Technical analysis – WTI Crude Oil eases after bullish wave [Video]

-

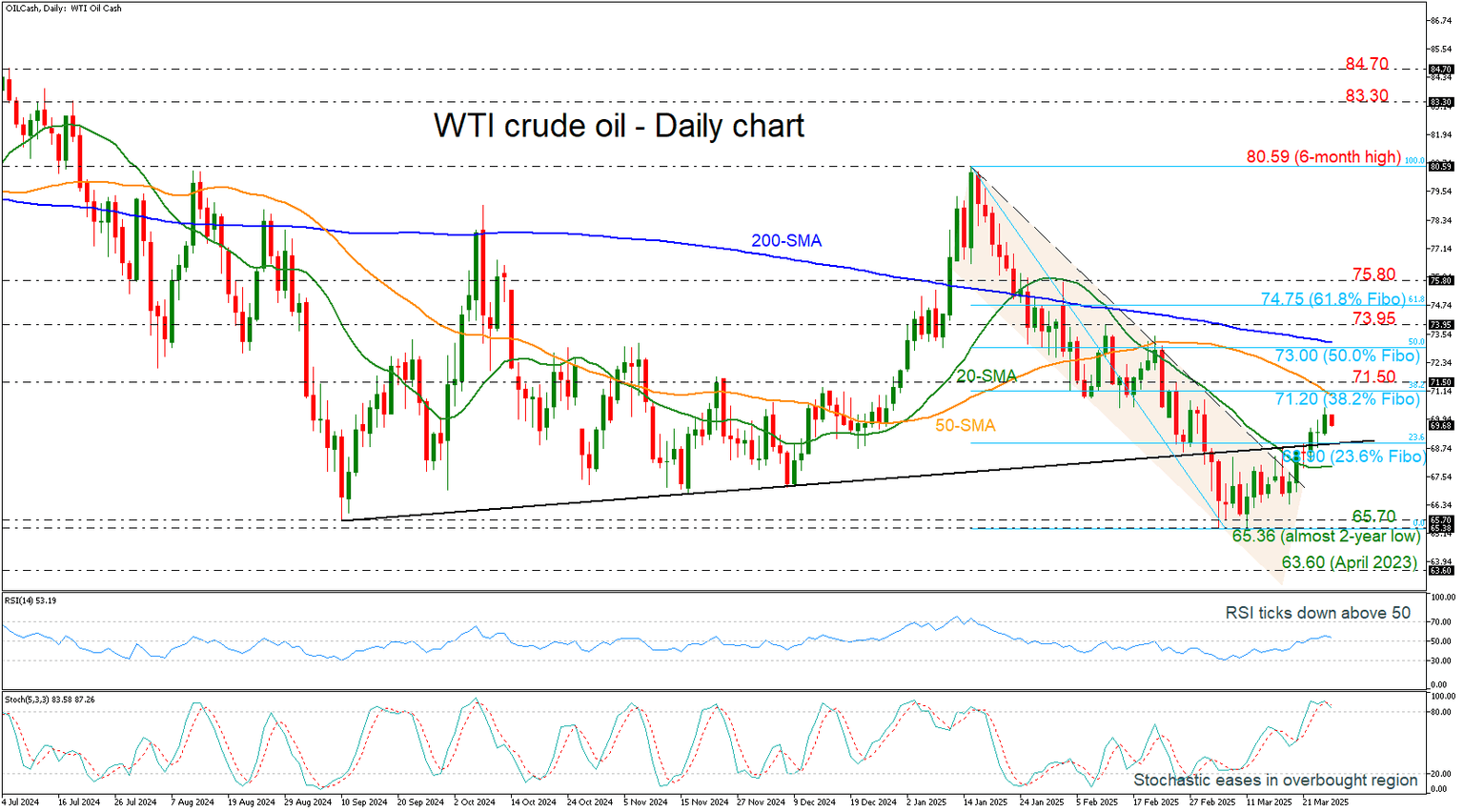

WTI crude oil breaks significant level of 68.90.

-

Technical oscillators suggest negative momentum.

![Technical analysis – WTI Crude Oil eases after bullish wave [Video]](https://editorial.fxsstatic.com/images/i/West-Texas-Intermediate_3_XtraLarge.png)

WTI crude oil has gained some notable ground after the selling interest toward the almost two-year low of 65.36, surpassing the crucial resistance levels of the 23.6% Fibonacci retracement level of the down leg from 80.59 to 65.36 at 68.90 and the long-term ascending trend line.

However, from a technical perspective, the momentum oscillators show weak movement. The RSI is pointing slightly down above the 50 territory, while the stochastic posted a bearish crossover between its %K and %D lines in the overbought region.

If the commodity falls below 68.90, it may challenge the 20-day simple moving average (SMA) at 68.00 before entering the descending channel. Lower, the 65.70 and 65.36 supports may cause negative actions.

On the other hand, a continuation of the up leg could reclaim the 38.2% Fibonacci of 71.20, which holds near the 50-day SMA, before battling with the 71.50 barrier. If the bulls continue to buy, the 50.0% Fibonacci and the 200-day SMA around 73.00 may prove to be tough obstacles.

All in all, WTI crude oil showed some improvement in the preceding days, but the technical oscillators suggest a negative bias.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.