The Arkk that never survived the flood

S2N spotlight

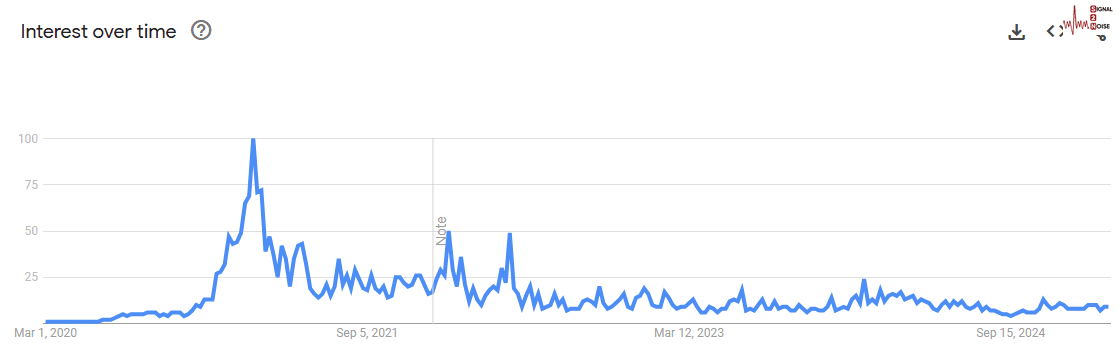

Do you remember when Cathie Wood was the poster child of innovation? Her celebrity has clearly waned according to Google Trends, not to mention her performance.

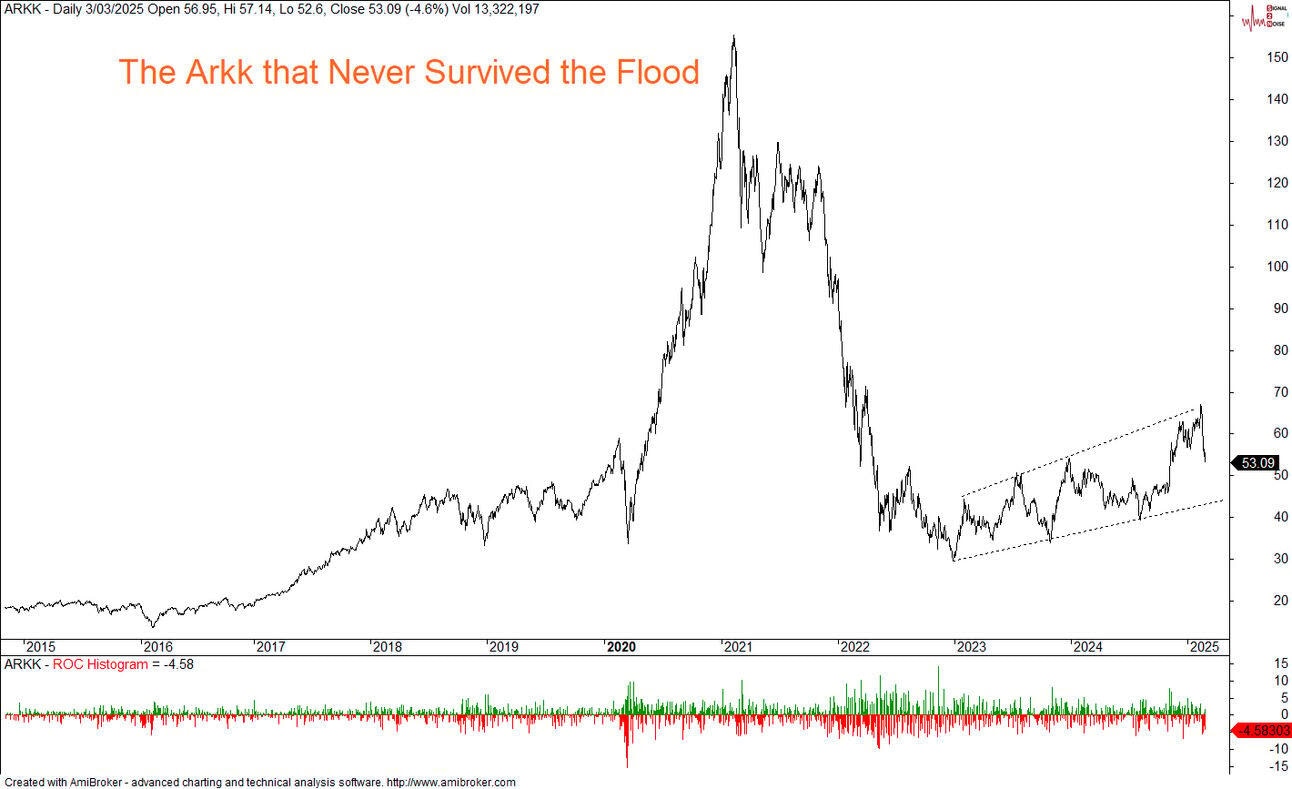

It is not surprising that Wood is not as popular as she once was. In February 2021, her Arkk Innovation Fund had more than $50 billion under management. She was a more regular fixture on TV than I am in my bathroom after breakdast; now her Arkk is unlikely to survive the flood. After suffering more than an 80% drawdown while the Nasdaq is trading at ATH’s, it seems the Arkk is in the death throws of a spectacular shipwreck.

