EURUSD

The Euro is regaining traction and rallies above 1.14 barrier, after yesterday’s brief probe above and subsequent consolidation. Bullishly aligned technicals support fresh extension higher and test of 1.1458, 17 Sep peak and 1.1473, Fibonacci 61.8% of 1.1712/1.1086, break of which to trigger further acceleration higher.

Session low at 1.1372, offers initial support, with extended dips to be contained at 1.1340 zone, broken bull-channel resistance / higher low of 13 Oct.

Res: 1.1458; 1.1473; 1.1500; 1.1564

Sup: 1.1400; 1.1372; 1.1340; 1.1317

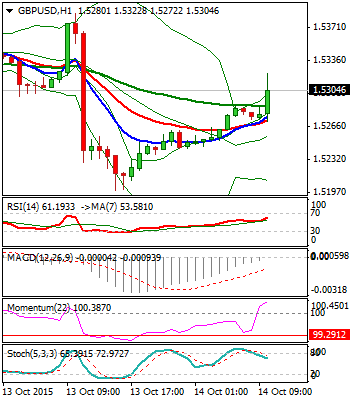

GBPUSD

Cable recovers yesterday’s losses, when the pair fell sharply after repeated rejection at strong 1.5380 barrier. Strong fall found support at 1.52 zone, with subsequent bounce, probing again above 200SMA at 1.5319. Failure to sustain break above 200SMA, which is seen as key barrier, keeps the downside at risk.

Daily technicals are mixed, with bearish setup of MA’s and slow Stochastic reversing from overbought territory, giving negative signals. Some support is for now given by bullishly aligned momentum.

Near-term studies entered neutrality zone and will be looking for signal, to establish fresh direction.

Lower platform at 1.5380, also 50% of 1.5656/1.5105 downleg, marks the upper breakpoint, while yesterday’s low at 1.52 is seen as a trigger for fresh weakness towards 1.5105 base.

Res: 1.5342; 1.5386; 1.5420; 1.5446

Sup: 1.5275; 1.5243; 1.5200; 1.5135

USDJPY

The pair remains under pressure in the near-term and probes again below triangle support, currently at 119.81. Repeated daily close in red, after multiple failure to break above 120.40/70, daily Ichimoku cloud, keep the downside under pressure. Daily studies maintain bearish tone and favor further downside. Final break below 119 support zone, low of short-term congestion and loss of 118.67, 02 Oct spike low, is required to confirm bearish resumption. Descending daily 20SMA, caps at 120.03, ahead of triangle resistance at 120.15, which mark the upper breakpoints.

Res: 120.03; 120.15; 120.55; 120.87

Sup: 119.47; 119.23; 119.05; 118.67

AUDUSD

Extended near-term correction off fresh high at 0.7380, briefly probed below 0.72 handle, near Fibonacci 38.2% of 0.6935/0.7380 upleg. Dips were contained by rising daily 10SMA /Tenkan-sen line, keeping daily bulls unharmed for now. The move is seen as correction of nine-day rally, with current low, seen as ideal reversal point, with extension above daily cloud top at 0.7321, needed to confirm. However, further easing cannot be ruled out, as daily slow Stochastic reversed from overbought territory and shows more room towards the downside. Rising daily 20SMA at 0.7128, reinforced by daily Ichimoku cloud base, few ticks lower, should contain extended dips. Otherwise, break here would signal an end of recovery phase.

Res: 0.7288; 0.7310; 0.7321; 0.7362

Sup: 0.7196; 0.7157; 0.7128; 0.7105

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.