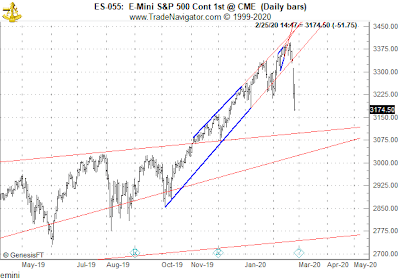

The sudden sharp declines in the last few days were triggered by the "Mars biblical Passover (transiting) the 12/26/19 Solar Eclipse", which has caused Tragedy, Panics and Crisis in the past including 9/11/01.

From my 5/5/13 blogpost on Mars and the Dragon:

"In Vedic Astrology, there's an ancient Dragon that was split in a

fierce battle into two parts, the upper half of the dragon's Body, Rahu

is the Moon's ("True") North Node and the lower half of the body is

Ketu, the Moon's South Node, which causes the Solar and Lunar Eclipses"

It takes Rahu and Ketu 18.6 years to go through all 12 signs and return to the same sign position.

When Rahu is in certain degrees of Sagittarius and Ketu is in certain degrees of Gemini (in Vedic Astrology), we often see global tragic & crisis events.

This is an 18.6 Year Cycle, so this doesn't happen too often.

The 18.6 Year Cycle of Rahu in Saggitarius & Ketu in Gemini:

1. 1945: Bombing of Hiroshima, 8/6-9/45

2. 1963: Assassination of President Kennedy, 11/22/63

3. 1982: Aids Virus

4. 2001: Twin Towers, 9/11/01 was triggered by Mars Passover the 12/26/19 Solar Eclipse.

5. 2020: Corona Virus, 2/22/20 was triggered by Mars Passover the12/26/19 Solar Eclipse.

Trading in Stocks, ETF, Options and Futures involve risks. Trade at your own Risk. Do your own homework. The contents of this blog are for general information and educational purposes only and should not be construed as an investment advice strategy. Past performance is no guarantee of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0800 after German inflation data

EUR/USD struggles to gain traction and trades in a narrow channel above 1.0800 on Monday as the risk-averse market environment helps the US Dollar stay resilient against its rivals. Meanwhile, the data from Germany showed that the annual CPI inflation declined to 2.2% in March, as expected.

Gold sits at record highs above $3,100 amid tariff woes

Gold price holds its record-setting rally toward $3,150 in the second half of the day on Monday. The bullion continues to capitalize on safe-haven flows amid intensifying global tariff war fears. US economic concerns weigh on US Treasury bond yields, allowing XAU/USD to push higher.

GBP/USD stays in range near 1.2950 as mood sours

GBP/USD fluctuates in a narrow channel at around 1.2950 at the beginning of the new week. Growing concerns over US President Donald Trump's tariffs igniting inflation and dampen economic growth weigh on risk mood and don't allow the pair to gain traction.

Seven Fundamentals for the Week: “Liberation Day” tariffs and Nonfarm Payrolls to rock markets Premium

United States President Donald Trump is set to announce tariffs in the middle of the week; but reports, rumors, and counter-measures will likely dominate the headline. It is also a busy week on the economic data front, with a full buildup to the Nonfarm Payrolls (NFP) data for March.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.