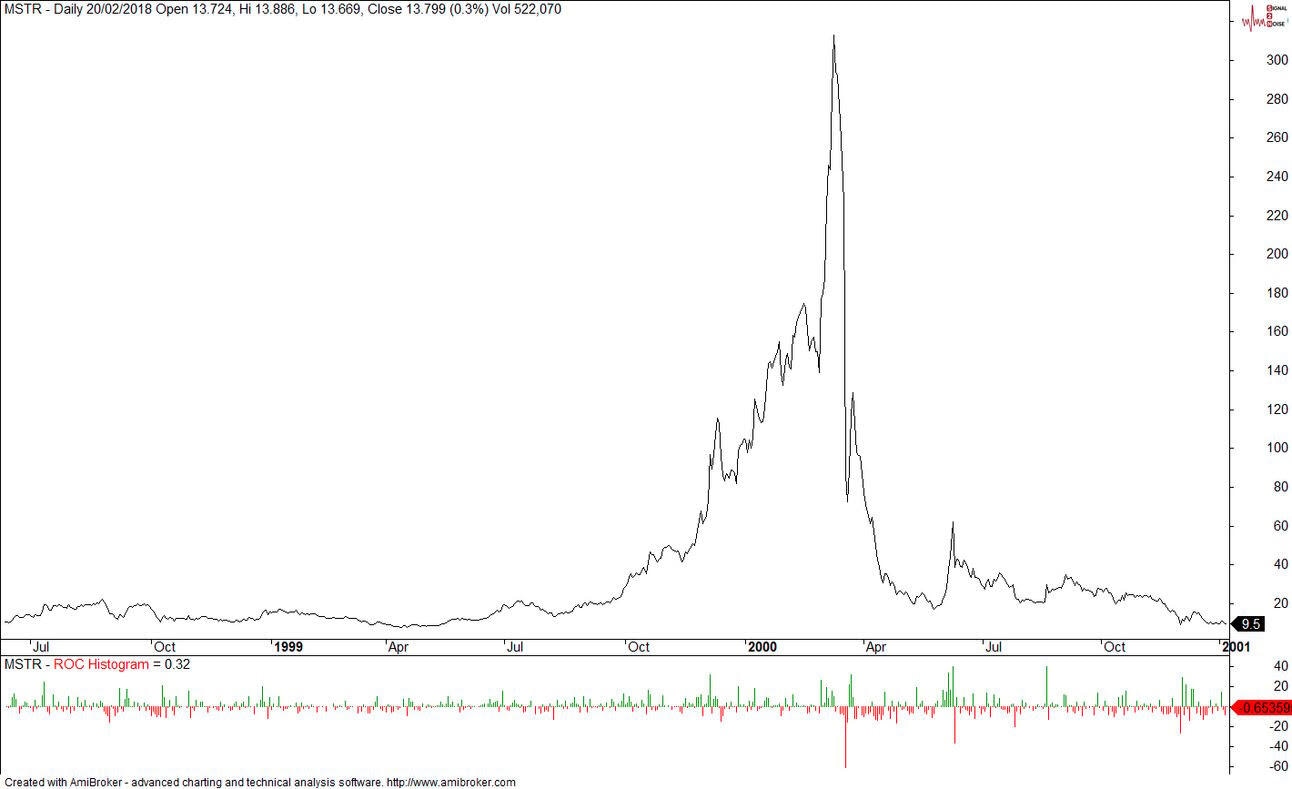

In 2000, there was a stock making massive moves as its price was heading to the moon, the best performer of the S&P 500. Sadly, it missed its moon landing and dropped 96%. Michael Saylor was described as the biggest loser, losing billions of personal wealth in MicroStrategy stock. But there was more to come from Saylor.

Michael Saylor is arguably a genius. There are not too many people capable of creating the hype he is able to generate around his investments. However, this is not the type of guy you want to listen to about investment advice. Listening to him about investment advice is like asking your Uber driver to perform heart surgery on you.

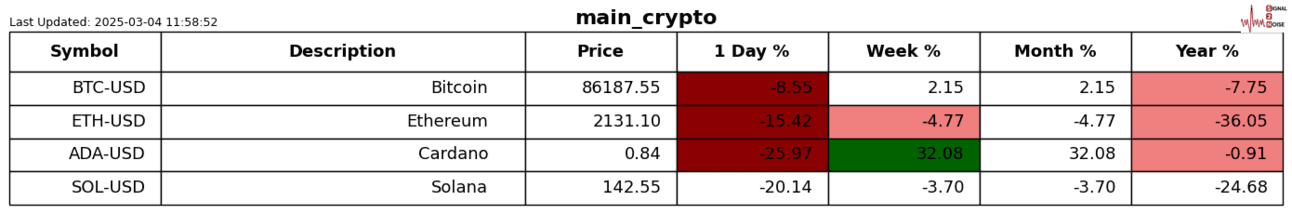

To close off this blowoff section, let us look at the Trump meme coin. Some of you will recall me being quite upset that he would take away from his incredible election victory and his Sunday inaguaration event with the launch of the Trump token that weekend. It is currently down 71%; not even the great lover could keep this one up. No doubt a lot of uninformed people lost a lot of money.

