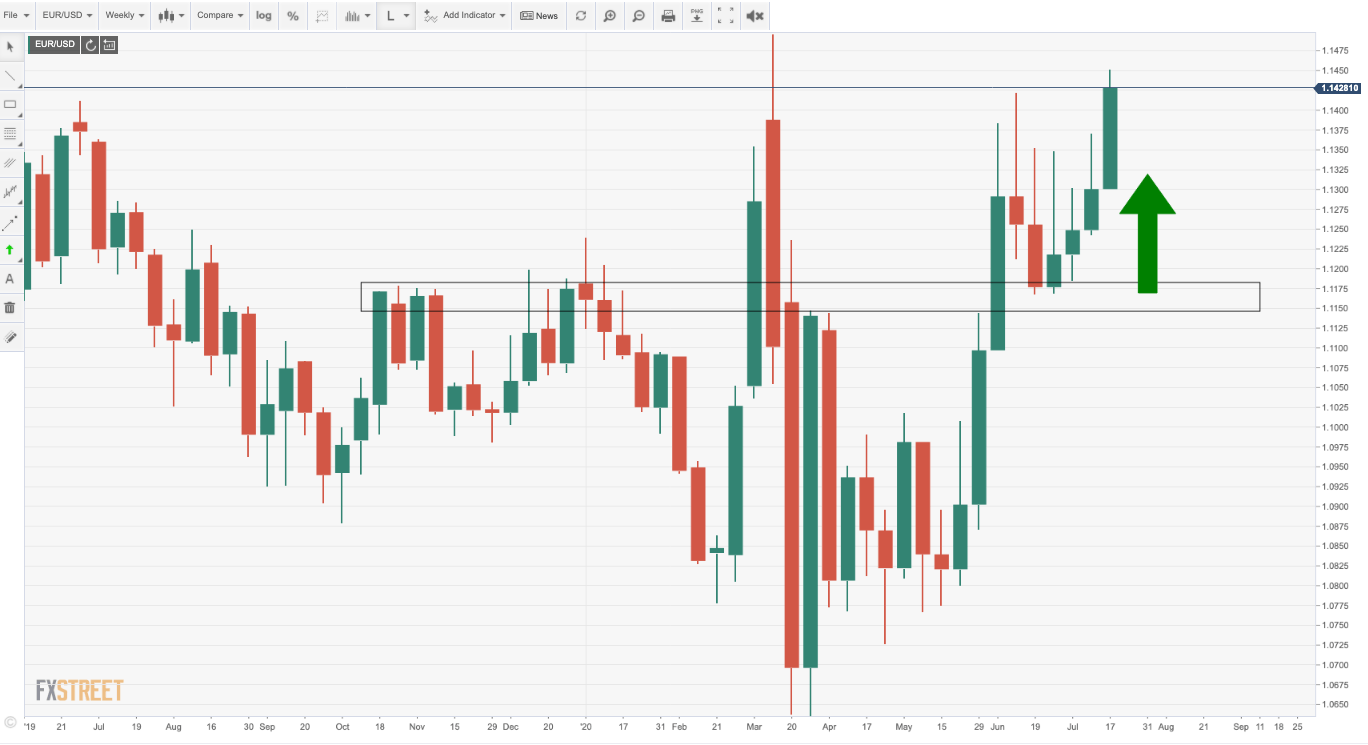

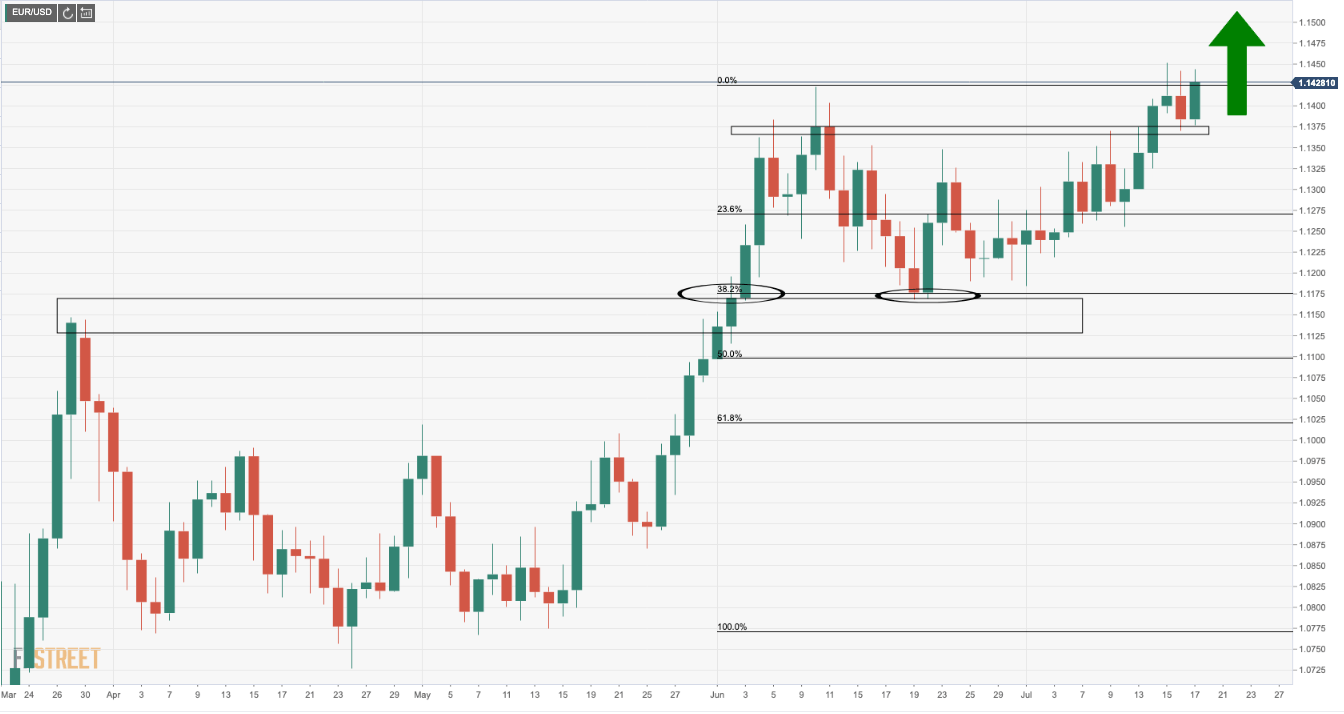

Bulls were able to capitalise on the euro rallying from last week's test of long term structural support as follows, making fresh daily highs for a bullish foothold:

