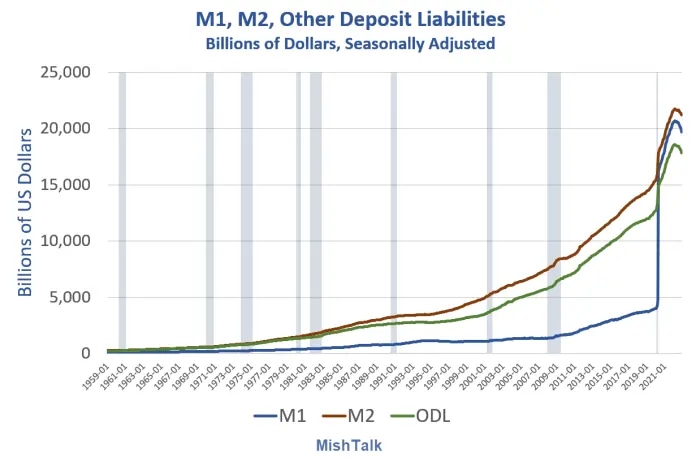

The biggest collapse in M2 money supply since the great depression

If your measure of inflation is money supply, then the economy is in a deflationary period right now.

Data for the above chart is from the Fed's H.6 Money Stock Report, released January 24.

Monetary Definitions

- M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of other checkable deposits (or OCDs, which comprise negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions) and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and other liquid deposits, each seasonally adjusted separately.

- M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (2) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing small-denomination time deposits and retail MMFs, each seasonally adjusted separately, and adding the result to seasonally adjusted M1.

- ODL is described below

A Better Definition of Money and Lacy Hunt's Thoughts on When a Recession Will Start

I discussed ODL in A Better Definition of Money and Lacy Hunt's Thoughts on When a Recession Will Start

The main difference between ODL and M2 is that ODL does not include currency or retail money market funds.

Currency is accepted at an increasingly fewer number of business establishments and simply cannot be used for very large sized transactions. Retail money market funds never became an important medium of exchange. Both are becoming a far less used medium of exchange.

ODL has the additional advantage that it is the main source of funding for bank loans and investments, making ODL both a monetary and credit aggregate. Friedman would not be surprised that the need to change the best definition of what constitutes money would change over the years.

The above blocks courtesy of Lacy Hunt at Hoisington Management.