S2N observations

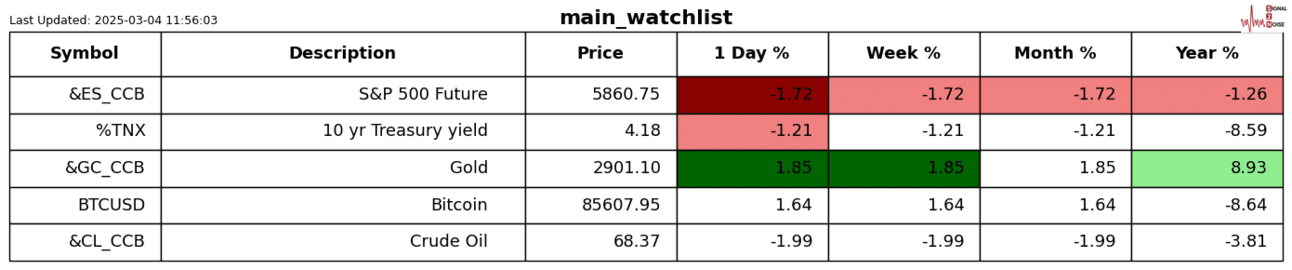

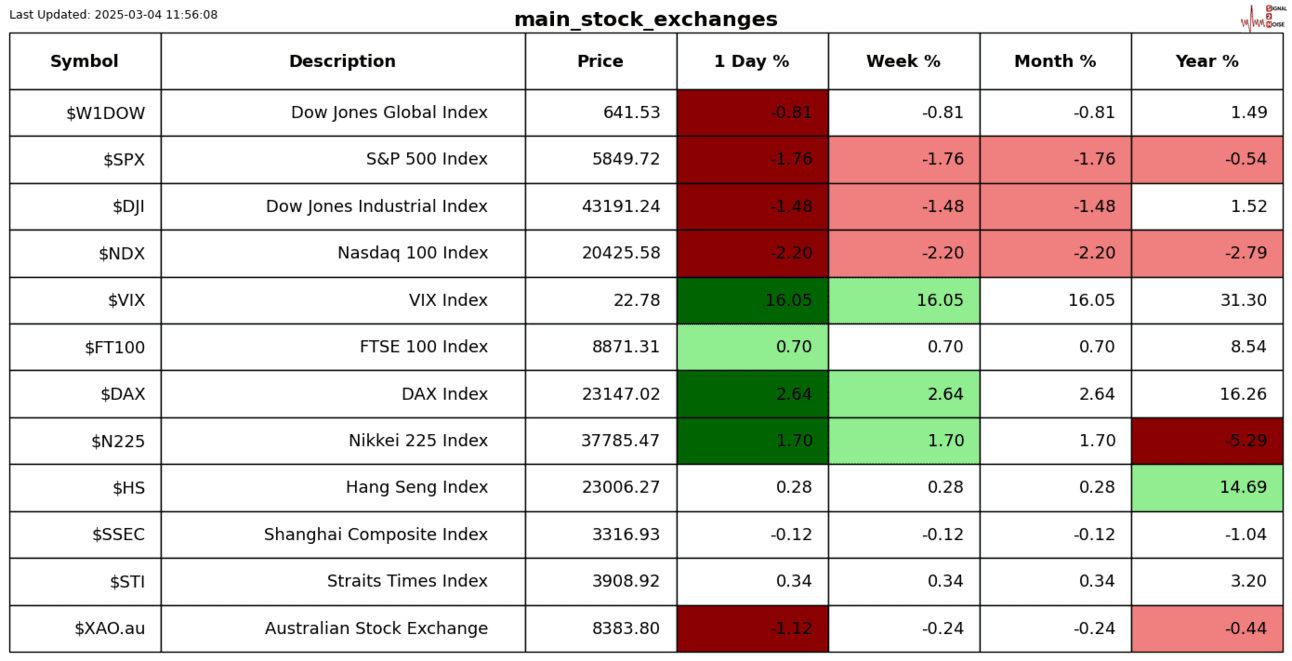

The level of sarcasm coming out of me today is shocking even to me. The EuroStoxx50 finally made it to an all-time high (ATH). Germany is apparently in recession, but its stock market at 23,000 seems to want to carry the continent. It will be very interesting to see what happens if the US leaves Europe to protect Ukraine on its own.

