EURUSD

The Euro holds overall negative tone and posted marginally lower low at 1.3177, levels last time seen one year ago, with near-term price action trading in consolidative mode, around 1.32 level. Oversold 4-hour and daily studies suggest more significant corrective action in the near-term, as hourly indicators are heading north. The pair attempts to fill Monday’s gap, the first step which will signal recovery under way, ahead of previous low at 1.3240 and 1.3266, Fibonacci 38.2% of 1.3410/1.3177 descend, break of which to open key near-term barrier and breakpoint at 1.3295, lower top of 22 Aug and psychological 1.33 resistance, reinforced by daily Tenkan-sen line. Break here is required to confirm near-term base and put bears on hold for stronger recovery. Otherwise, lower top formation and fresh weakness would keep larger bears intact for extension towards next targets at 1.3103, Sep 2013 higher low and 1.3022, Fibonacci 138.2% expansion of the wave from 1.3699.

Res: 1.3220; 1.3240; 1.3266; 1.3300

Sup: 1.3177; 1.3150; 1.3103; 1.3050

GBPUSD

Cable attempts to stabilize after bounce from fresh low at 1.6534 returned to near-term congestion tops and strong resistance at 1.66 zone. Slight improvement of hourly studies keeps fresh attempts higher in play, as 4-hour indicators are heading off oversold zone. However, more significant recovery requires break above 200SMA at 1.6680 and 18 Aug lower top at 1.6736, to offset larger bears. Otherwise, preferred scenario would be lower top formation and fresh weakness towards targets at 1.6500, round figure support and 1.6464, 24 Mar low.

Res: 1.6600; 1.6622; 1.6651; 1.6677

Sup: 1.6564; 1.6534; 1.6500; 1.6464

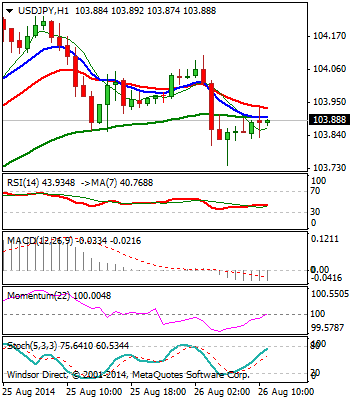

USDJPY

The pair maintains overall bullish tone, as fresh bulls cracked key 104.11, 04 Apr peak, the last obstacle on the way to 105.43, 02 Jan peak. Corrective action is under way, with pullback probing below initial 104 support, ahead of fresh attempt higher. Extended pullback to face supports art 103.50, 22 Aug low and 103.20, Fibonacci 38.2% of 101.49/104.26 upleg. Ideally, reversal should be contained here and should not extend below 103 zone, previous peaks and Fibonacci 38.2% retracement of 101.07/104.26 upleg, to keep bulls intact.

Res: 104.10; 104.26; 104.50; 104.83

Sup: 103.50; 103.20; 103.07; 102.70

AUDUSD

The pair trades in near-term corrective mode off fresh low at 0.9237, after pullback off 0.9342 retested 0.9237 support. Near-term tone is neutral and sideways trading is expected to continue, while 0.9342 top caps. Break here to signal double-bottom formation on 4-hour chart and stronger rally, which requires break above pivotal 0.9372, 06 Aug lower top, to confirm the scenario. Conversely, slide below 0.9270 higher low to weaken immediate structure and risk return to 0.9237 low.

Res: 0.9300; 0.9327; 0.9342; 0.9372

Sup: 0.9285; 0.9270; 0.9237; 0.9200

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.