Taiwan could avoid the worst of Trump’s reciprocal tariffs

Taiwan, due to its investments in the US and key tech exports, is likely to face smaller tariff hikes compared to other Asian countries as the Trump administration expands its global trade war with reciprocal tariffs starting on 'Liberation Day' on 2 April.

Taiwan’s rising trade surplus with the US lands it among the “dirty 15” economies

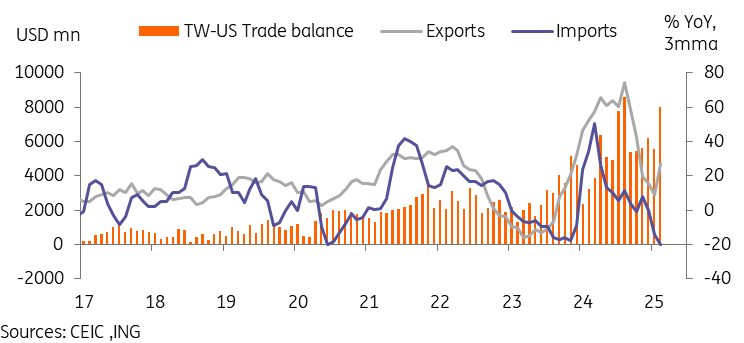

Taiwan's trade surplus with the US has risen more than sevenfold since 2017, rising from USD8.4bn to USD64.9bn in 2024.

Taiwan has grown in importance among US trade partners, ranking as the 7th largest trade partner and the sixth largest trade deficit partner in 2024. Imports from Taiwan accounted for approximately 3.6% of total US imports last year.

This has resulted in Taiwan coming under scrutiny as one of the so-called “dirty 15” countries with trade imbalances with the US.

Taiwan's trade surplus with the US has surged in recent years

Will Taiwan be hit in the reciprocal tariff round?

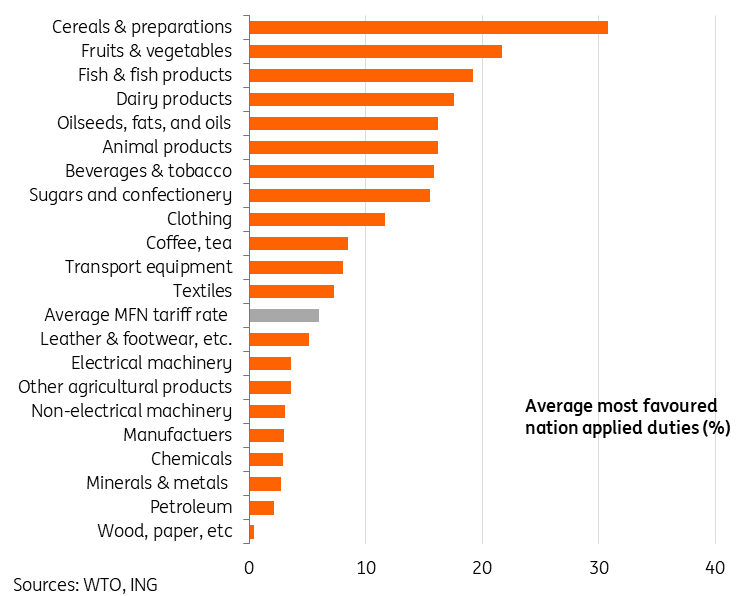

Taiwan's average tariff rate for most favoured nations is 6.5%, and the overall average nominal tariff rate for imported goods was 6.34% which, while not the highest in Asia, is higher than the US and thus does risk reciprocal tariff action.

In 2023, the average nominal tariff rate for industrial products is 4.13% and 15.06% for agricultural products. For the US, the main areas of focus for Taiwan's tariffs are likely to be on agricultural products as well as vehicles, which currently have higher tariff rates.

However, Trump has noted that he “may give a lot of countries breaks.”

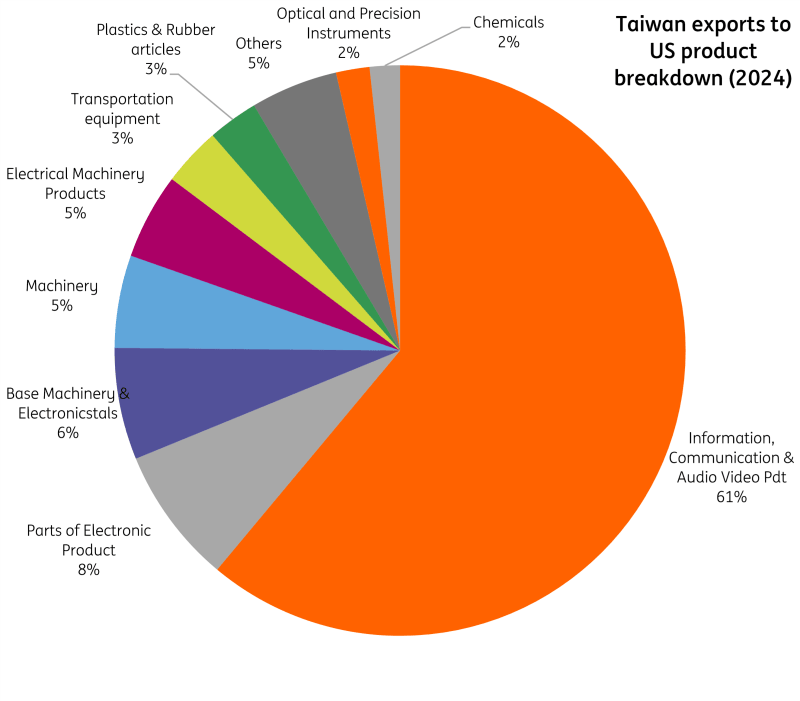

Taiwan’s key exports of semiconductors and computer products to the US have limited replacement alternatives, raising the probability of being exempted.

SMC’s commitment to invest at least USD100bn on top of previous commitments to invest USD65bn into US chip manufacturing facilities have been frequently touted by members of Trump's administration as a sign of success for tariffs, with Trump himself claiming that it would "create hundreds of billions of dollars in economic activity and boost America’s dominance in artificial intelligence and beyond." It is possible that this high-profile announcement may have also brought Taiwan enough goodwill to soften or avert tariffs.

The nature of Taiwan’s key exports to the US and its latest actions would seem to put Taiwan as one of the more likely economies to benefit from a tariff reprieve, or at worst, comparatively smaller tariff hikes.

Taiwan's tariffs place it at risk for reciprocal tariffs but recent actions may buy some goodwill

Significant reciprocal tariffs a notable headwind to Taiwan's trade

However, if we've learned anything from Trump's first two months in office, it is that predicting tariff action is difficult, and Taiwan cannot guarantee that it will avoid damaging tariffs.

If significant tariffs on Taiwan do come into effect, Taiwan’s trade picture would be heavily impacted, as exports to the US have been the main area of growth. This would especially be the case if Taiwan is hit with a blanket tariff rather than an exact mirroring of its existing tariffs, as the products on which Taiwan has the highest tariff rates are not a significant part of Taiwan's exports to the US.

According to Taiwan’s Directorate-General of Budget, Accounting and Statistics, external demand represented around 13.2% of GDP in 2024.

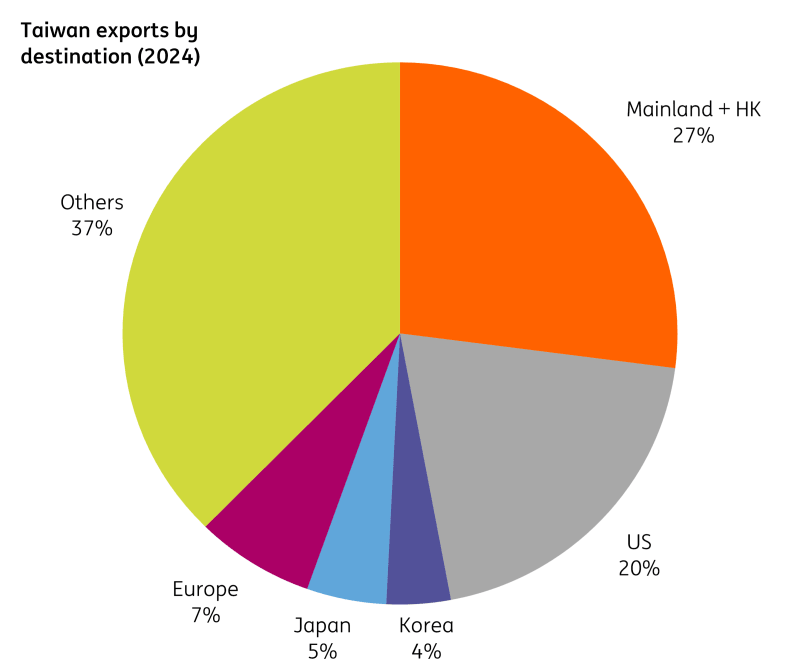

Exports to the US totalled USD111.4bn in 2024, up 46.1% YoY. Export growth to the US far outpaces growth to other regions and is the main driver behind Taiwan’s trade growth over the past year.

Exports to the US represented 20% of total exports in 2024, behind only Mainland China and Hong Kong at 27%.

In terms of the key categories impacted, information, communication & audio video products account for 61% of Taiwan’s exports to the US, followed by electronic parts and machinery categories (5-6%). Given a lack of substitution products and Taiwan's current dominance in the field, US imports could end up bearing the brunt of any potential tariff on semiconductor imports. At the same time, Taiwan could likely find alternative buyers if it came to that. Much as we saw in the case of Canada's energy exports to the US, semiconductors could end up exempt or see a smaller tariff. Other product categories, such as computers and other electronics, could be less lucky, and high tariffs could hamper the current cost competitiveness that Taiwanese products enjoy in the US market.

The vast majority of Taiwan's exports to the US are tech-related

The US is one of Taiwan's most important export destinations

Read the original analysis: Taiwan could avoid the worst of Trump’s reciprocal tariffs

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.