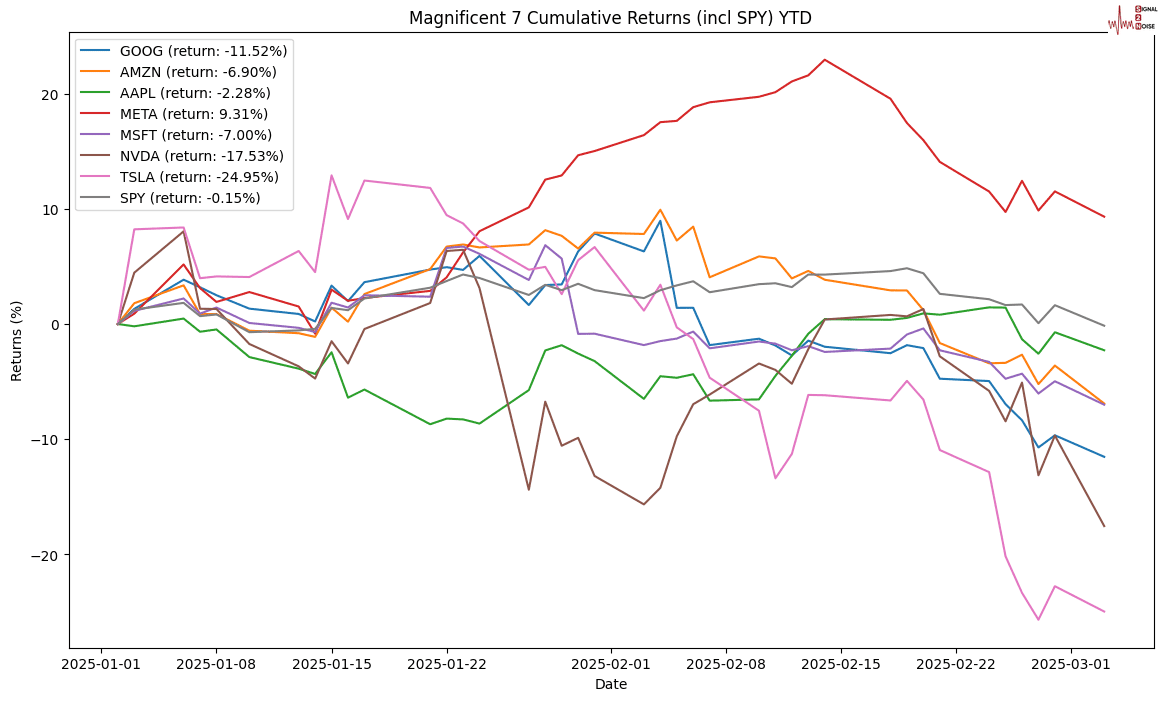

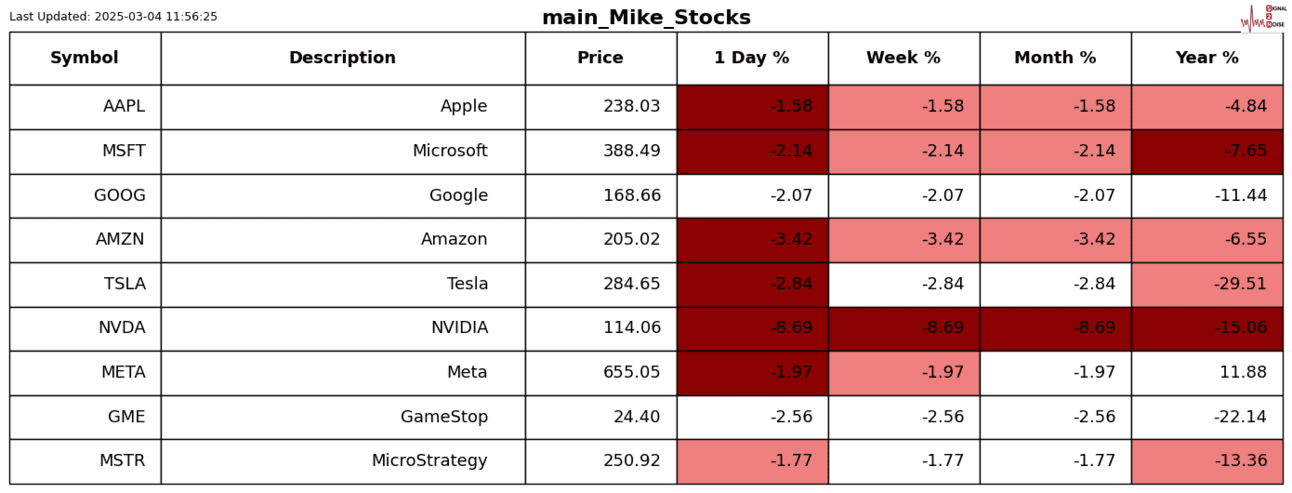

It is interesting to see how the Magnificent 7 are performing year-to-date. Not so magnificently. Meta is the only one making money. Apparently Bezos girlfriend is heading to space on a soon-to-launch all-girls mission to out of space. Sorry Mark I had to mention her after your inaguaration faux pas.

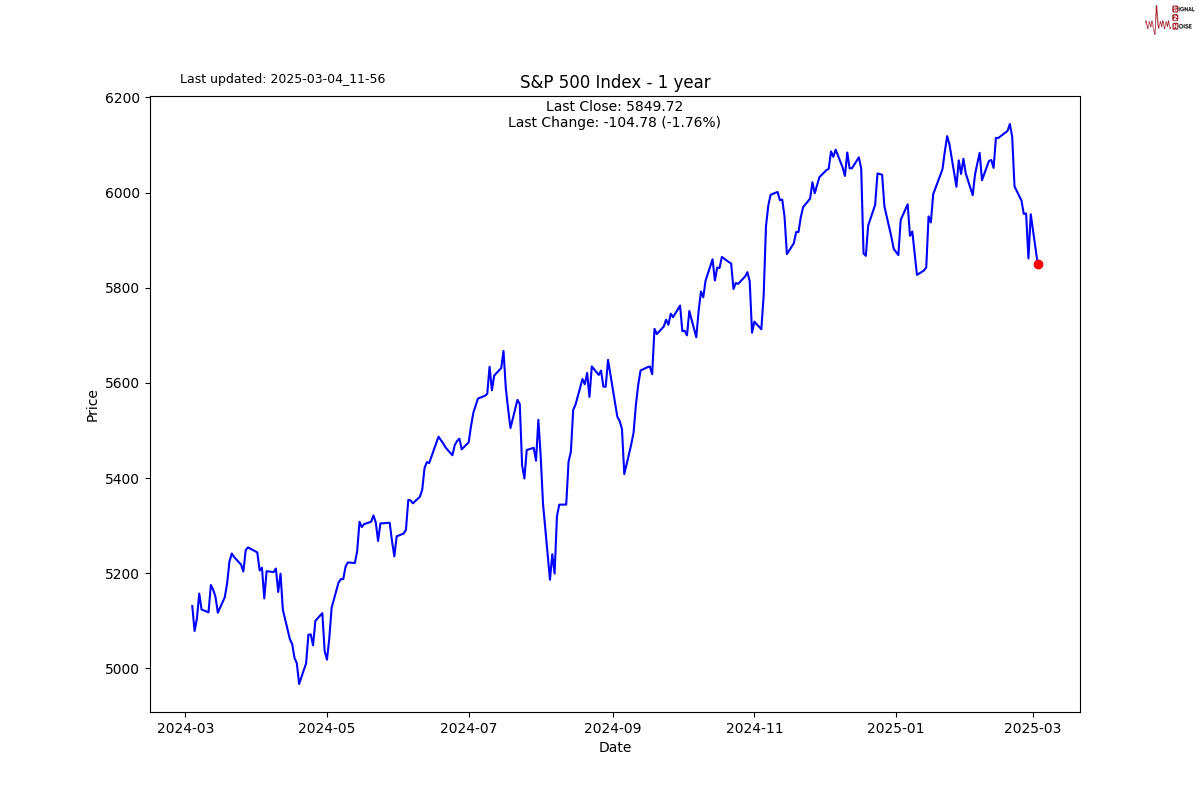

You can see market breadth is starting to escape. Not sure where the market draws more oxygen from. The S&P500 constituents are all below 50% of their respective moving averages, except for the 200-day. However, even the 200-day is well off its bullish highs.

