Tariff stunner aftermath – Stocks and USD

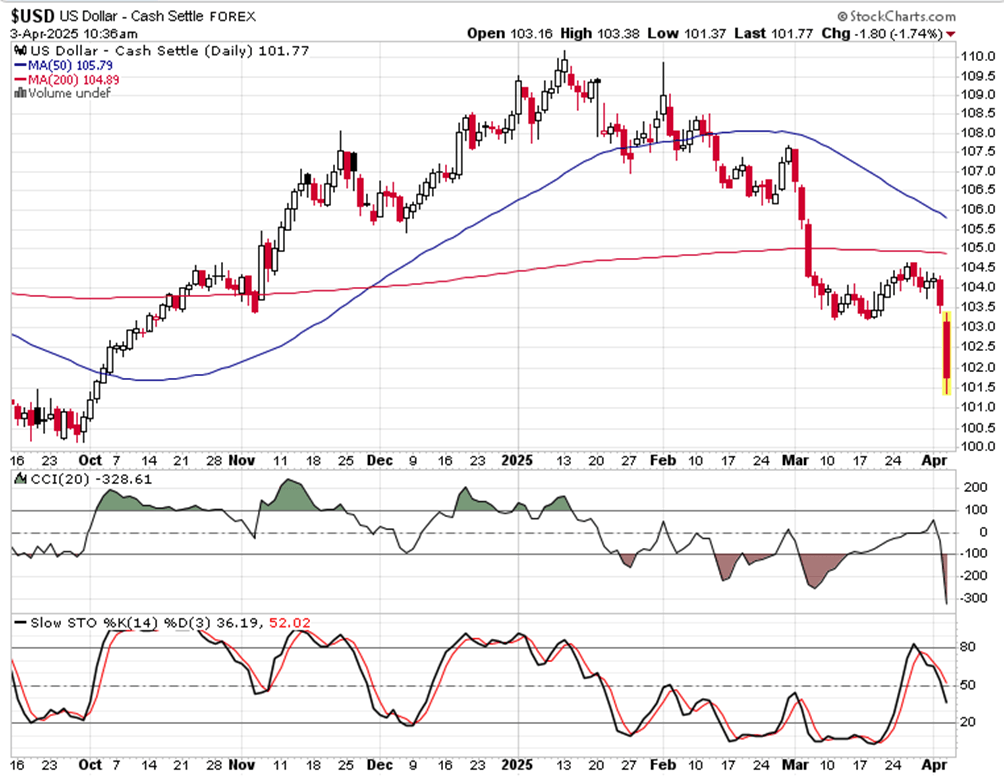

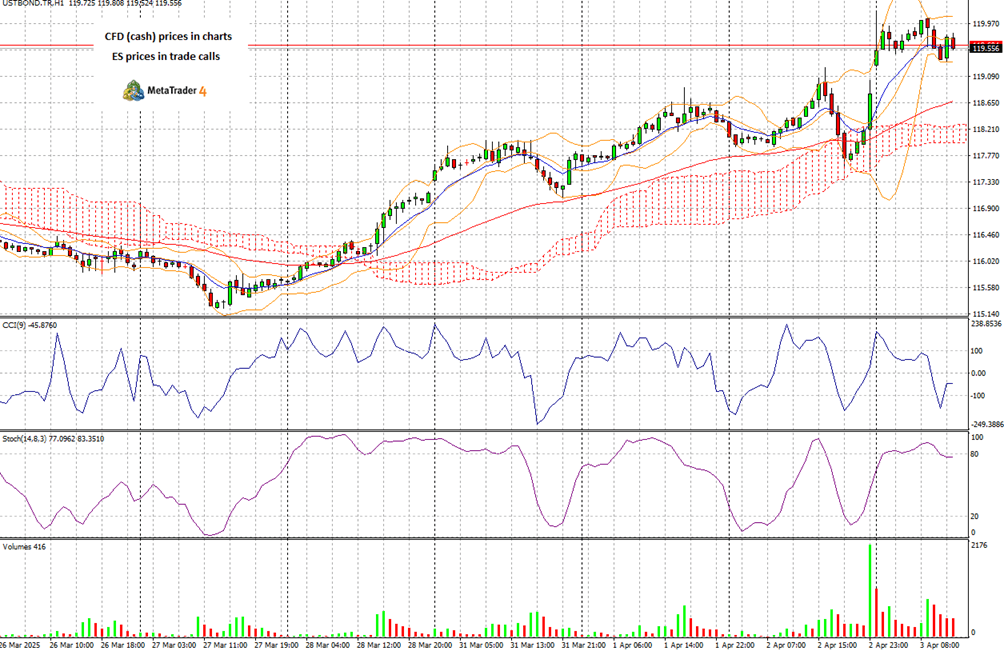

S&P 500 reversed immediately on more than reciprocal tariffs that also sent USD sharply lower. The leaked rumor of three bands, differentiation by industry and country helped with risk taking during the day, however proved incorrect and the clearly apparent objective in tariffs calculation, is addressing trade balance. That also has the effect of decreasing demand for USD and driving yields lower (= supporting Treasuries) – today‘s extensive video goes in-depth into impact on key countries (who will dare to retailiate meaningfully?), stocks, USD and bonds prospects beyond today.

What‘s key for sizable gaps situations such as today, is assessing technically the chart (where can be the next retracement area, can prices be squeezed there before continuing lower) – be very selective and ready for volatility as I‘m looking foremost to Germany, France and China to retaliate.

USD and 1-3 Treasuries aggregate to set the tone, below.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.