Technicals suggest Gold downside this week

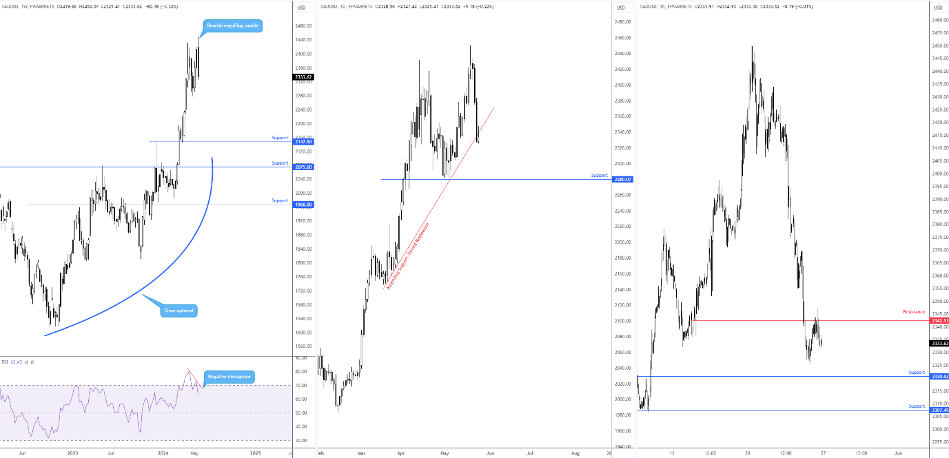

While the uptrend in gold (XAU/USD) remains well and truly intact – last week refreshed all-time highs of $2,450 – momentum shows signs of softening as the yellow metal recorded its largest one-week loss this year (down -3.3%).

Higher-timeframe structure favouring shorts

Price action on the weekly timeframe concluded the week in the shape of a bearish engulfing formation, a two-candle signal aided by the Relative Strength Index (RSI) displaying negative divergence out of overbought territory. The weekly bearish signal is equally supported by price action on the daily chart. Following a spirited one-sided decline on Wednesday and Thursday, a move that pulled price through an ascending support-turned-resistance line, extended from the low of $2,147, this may, given Friday retested the underside of the line, open the door to further downside towards familiar support marked at $2,280.

H1 sellers to target daily support?

You can see that the precious metal spent a large part of the London session testing the grip of resistance on the H1 chart from $2,342 on Friday and moderately pushed lower during US hours. In view of the daily timeframe’s technical landscape supporting further underperformance in this market, despite the clear-cut uptrend, observable on both weekly and daily charts, a short-term push lower could be seen this week in the direction of H1 support from $2,320, closely followed by another layer of support coming in from $2,307 and then, with a little oomph, perhaps towards the daily support level mentioned above at $2,280. However, this daily level will likely be a test for bears as longer-term dip buyers could look to show from here, in line with the overall uptrend.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,