Surprise: The BLS admits another phony jobs report

Jobs unexpectedly soared this month and the unemployment rate took a big dip. But the BLS admitted another error.

The BLS Employment Report for May shows employment rose by 2.5 million and the unemployment rate fell to 13.3%

Initial Reaction

Both numbers are way better than the consensus.

The Bloomberg Econoday consensus jobs estimate was -7.725 million and the unemployment rate consensus was -19.8%.

My unemployment rate estimate was -18.5%. I did not estimate jobs, fearing another fiasco like this.

BLS Admits Another Error

In the household survey, individuals are classified as employed, unemployed, or not in the labor force based on their answers to a series of questions about their activities during the survey reference week (May 10th through May 16th). Workers who indicate they were not working during the entire survey reference week and expect to be recalled to their jobs should be classified as unemployed on temporary layoff.

In May, a large number of persons were classified as unemployed on temporary layoff. However, there was also a large number of workers who were classified as employed but absent from work. As was the case in March and April, household survey interviewers were instructed to classify employed persons absent from work due to coronavirus-related business closures as unemployed on temporary layoff.

However, it is apparent that not all such workers were so classified. BLS and the Census Bureau are investigating why this misclassification error continues to occur and are taking additional steps to address the issue.

If the workers who were recorded as employed but absent from work due to "other reasons" (over and above the number absent for other reasons in a typical May) had been classified as unemployed on temporary layoff, the overall unemployment rate would have been about 3 percentage points higher than reported (on a not seasonally adjusted basis).

However, according to usual practice, the data from the household survey are accepted as recorded. To maintain data integrity, no ad hoc actions are taken to reclassify survey responses.

Add 3 percentage to unemployment rate for a better estimate.

Job Revisions

The change in total nonfarm payroll employment for March was revised down by 492,000, from -881,000 to -1.4 million, and the change for April was revised down by 150,000, from -20.5 million to -20.7 million. With these revisions, employment in March and April combined was 642,000 lower than previously reported.

BLS Jobs Statistics at a Glance

- Nonfarm Payroll: +2,500,000 - Establishment Survey

- Employment: +3.839,000 - Household Survey

- Unemployment: -2,093,000 - Household Survey

- Involuntary Part-Time Work: -254,000 - Household Survey

- Voluntary Part-Time Work: +2,039,000 - Household Survey

- Baseline Unemployment Rate: -1.4 to 13.3% - Household Survey

- U-6 unemployment: -1.6 to 21.2% - Household Survey

- Civilian Non-institutional Population: +151,000

- Civilian Labor Force: +1,746,000 - Household Survey

- Not in Labor Force: -1,595,000 - Household Survey

- Participation Rate: +0.6 to 60.8% - Household Survey

BLS Employment Report Statement

Total nonfarm payroll employment fell by 20.5 million in April, and the unemployment rate rose to 14.7 percent, the U.S. Bureau of Labor Statistics reported today. The changes in these measures reflect the effects of the coronavirus (COVID-19) pandemic and efforts to contain it. Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality.

