EUR/USD technical analysis: Retains positive tone but negative signals apply strain

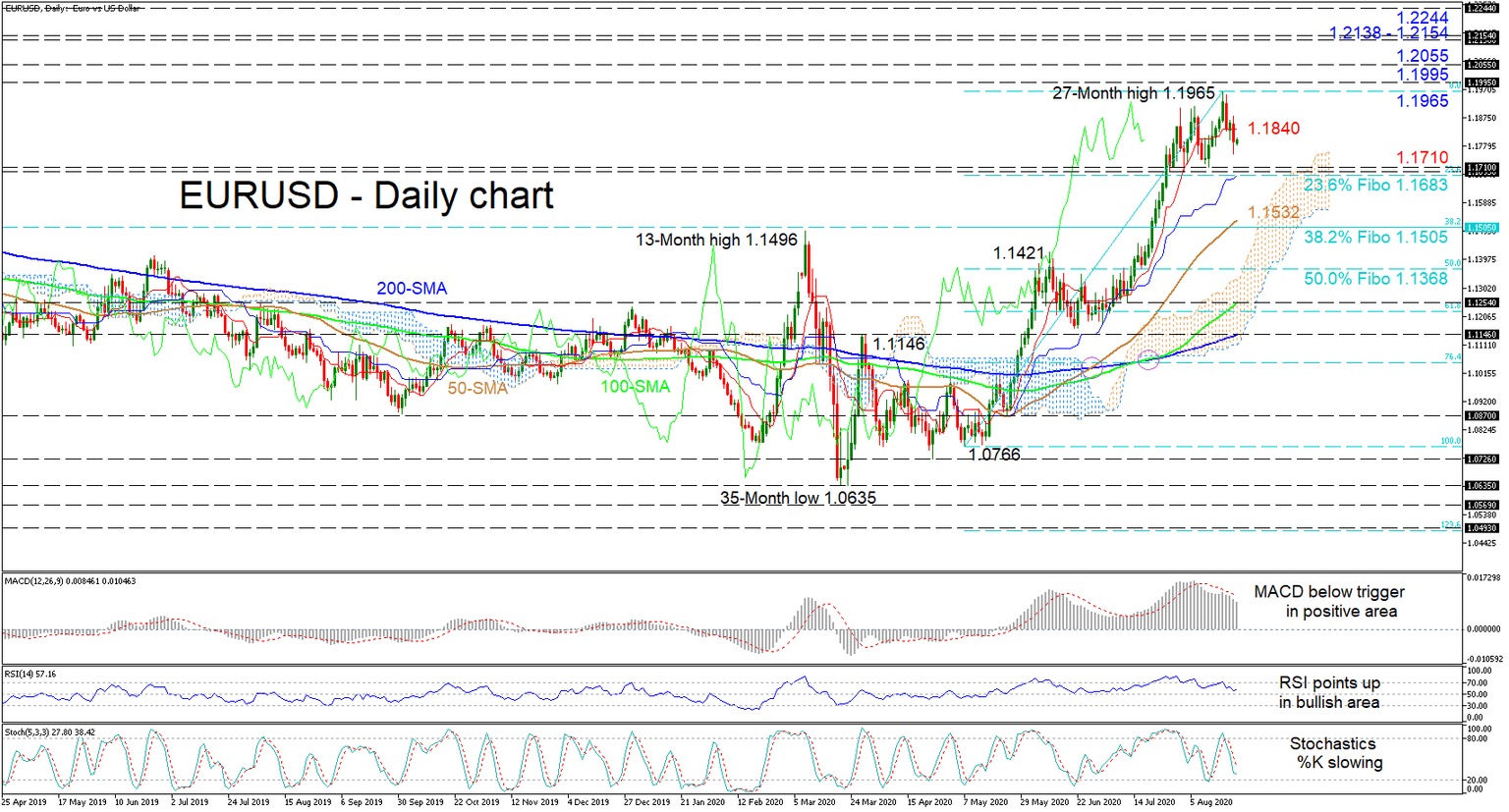

EURUSD maintains a bullish tone despite the pullback from the fresh 27-month peak of 1.1965. The Ichimoku lines sustain a bullish momentum some distance above the Ichimoku cloud, while the advancing simple moving averages (SMAs) dictate a predominant positive bearing.

That said, the short-term oscillators reflect a negative picture however and momentum seems to be shifting. The MACD has weakened below its red trigger line but remains far in the positive region, while the RSI is picking up after slipping near its 50 mark. The negative mode of the stochastic oscillator appears to be easing with the %K line starting to turn ahead of the 20 level, which could assist the broader positive picture. Nonetheless, traders can’t rule out the retracement extending towards 1.1700.

If sellers manage to take control, initial hardened support may arise from 1.1710 to 1.1683; the latter being the 23.6% Fibonacci retracement of the up leg from 1.0766 to 1.1965 and where the blue Kijun-sen line currently lies. Diving under this critical section, the pair may test the cloud and the 50-day SMA presently at 1.1532 ahead of the 38.2% Fibo of 1.1505. Further loss of ground may then challenge the 50.0% Fibo of 1.1368, in-line with the July 16 key trough.

Otherwise, if buyers intensify and jump above the flat red-Tenkan-sen line at 1.1840, the price may revisit the multi-month peak of 1.1965. Another leg higher, the 1.1995 high from May 2018 (near the key 1.2000 mark) may impede the price from stretching towards the 1.2055 barrier. Should additional gains unfold, the 1.2138 to 1.2154 resistance band may hinder the pair from reaching the 1.2244 high from back in April of 2018.

Summarizing, the short-term picture is strongly bullish above 1.1710 and a break above 1.1965, and specifically 1.2000, may boost the current bias.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.