Technical analysis: Gold fails to leave 1,800 level in the dust, upside shaky

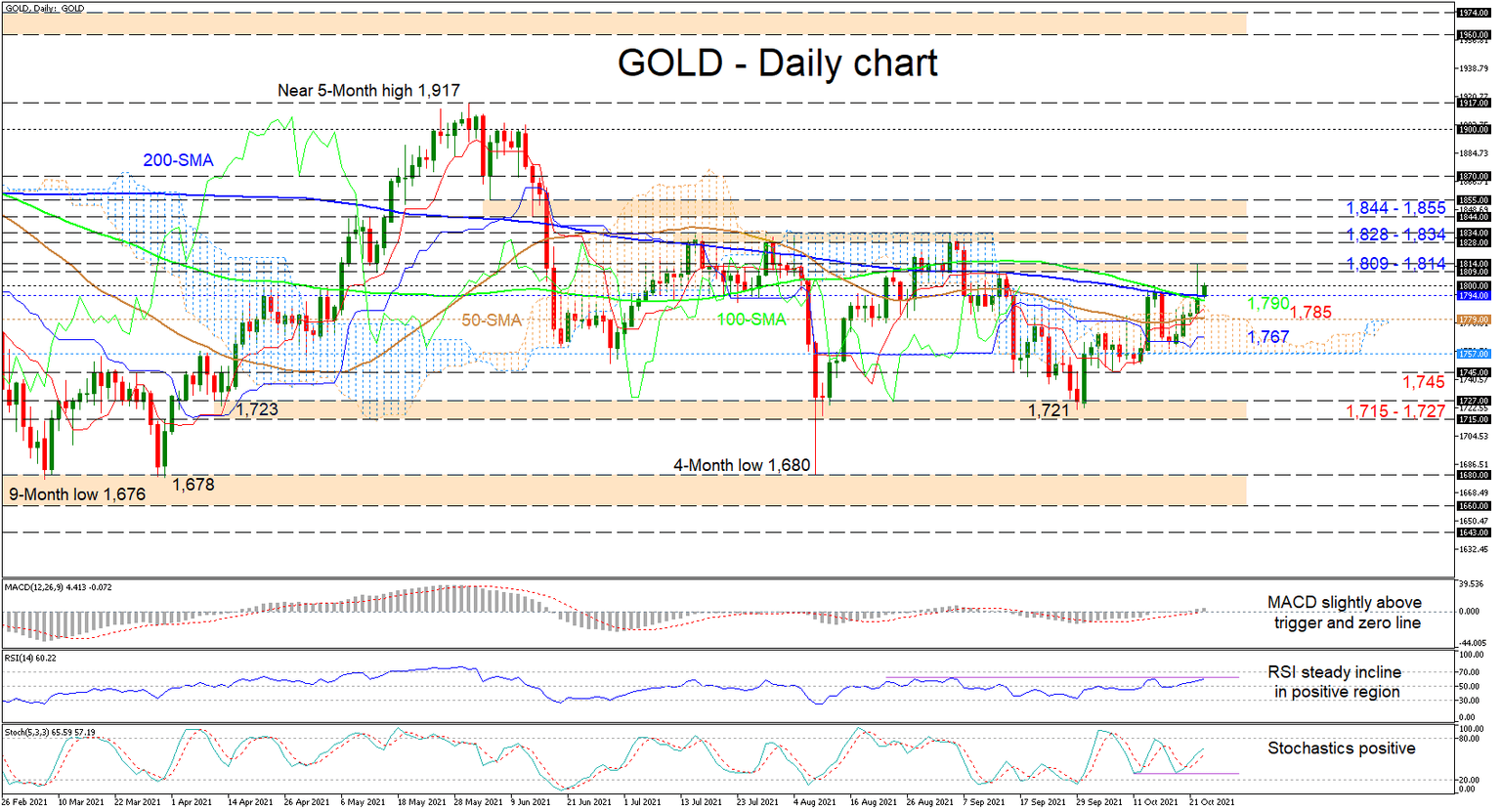

Gold is struggling to convincingly conquer the 1,800 handle and thus some doubt has been thrown into gold’s positive picture as sellers pushed back heavily in Friday’s trading session. The simple moving averages (SMAs) are overall on a horizontal trajectory and are converging, endorsing a more neutral price demeanour.

The Ichimoku lines are showing that bullish pressures have not fully disappeared, while the short-term oscillators are reflecting an increase in positive momentum. The MACD is making additional progress above its red trigger line nudging into the positive region, while the RSI is improving in bullish territory. The upbeat stochastic oscillator is promoting an upwards drive in the commodity.

If the price closes above the 1,800 barrier, nearby upside hindrance could stem from the resistance belt of 1,809-1,814. Overstepping the highs from September 14 and October 22 that form this obstacle, buyers may jump to challenge the ceiling of 1,828-1,834 that has kept the commodity consolidating since mid-July. Triumphing over this reinforced border, the price could then meet the resistance boundary of 1,844-1,855.

To the downside, sellers face an immediate region of support beginning from the 200-day SMA at 1,794 until the 50-day SMA at 1,779. Should the price sink beneath this reinforced buffer zone, the blue Kijun-sen line at 1,767 could come into focus ahead of the Ichimoku cloud’s floor at 1,757. Retreating further underneath the cloud and the neighbouring lows until 1,745, the bears could then make efforts to test the support section of 1,715-1,727.

Summarizing, gold’s short-term outlook remains neutral. That said, the precious metal is making attempts to decisively close north of the 1,800 border. A break above 1,834 could bolster upside momentum, while a drop below 1,715 is needed to reinforce negative tendencies.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.