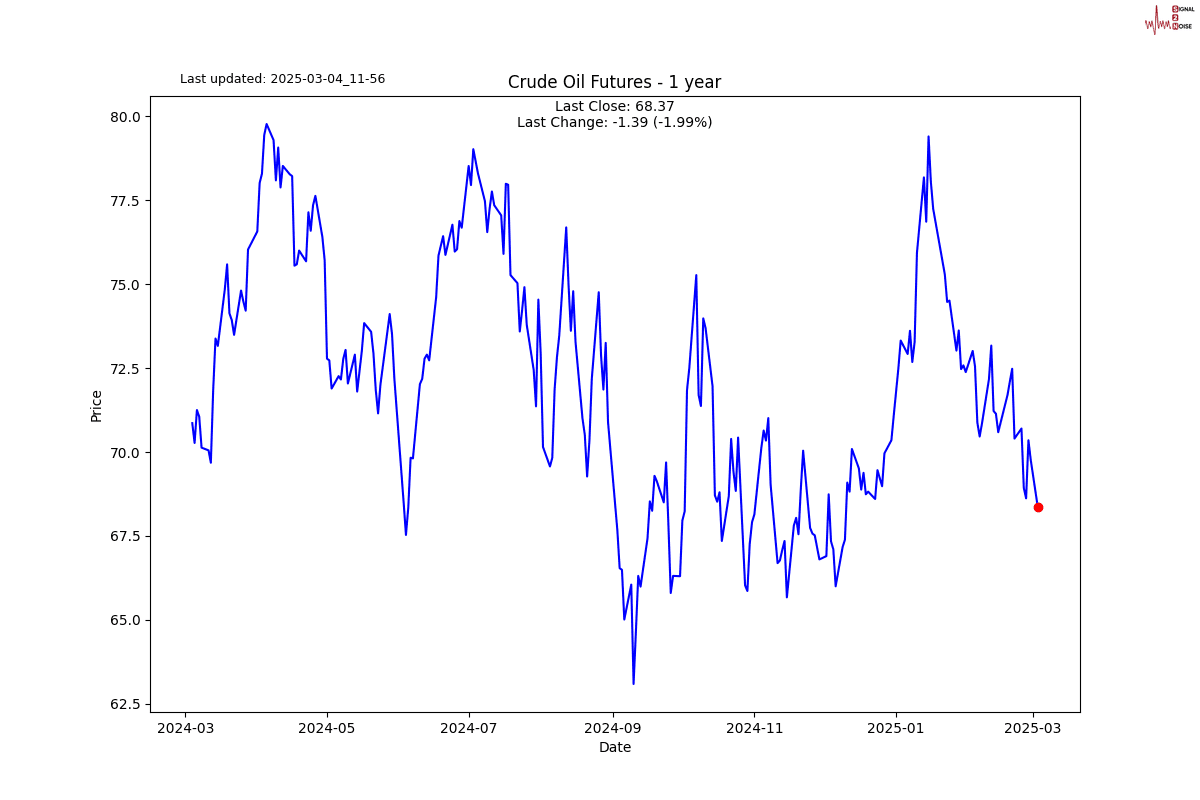

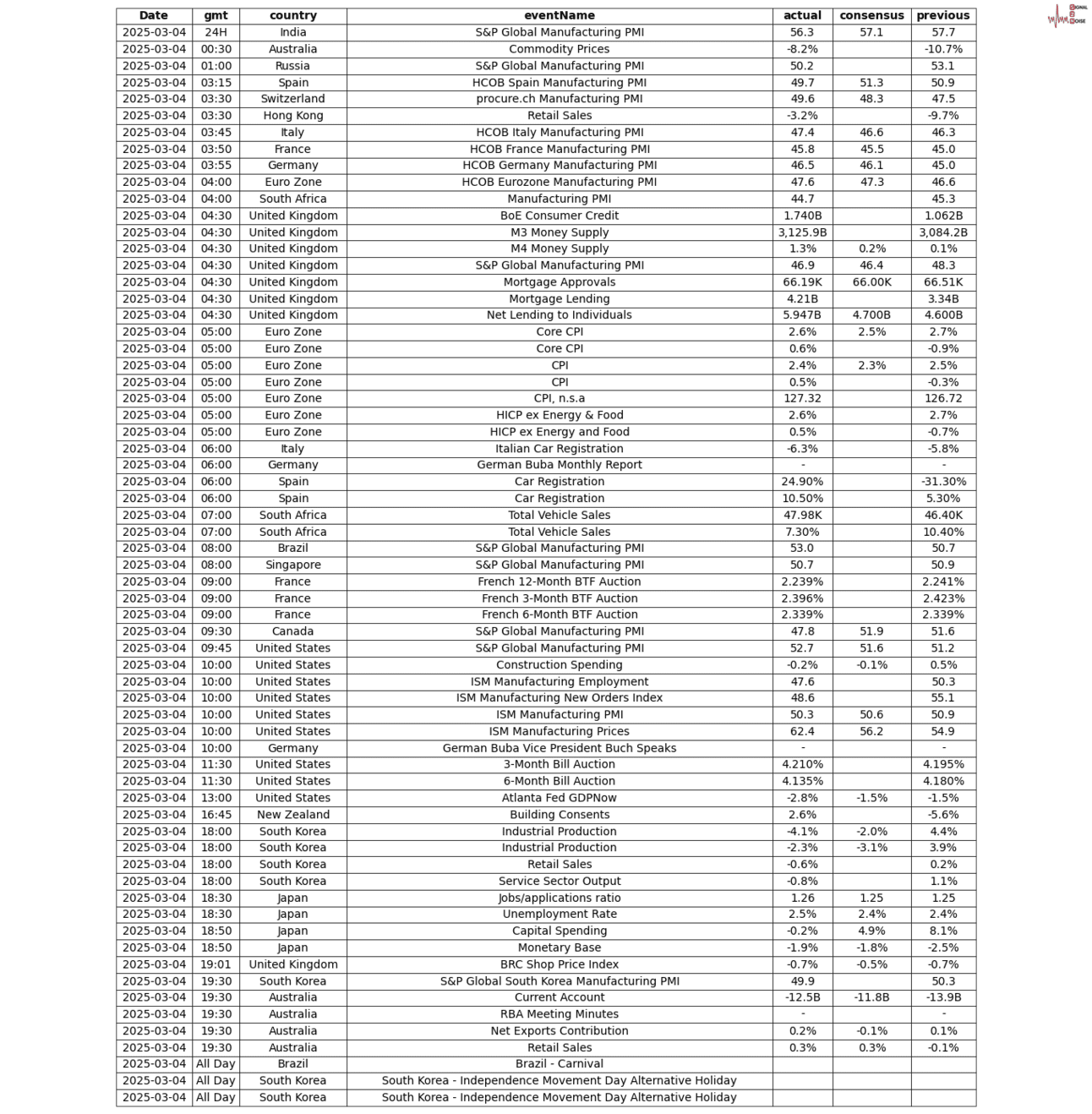

Finally, a lot has been said about the Atlanta Fed’s GDP Now indicator forecasting a recession in Q1 2025. In other words, we are in one. The data release is on the 6th. I will share thoughts when released, but I am pretty sure the US is in recession.

