Tech, Silver or Copper – Which one is waking up

S&P 500 kept on the positive Thanksgiving week note called, and allowed clients for quick intraday positioning to take advantage of a bout of Nasdaq outperformance – and my swing trading clients not chasing every intraday move, benefited also from the continued push higher, because rotations are the health of bull markets, and my call for a tame, but still up Santa Claus rally, is well known. Then, I‘m keeping an eye on trailing stop-loss placement for the purpose of locking in the growing swing gains.

Weekend visitors to my feed have noticed an important aspect that I‘m raising as part of the gold bid (on the central banks‘ side), and that‘s the 100% tarrifs intention floated, and what that does to the international balance of forces as regards dedollarization – see here 1, 2 and 3 for greater details, and put these in context of China rare earths move just in. This is all part of sharply rising geopolitical tensions following election results, with many worldwide flashpoints.

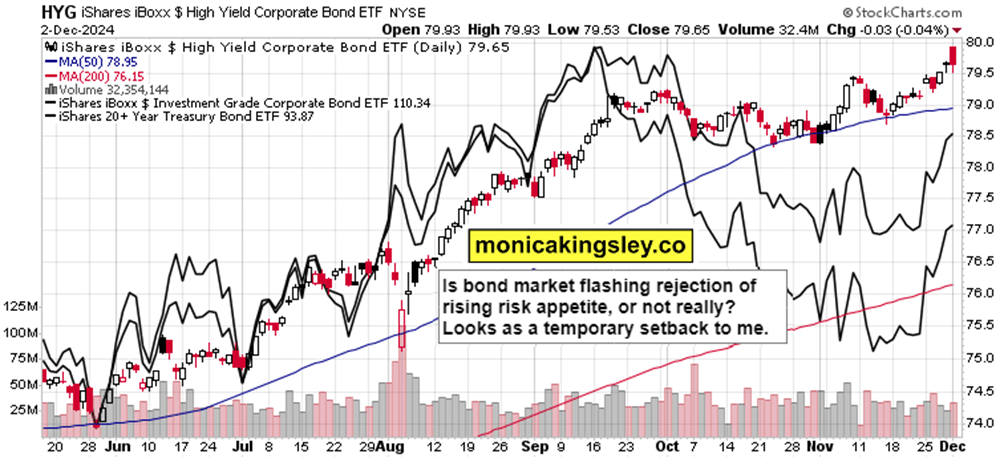

Let‘s start by quoting my S&P 500 weekend call for clients, and then let‘s examine the bond market health, and then I‘m bringing you the oil chart in light of yesterday‘s improtant WTIC move – way more details follow in the premium analytical sections

(…) The new 6,020 support kept holding, no danger to 5,985 (the key support), and rotations powering the 500-strong index higher. …[5 sectoral picks to outperform the index] … Sunday‘s open will be insightful, and bulls want to see it up challenging and eating supply at the level of Friday‘s S&P 500 highs.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.