The Australian dollar has enjoyed a surge higher in the last 24 hours moving from its consolidation zone just below 0.73 up to a two week high above the previous key level at 0.74. The 0.74 level has kicked in as resistance and has sent the AUD/USD back under where it is presently trading. Over the last month the AUD/USD has fallen sharply which culminated in a new six year low near 0.7200 towards the end of last week. It has spent the last week trading right around the key 0.73 level after enjoying some support from around 0.7260. before its recent surge higher. For the best part of the last few weeks the AUD/USD has traded in a narrow range between 0.74 and 0.75 with the former providing reasonable support and the latter providing stiff resistance during this time. It had been relying upon support at 0.74 and testing this level however this has now been broken and the AUD/USD has been consolidating around the 0.73 level for the last week or so. Back at the end of June the Australia dollar was starting to feel some selling pressure from the 0.77 level and it had its eyes firmly focused on the long term support level at 0.76.

In the first half of June the Australian dollar surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. Throughout this time it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77. Over the last couple of months the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion.

Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150. For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels.

(Daily chart / 4 hourly chart below)

AUD/USD August 4 at 23:40 GMT 0.7380 H: 0.7428 L: 0.7263

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the Australian dollar is easing back below 0.74 after surging higher to above 0.74. Current range: trading right around 0.7380.

Further levels in both directions:

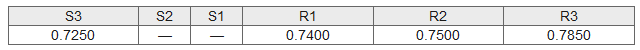

- Below: 0.7250

- Above: 0.7400, 0.7500, and 0.7850.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.