S2N screener alert

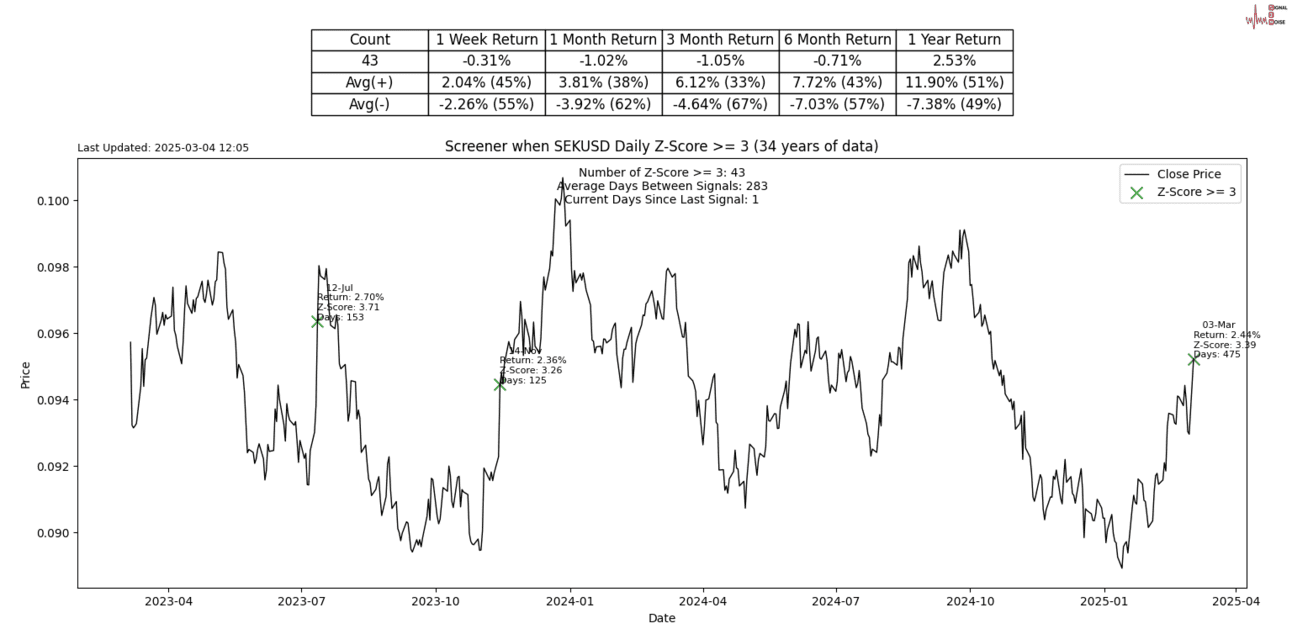

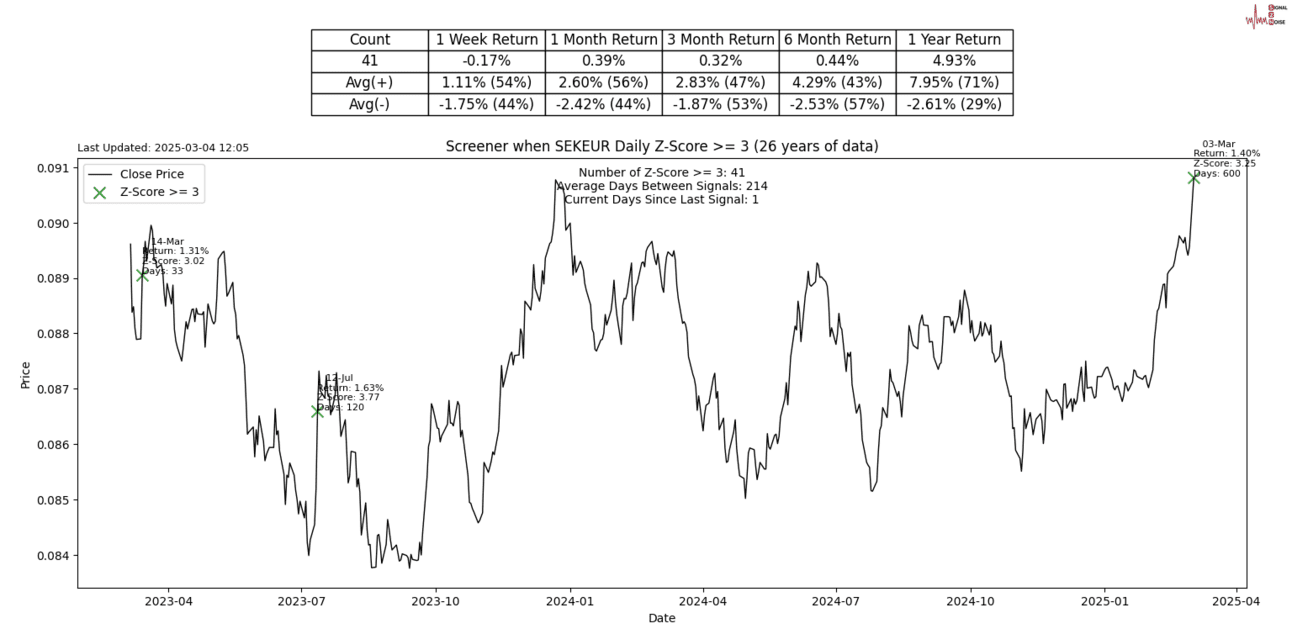

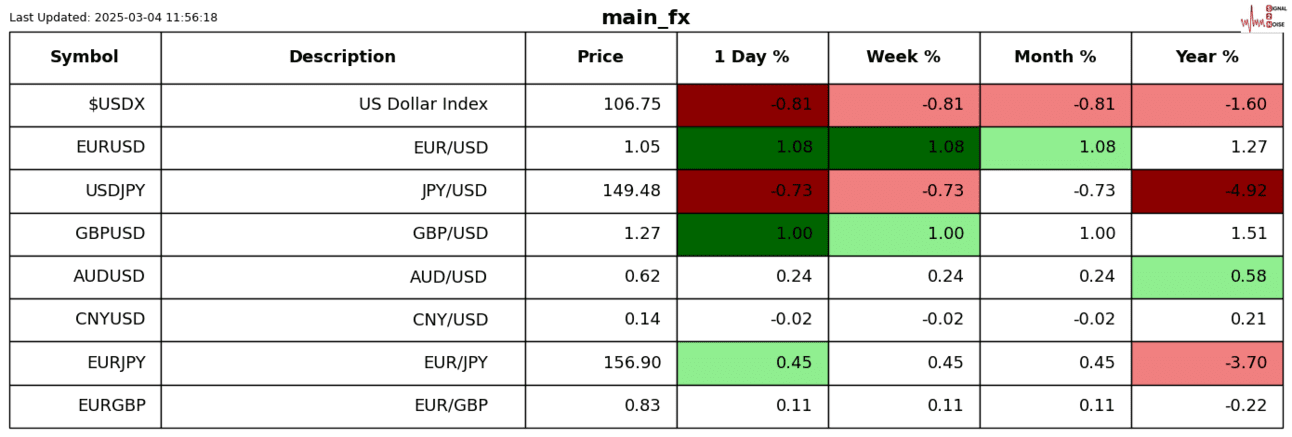

The Swedish Kroner had strong 3-sigma