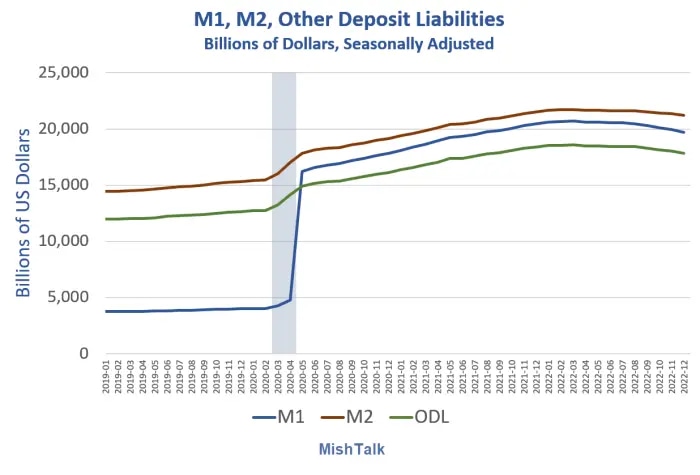

M1, M2, Other Deposit Liabilities Detail Since 2019

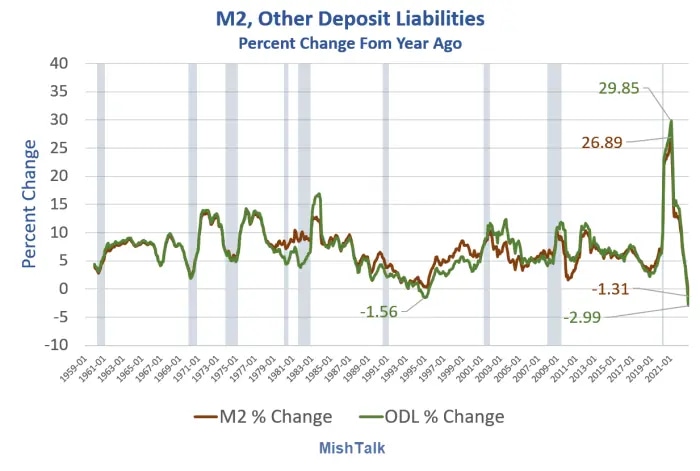

M1, M2, Other Deposit Liabilities Percent Change From Year Ago

The Fed's QE panic attack during and after the Covid pandemic seriously distorted percentage changes in M1 money supply.

M2, Other Deposit Liabilities Percent Change From Year Ago

Monetary Distortions

In the mid-1990s the Greenspan Fed hugely distorted the M1 measure of money via Sweep Account Programs.

Sweeps are the process by which banks take money from checking accounts and move it to accounts that pay interest. The interest did not go to consumers, of course, but to banks.

Simply put, unbeknown to depositors, money people think is in their checking accounts and is supposedly available on demand is not there.

For a while, the St. Louis Fed published Sweep Data, then stopped in 2012.

I believe increasing use of Sweeps kept year-over-year M1 negative from June of 1995 all the way to February of 1998.

Reverse Repos

Reverse repos explain the surge in M1 relative to M2 in the lead chart.

The Fed has seriously distorted money supply. and in the process is giving huge amounts of free money to financial institutions.

With M1 so distorted let's return to ODL.

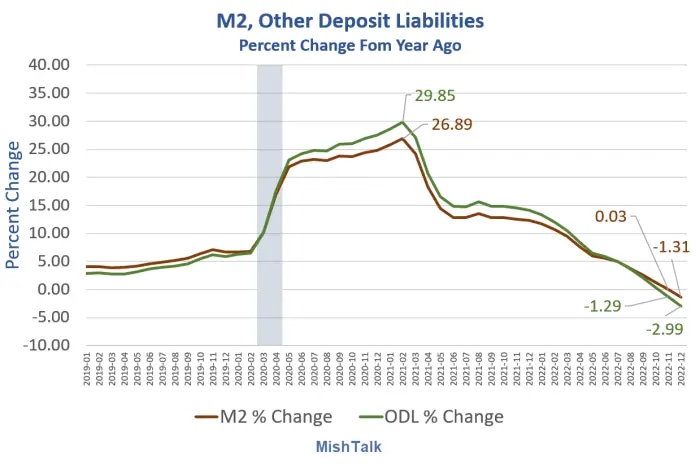

M2, Other Deposit Liabilities Percent Change From Year Ago Detail

Not Since 1932

Lacy Hunt On What It Means

From the last quarter of 2021 to the same quarter in 2022, nominal ODL is estimated to have declined at record 2.8% annual rate, the largest yearly drop in history. In real terms, ODL also contracted at a record pace.

Based upon the Fed’s monthly $96 billion balance sheet reduction and the monetary policy lags, the rate of ODL decline will accelerate in at least the first half of 2023.

If the Fed sticks with its plan to raise the Federal Funds rate another 75 basis points, the rate of decrease in ODL will be sufficient to neutralize the money mountain of 2020/21 by the second quarter of 2023, when taking velocity into consideration.

The above is from Lacy Hunt prior to the H.6 release on Tuesday.

Both Lacy and I think a recession started in November or December.

Loose Ends

Long-time readers may recall that I came up with M' (pronounced M-Prime) as a way of reconstructing M1.

M' was my way of coming up with a better version of money that was supposedly available on demand but really isn't.

The process became impossible when the St. Louis Fed stopped publishing Sweeps data. Once again, money you think is in your account and is supposedly available on demand, really isn't.

Lacy's ODL is not to be confused with the Fed's reporting of "other liquid deposits."

In retrospect, a name like M2-, M2', or "Prime M2" might better name to convey the Lacy's message.

Free Money

Finally, through all these manipulations the Fed bailed out banks over time whereas the ECB with its negative rates didn't. How much free money?

Confused? The Central Bankers want it that way.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc