By all accounts, the June Consumer Price Index (CPI) report was great news, but you might want to take it with a grain of salt.

This apparent victory over price inflation likely means the Fed will surrender to inflation.

This CPI report likely tees up a much-anticipated interest rate cut in September. In other words, the apparent victory over rising prices means the Fed can go back to creating inflation.

The June CPI numbers

CPI came in cooler than expected by every major metric.

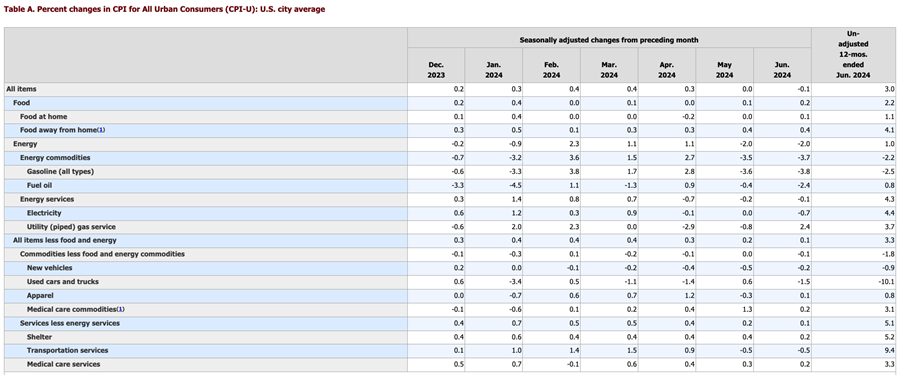

Month-on-month, CPI fell by -0.1 percent in June, according to the Bureau of Labor Statistics (BLS) report. The expectation was for prices to rise 0.1 percent. The last time we saw a negative month-on-month CPI print was in December 2022.

On an annual basis, CPI was 3.0 percent. That compares to a 3.1 percent projection.

Core CPI was up slightly by 0.1 percent. The expectation was for a 0.2 percent rise.

On an annual basis, core CPI came in at 3.1 percent, slightly better than the 3.2 percent projection.

There are a couple of things to note as you digest these numbers.

- All of the annual numbers remain well above the mythical 2 percent target. Nevertheless, they are likely low enough for the Fed to justify declaring victory over inflation and moving forward with an interest rate cut in September.

- Inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

- The Fed doesn't want to get rid of price inflation. It just wants it low enough that you don't notice.

Digging deeper into the numbers, we find falling energy prices drove overall CPI lower. Gasoline prices fell by -3.7 percent in June. Overall energy prices dropped by -2 percent month-on-month.

Food prices continued to rise, with food at home up 0.1 percent on the month and food away from home up 0.4 percent.

Shelter prices also continued to rise.

The grain of salt

We can debate whether or not price inflation is really dead, however, this CPI report creates the impression that it's time to start performing last rights.

The problem is the moment we start throwing dirt on inflation's grave, the Fed is going to begin inflation's resurrection.

As the Washington Post put it, the June CPI helps "cement the path to rate cuts." One analyst told the New York Times, "The latest inflation numbers put us firmly on the path for a September Fed rate cut.”

Here's the grain of salt in all of this good news: rate cuts mean more inflation.

Because most people think inflation simply means "rising prices," they miss what's going on. If CPI isn't going up more than 2 percent, they believe there is no inflation. But Rising prices (price inflation) are merely a symptom of monetary inflation.

Monetary inflation is an increase in the amount of money and credit in the economy. When you get the definition of inflation right, it becomes clear that the Fed creates inflation with a loose monetary policy and this leads to rising prices.

When the Fed starts cutting interest rates, it incentivizes borrowing. That means more credit, and that increases the money supply. So, rate cuts mean inflation.

This is why I say a declaration of victory over inflation is really a surrender.

In fact, the Federal Reserve never did enough to slay the inflation dragon. The rate hikes and balance sheet reduction may have knocked the monster out, but it's not dead.

The central bank pumped nearly $5 trillion into the economy during the pandemic in quantitative easing alone. That was on top of nearly $4 trillion created in the years after the 2008 financial crisis. Meanwhile, the Fed held rates at zero for nearly a decade. They had just gotten started normalizing rates when they started cutting again in 2019 after the stock market got wobbly. Then it went back to zero during the pandemic. This recent tightening cycle did little to wring all of that money out of the economy. The inflation created since 2008 is still sloshing around out there.

Now it's set to add more.

That's inflation!

While the Fed did tighten monetary policy when price inflation became too hot to ignore, it never did make monetary policy tight. Even before rate cuts, monetary policy is currently loose by historic standards, as indicated by the Chicago Fed's own financial conditions index. The NFCI was –0.53 as of July 5. A negative number means financial conditions are loose by historic standards.

Based on the Bloomberg Financial Conditions Index, financial conditions are currently in the loosest condition since 1997.

Of course, the Fed needs to cut rates.

While the central bank hasn't done enough to slay the inflation dragon, it has raised rates high enough to break things in this debt-riddled bubble economy.

In other words, the Fed is stuck between a rock and a hard place.

Federal Reserve Chairman Jerome Powell even admitted this during his testimony on Capitol Hill, saying, "We are well aware that we now face two-sided risks.”

Powell went on to say, "Reducing policy restraint too late or too little could unduly weaken economic activity and employment." But lowering interest rates too soon could "stall or even reverse the progress we've seen on inflation."

Can the Fed really thread this needle? It seems unlikely.

None of this indicates you should stop worrying about price inflation.

In fact, this is all more reason to worry.

The Fed is about to declare victory over price inflation based on some sketchy CPI data so that it can go back to creating inflation.

Money Metals Exchange and its staff do not act as personal investment advisors for any specific individual. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. Readers and customers should be aware that, although our track record is excellent, investment markets have inherent risks and there can be no guarantee of future profits. Likewise, our past performance does not assure the same future. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing through Money Metals, you understand our company not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. This Website is provided “as is,” and Money Metals disclaims all warranties (express or implied) and any and all responsibility or liability for the accuracy, legality, reliability, or availability of any content on the Website.

Recommended Content

Editors’ Picks

EUR/USD trades sideways below 1.0450 amid quiet markets

EUR/USD defends gains below 1.0450 in European trading on Monday. Thin trading heading into the Xmas holiday and a modest US Dollar rebound leaves the pair in a familiar range. Meanwhile, ECB President Lagarde's comments fail to impress the Euro.

GBP/USD stays defensive below 1.2600 after UK Q3 GDP revision

GBP/USD trades on the defensive below 1.2600 in the European session on Monday. The pair holds lower ground following the downward revision to the third-quarter UK GDP data, which weighs negatively on the Pound Sterling amid a broad US Dollar uptick.

Gold price sticks to modest gains; upside seems limited amid USD dip-buying

Gold price attracts some follow-through buying at the start of a new week and looks to build on its recovery from a one-month low touched last Thursday. Geopolitical risks stemming from the protracted Russia-Ukraine war and tensions in the Middle East, along with trade war fears, turn out to be key factors benefiting the safe-haven precious metal.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.