From a daily perspective, the charts remain structurally bullish as a retest of old resistance, new support, has held-up, so far:

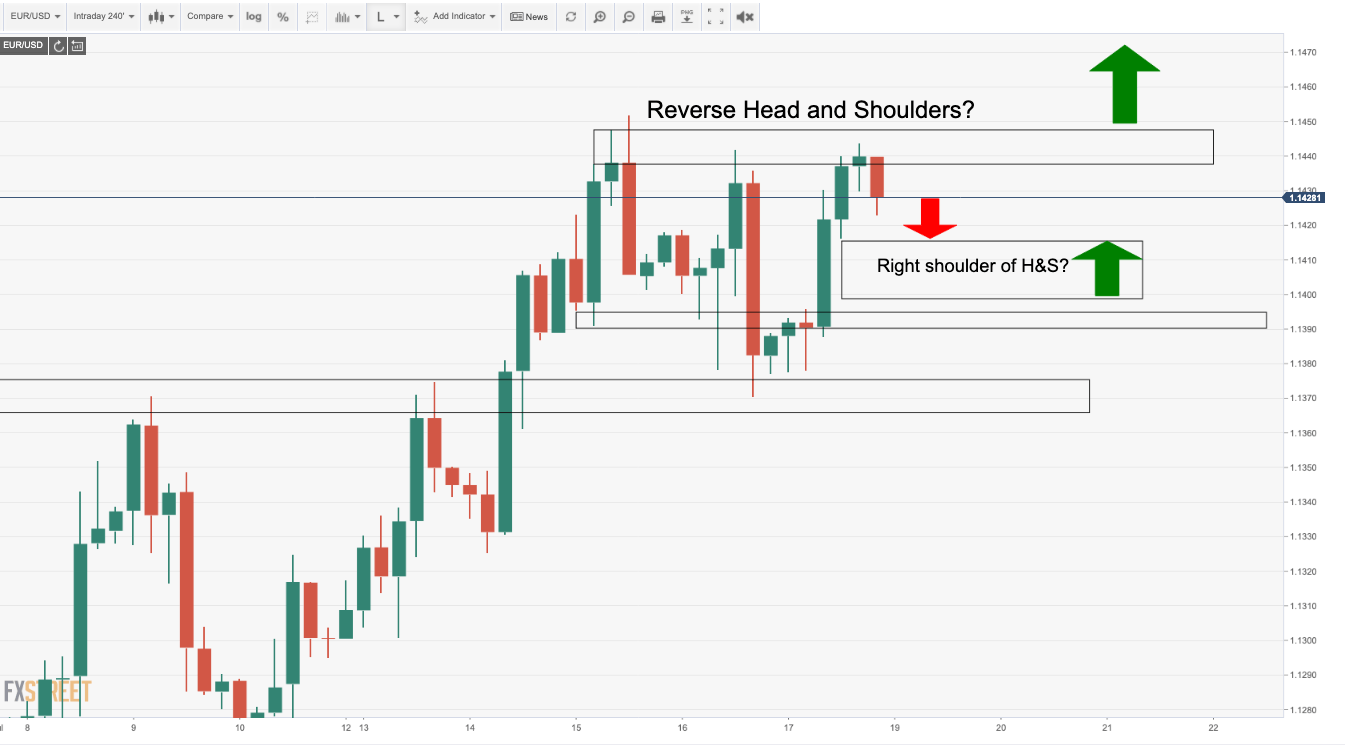

4HR Reverse H&S in the making?

However, the pair has dropped back into a consolidation area, or otherwise known as the barroom brawl where there is no clear bias.

If there is a bearish open this week, it will serve well to fit the above analysis as profit-taking ensues.

A break of the 4 HR head and shoulders head and support structure will open up the case for the downside to resume once again and invalidate the bullish outlook.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds lower ground below 1.0300 as traders await US NFP

EUR/USD holds lower ground below 1.0300 in European trading hours on Friday. Concerns over US President-elect Trump's policies and hawkish Fed expectations favor the US Dollar ahead of the critical US Nonfarm Payrolls data release.

GBP/USD falls back below 1.2300, US NFP eyed

GBP/USD is falling back below 1.2300 in the European morning on Friday, failing to sustain the rebound. The pair remains vulnerable amid persistent US Dollat strength and the UK bond market turmoil. The focus now shifts to the US labor market data for fresh trading directives.

Gold price sticks to intraday gains near multi-week top; US NFP in focus

Gold price attracts buyers for the fourth straight day on Friday amid some haven flows. The Fed’s hawkish stance, elevated US bond yields and a bullish USD should cap gains. Traders might also opt to wait for the release of the key US NFP report later this Friday.

Nonfarm Payrolls forecast: US December job gains set to decline sharply from November

US Nonfarm Payrolls are expected to rise by 160K in December after jumping by 227K in November. US jobs data is set to rock the US Dollar after hawkish Fed Minutes published on Wednesday.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.