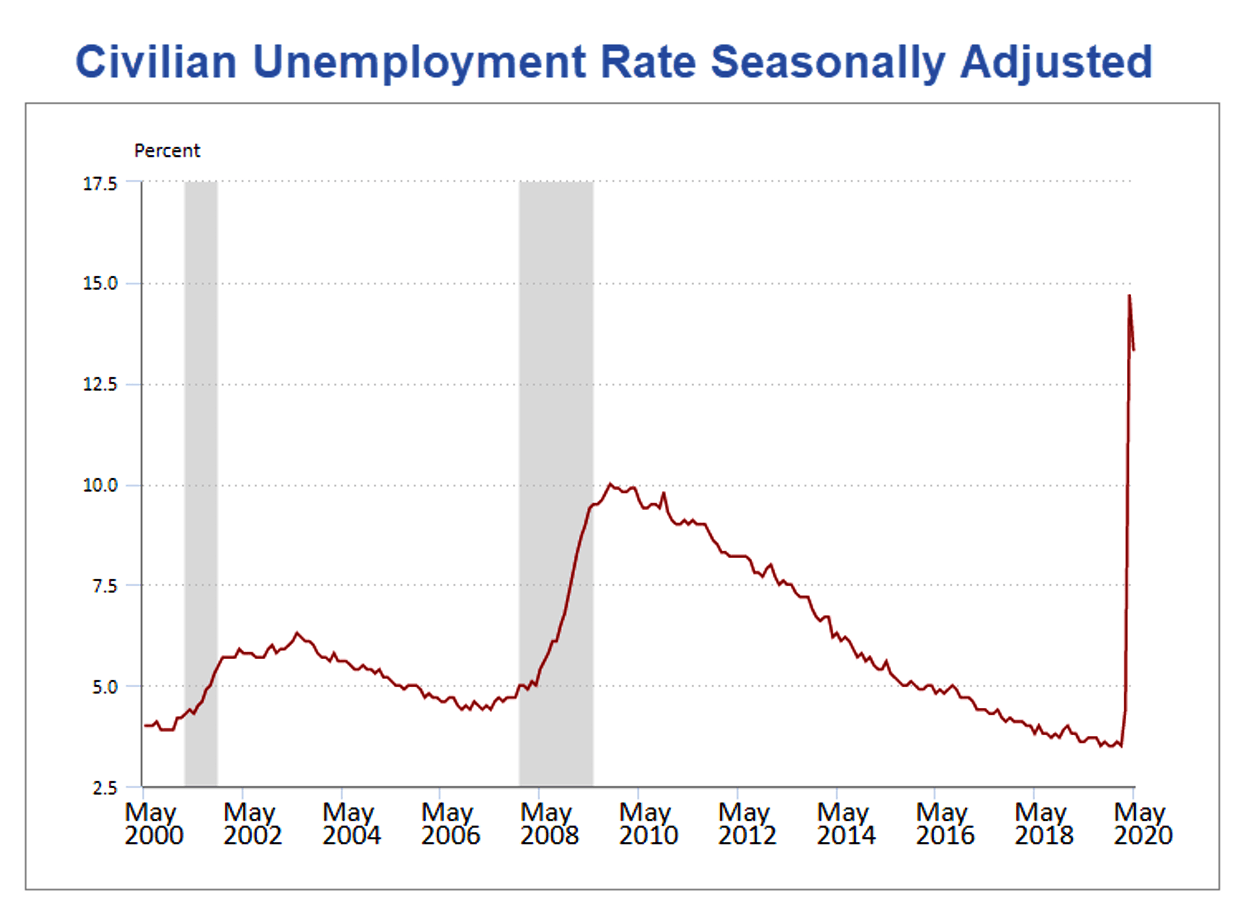

Unemployment Rate – Seasonally Adjusted

The above Unemployment Rate Chart is from the BLS. Click on the link for an interactive chart.

