Telltale sign

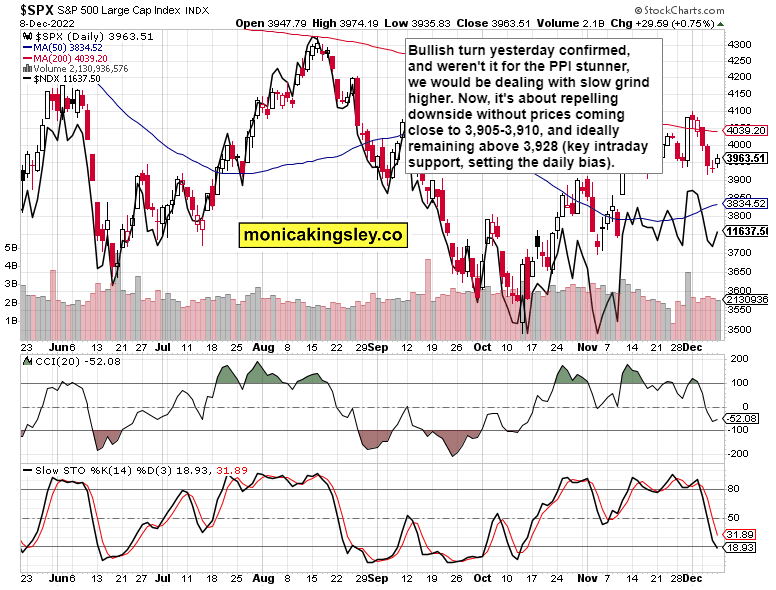

PPI and core PPI came above expectations, fuelling a sharp S&P 500 decline upon the data release. Similarly to yesterday though, the market reaction isn‘t unequivocal as neither USD nor yields are correspondingly up. Real assets aren‘t tanking either, not even the 3m Treasury yield has moved much. And that leads me to think the bearish gap on the news release, will be taken on at least to the 3,965 level degree, after an otherwise positive, bullish turn in paper assets yesterday, which was accompanied by a not at all contradictory real assets message.

Summing up, the (especially the one that Fed is looking at – the core) PPI figure has spooked the markets, but there is no deleveraging panic kicking in. Gold and silver are up – and so is oil, with copper likely to improve later today as well. The dollar isn‘t barking (remember yesterday‘s article featuring similar theme), and that‘s a telltale sign that a sharp selling spree isn‘t likely to kick in after today‘s opening bell. Being ready for all eventualities, watch for the opening selling pressure to ideally dissipate within dozens of minutes after the bell, and for solid bid lifting prices above 3,965 to materialize next.

Failing that, 3,905-3,910 is the support next, which I however don‘t see as likely to be jeopardized – chop would be more probable instead of a fall, as the seasonal tendencies counter the sellers still. Similarly, precious metals and commodities are likely to weather today‘s volatility fine, with the former outperforming the latter (headwinds are to be more lasting in commodities as opposed to gold and silver, which benefit from signs of inflation being as sticky as I‘ve been telling you about for months it would be.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.