EUR/USD Daily

Limited to 1.1320 high so far though the upside stays in focus and see scope to retest the 1.1338 high. Break here will see scope to target the 1.1400 level. Beyond this will shift focus to the 1.1460 and 1.1495, Sep/Oct highs. Support starts at 1.1246 then the 1.1161 low, seen protecting the downside. [PL]

USD/CHF Daily

Rejection from the .9820 high yesterday see pressure returning to the downside and the .9695 low at risk. Follow-through below this will see further decline to .9612 and .9578 support. Resistance now at the .9786, Dec low, and .9820 and lift over these needed to ease downside pressure. [PL]

USD/JPY Daily

Bears showing no signs slowing and break of the 113.00 level see further decline to 112.45 next then the 112.00 level. Below the latter will shift focus to the 110.00 level though stretched intraday and daily tools caution corrective bounce. Resistance now at 114.21 and 115.54. [PL]

EUR/CHF Daily

Steadying at the 1.0952 low to consolidate the sharp drop from 1.1200 high of last week. However, the upside seen limited with resistance now at 1.1019/34 area. Would take lift over this to see room for stronger recovery to the 1.1100 level. Break of the 1.0940 support will see deeper pullback to the 1.0900 level and 1.0870 support. [PL]

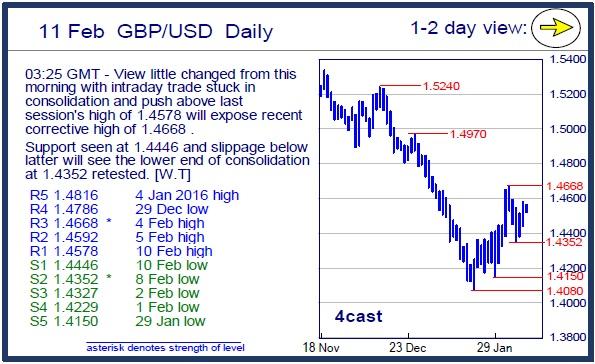

GBP/USD Daily

View little changed from this morning with intraday trade stuck in consolidation and push above last session's high of 1.4578 will expose recent corrective high of 1.4668 . Support seen at 1.4446 and slippage below latter will see the lower end of consolidation at 1.4352 retested. [W.T]

EUR/GBP Daily

Lower to unwind the strong rally from the .7526 low of last week. Setback from the .7851 high to break the .7756/31 support see room for stronger pullback to the .7666/61 area. Higher low sought for renewed strength later, above the .7851 high will see resumption of the strong up-leg from the Nov low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.