moves against the US Dollar and Euro yesterday.

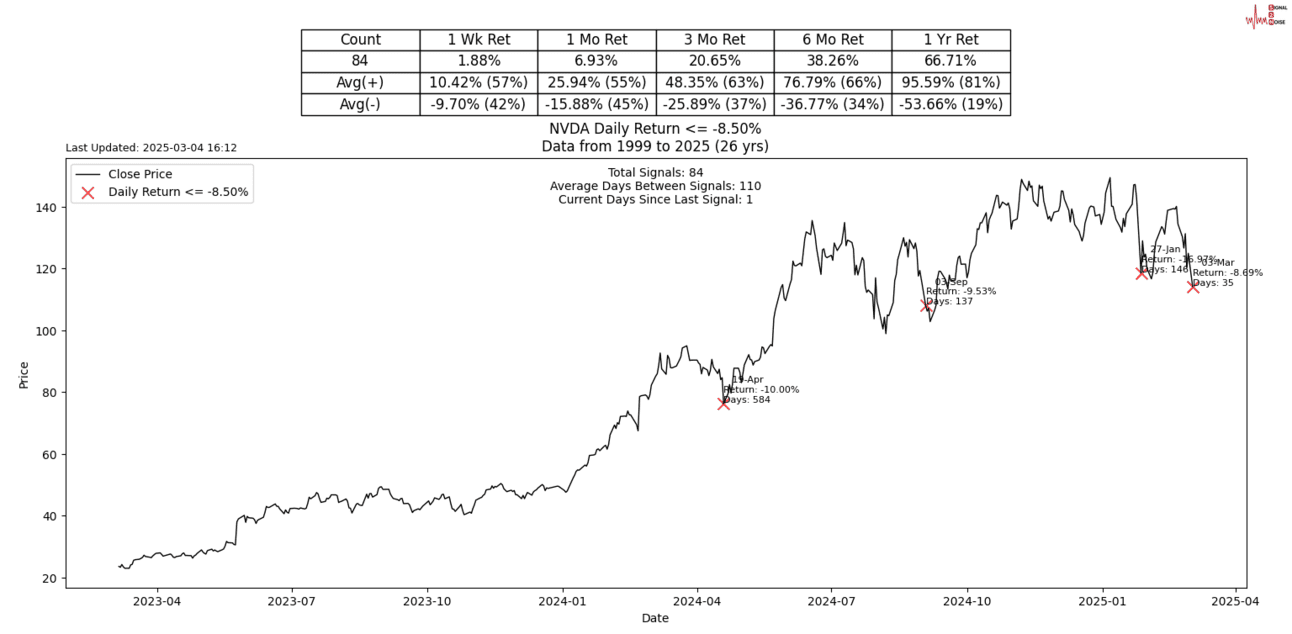

Nvidia had a sharp down day yesterday, more than -8.5%, not as rare as I thought. The 84th time.

