RBA Gov Glen Stevens is due to speak in Sydney tomorrow, and with a shortfall of domestic news traders will be listening out for further clues regarding interest rates and the "historically high" A$.

The markets are now pricing in a 7% chance of a rate cut following a rising unemployment and jawboning from RBA Gov Glenn Stevens. However I doubt we'll be seeing any rate cut soon as RBA remain within a 'neutral' stance and continue to reiterate the message "The most prudent course was likely to be a period of stability in interest rates." Whilst Stevens has hinted he would like a lower A$ (and expects we will see one) he has steered away from more stern words of intervention, and I expect this to be the case tomorrow.

Of course if there are talks of the high A$ or stern words relating to their "extra ammunition" then we should see A$ firmly back below 94c.

However over the coming weeks whilst both the FED and RBA are reluctant to outline a clear timetable of interest rate changes then AUDUSD will continue to frustrate position traders in seek of that next home run.

The US will release housing and inflation data on Tuesday night to provide further direction for the A$. Existing home sales are forecast at an 8-month high whilst Core CPI is expected to rise a further 0.2%. If these come to fruition then I'd expect to see A$ back below 94c.

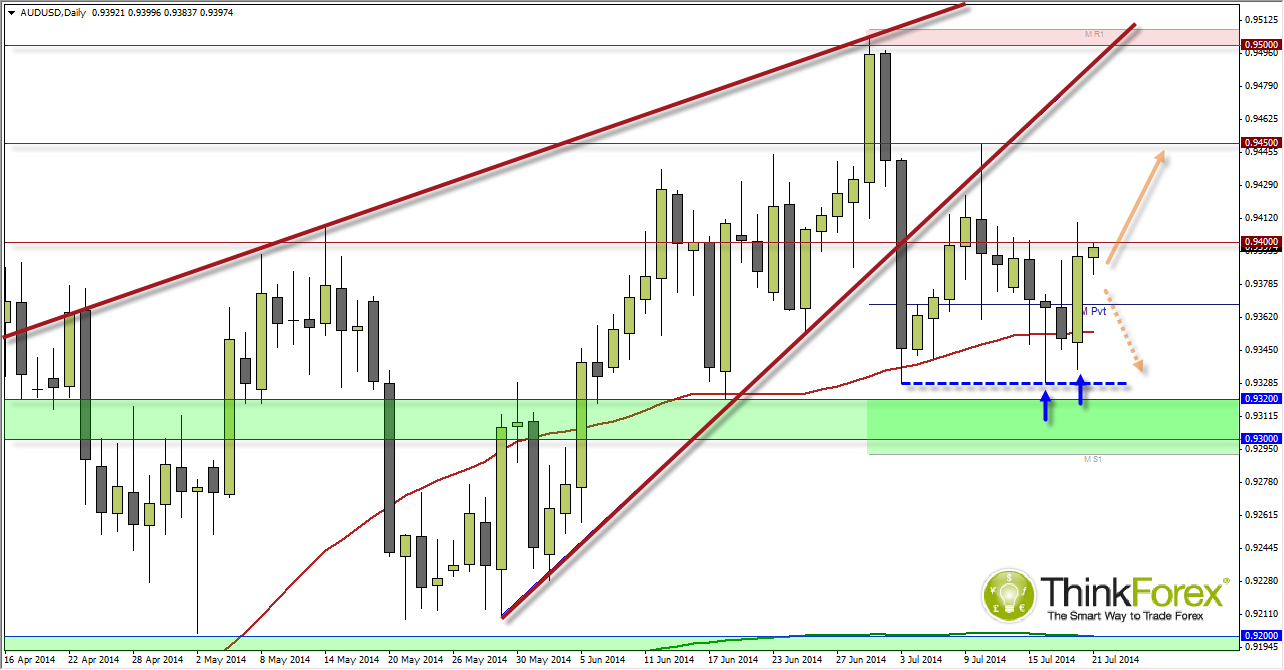

There is a bed of support between 0.9362-68, but a break below here should then target last weeks lows at 0.9328. However this is where it begins to get more interest due to the price action at these levels last week: The 2-day decline from the 0.95c highs were the most bearish since Jan, yet last Wednesday the A$ bulls managed to keep above this low by 0.7 pips and close the session with a bullish pinbar. Last Friday then saw a bullish engulfing candle close to a 5-day high, and remain above the 50-day eMA. Tis paints a more bullish picture near-term and raises the potential for a break back above 94c.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.