That was the SPX dip

Now comes the upswing continuation without much ado – and you as clients are reaping benefits whether in ES or in DAX. The sellers were unable to break through the 4,371 – 4,382 support zone, and the stock market rally continued on retreating yields (and not too bad bond auction yesterday).

Tellingly, the sellers had no success following through with the feeble downswing attempts that reached only mid 4,360s earlier in the week. That‘s a clear sign that that profitable positioning for clients, keeps making best sense (and these gains keep growing still – look no further than the bullish BTC and ETH as signs of confirmation themselves as to crypto having turned bullish too).

I‘ll therefore spend more time commenting on markets live today, and of course you‘ve noticed both gold break below Tuesday‘s lows (yes, I advised clients yesterday that such a break is very much possible, and gave a support target too), and the same goes for continued oil vulnerability to the downside. Rich chart section has more details.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 6 of them.

This market breadth commentary – and its resolution – make it clear why I weren‘t looking for a successful correction following Tuesday NYC lunch time, let alone rolling over to the downside.

Stocks and sectors

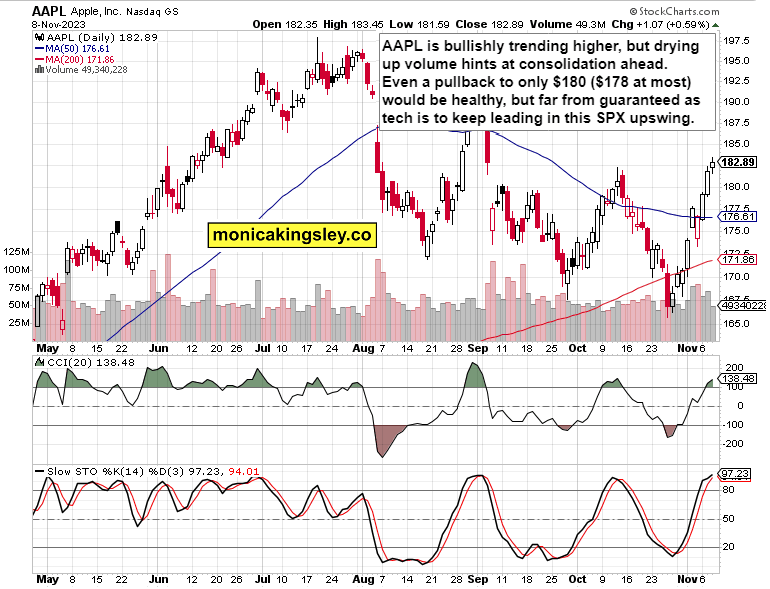

Following yesterday‘s AMZN and MSFT talk, I would add to the (self evidednt) bullish picks AAPL as well – the prospects for a shallow pullback are there, but likely not hitting over the nearest days even as S&P 500 market breadth would continue expanding.

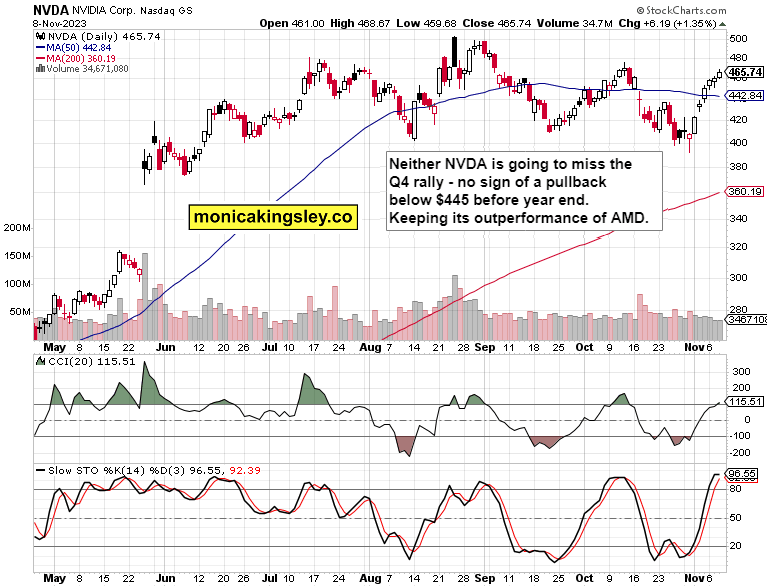

NVDA sellers did as much as they could – and the Aug highs would be overcome during Q4 rally. Semiconductors are to still keep doing fine.

Gold, Silver and Miners

Precious metals are approaching and bobbing above the target given, and low volume confirms hesitation of buyers to step in. The 200-day moving average will be tested in the end, yet that would leave gold with a good snapback rally potential.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.