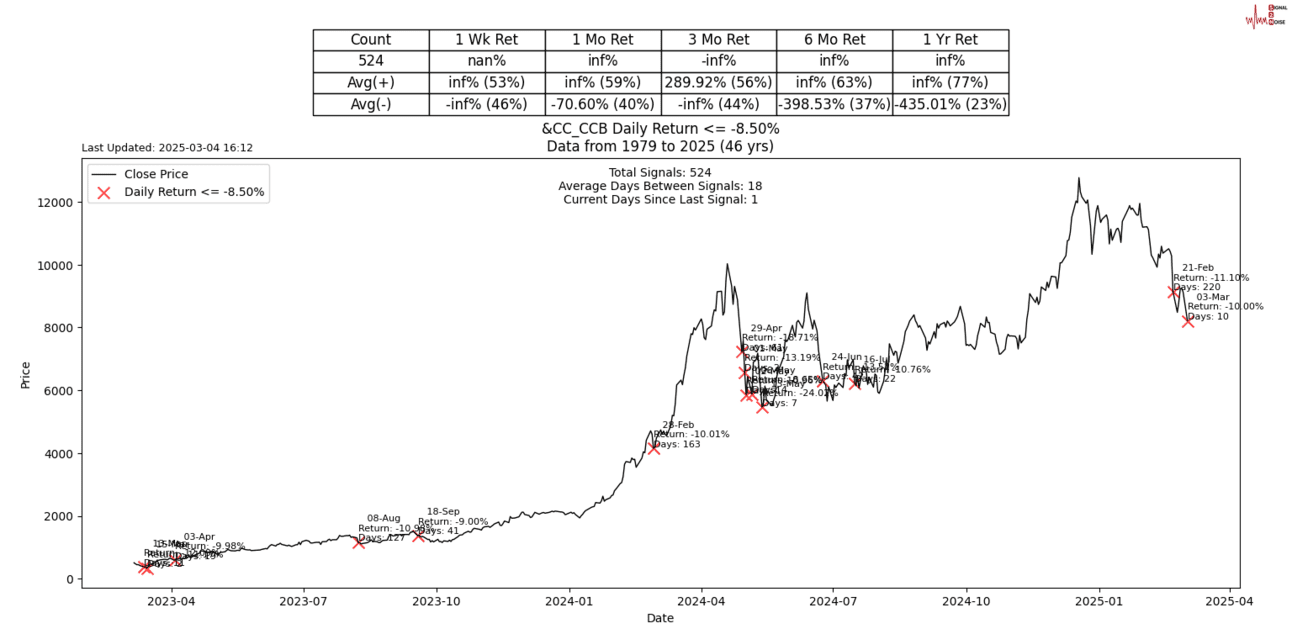

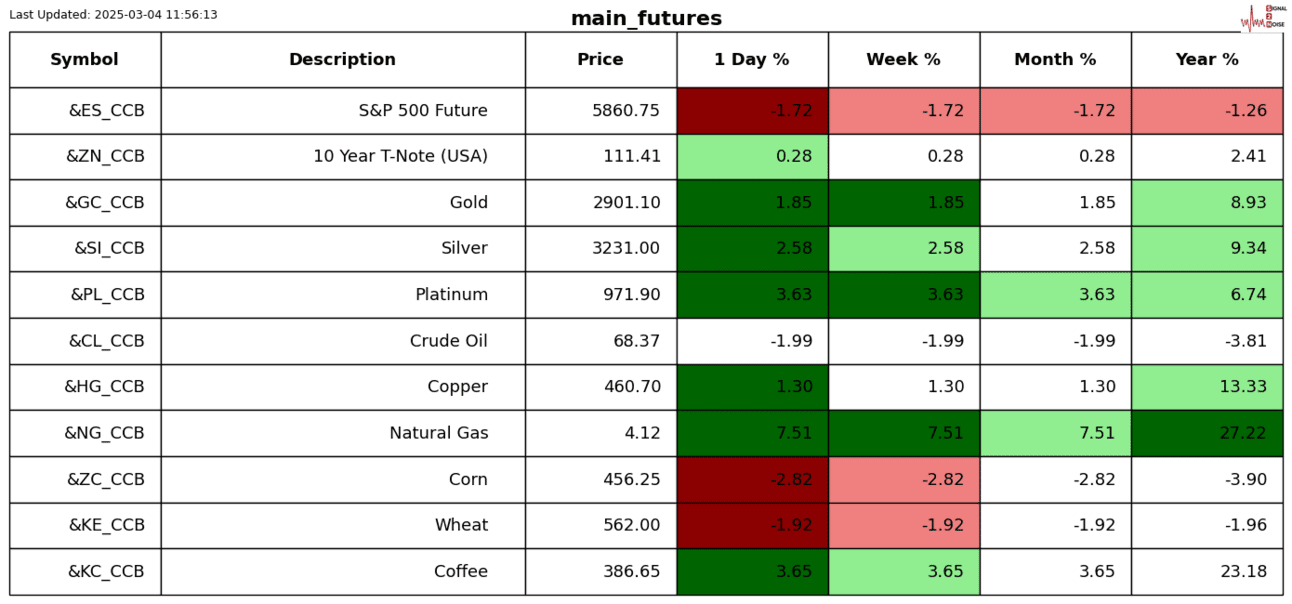

Cocoa futures dropped more than -10% yesterday.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.