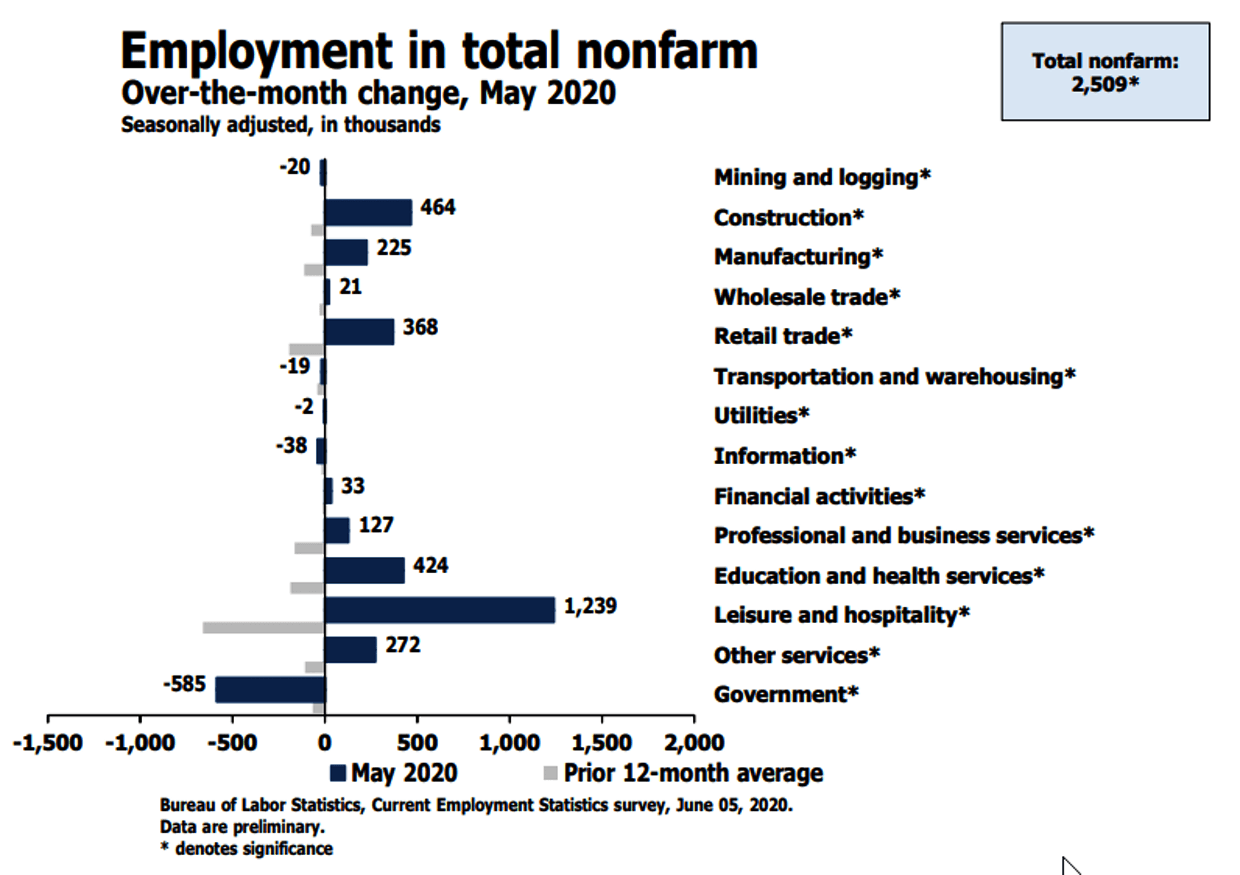

Month-Over Month Changes by Job Type

Hours and Wages

Average weekly hours of all private employees rose 0.5 hours to 34.7 hours. Average weekly hours of all private service-providing employees rose 0.4 hours to 33.8 hours. Average weekly hours of manufacturers rose 0.8 hours to at 38.9 hours.

Average Hourly Earnings of All Nonfarm Workers fell $0.29 to $29.75 . These numbers are so distorted I will skip percentages this month.

Average hourly earnings of Production and Supervisory Workers fell $0.14 to $25.00. These numbers are so distorted I will skip percentages this month.

Year-Over-Year Wage Growth

- All Private Nonfarm rose from $27.87 to $29.75.

- Production and supervisory rose from $23.42 to $25.00.

These numbers are totally distorted because more higher-paid workers kept their jobs than lower-paid employees.

For a discussion of income distribution, please see What’s “Really” Behind Gross Inequalities In Income Distribution?

Birth Death Model

Starting January 2014, I dropped the Birth/Death Model charts from this report. For those who follow the numbers, I retain this caution: Do not subtract the reported Birth-Death number from the reported headline number. That approach is statistically invalid. Should anything interesting arise in the Birth/Death numbers, I will comment further.

This was my comment last month, repeated below.

BLS Special Statement on the Birth-Death Model

The BLS changed the estimation method used in the establishment survey for April. Business births and deaths cannot be adequately captured by the establishment survey as they occur. Therefore, the establishment survey estimates use a model to account for the relatively stable net employment change generated by business births and deaths. Due to the impact of the COVID-19 pandemic, the relationship between the two was no longer stable in April. Therefore, the establishment survey made changes to the birth-death model. These changes include using a portion of business deaths reported by establishments in the estimation process. These business deaths are normally excluded from the estimation process. BLS also added a regression variable to the model for forecasting net business births and deaths. The regression variable added more recent information to the model, which typically relies on inputs only available on a lag of several months. The establishment survey also uses outlier detection as a usual part of the seasonal adjustment process. All outliers for seasonal adjustment are identified on a monthly basis in the establishment survey seasonal adjustment documentation.

The Birth-Death model is officially garbage, much more than normal, but we likely will not find how distorted this is until the annual revisions next year.

Table 15 BLS Alternative Measures of Unemployment

Table A-15 is where one can find a better approximation of what the unemployment rate really is.

Notice I said “better” approximation not to be confused with “good” approximation.

The official unemployment rate is 13.3%. However, if you start counting all the people who want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6.

U-6 is much higher at 21.2%. Both numbers would be way higher still, were it not for millions dropping out of the labor force over the past few years.

Some of those dropping out of the labor force retired because they wanted to retire. The rest is disability fraud, forced retirement, discouraged workers, and kids moving back home because they cannot find a job.

Strength is Relative

It’s important to put the jobs numbers into proper perspective.

In the household survey, if you work as little as 1 hour a week, even selling trinkets on eBay, you are considered employed.

In the household survey, if you work three part-time jobs, 12 hours each, the BLS considers you a full-time employee.

In the payroll survey, three part-time jobs count as three jobs. The BLS attempts to factor this in, but they do not weed out duplicate Social Security numbers. The potential for double-counting jobs in the payroll survey is large.

Household Survey vs. Payroll Survey

The payroll survey (sometimes called the establishment survey) is the headline jobs number, generally released the first Friday of every month. It is based on employer reporting.

The household survey is a phone survey conducted by the BLS. It measures unemployment and many other factors.

If you work one hour, you are employed. If you don’t have a job and fail to look for one, you are not considered unemployed, rather, you drop out of the labor force.

Looking for jobs on Monster does not count as “looking for a job”. You need an actual interview or send out a resume.

These distortions artificially lower the unemployment rate, artificially boost full-time employment, and artificially increase the payroll jobs report every month.

Final Thoughts

Last month I stated "This was the most distorted BLS report in history."

Given the BLS repeated the same error, this report was worse.

Mish

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc