Surging ahead: AUD/USD's technical breakout and market dynamics

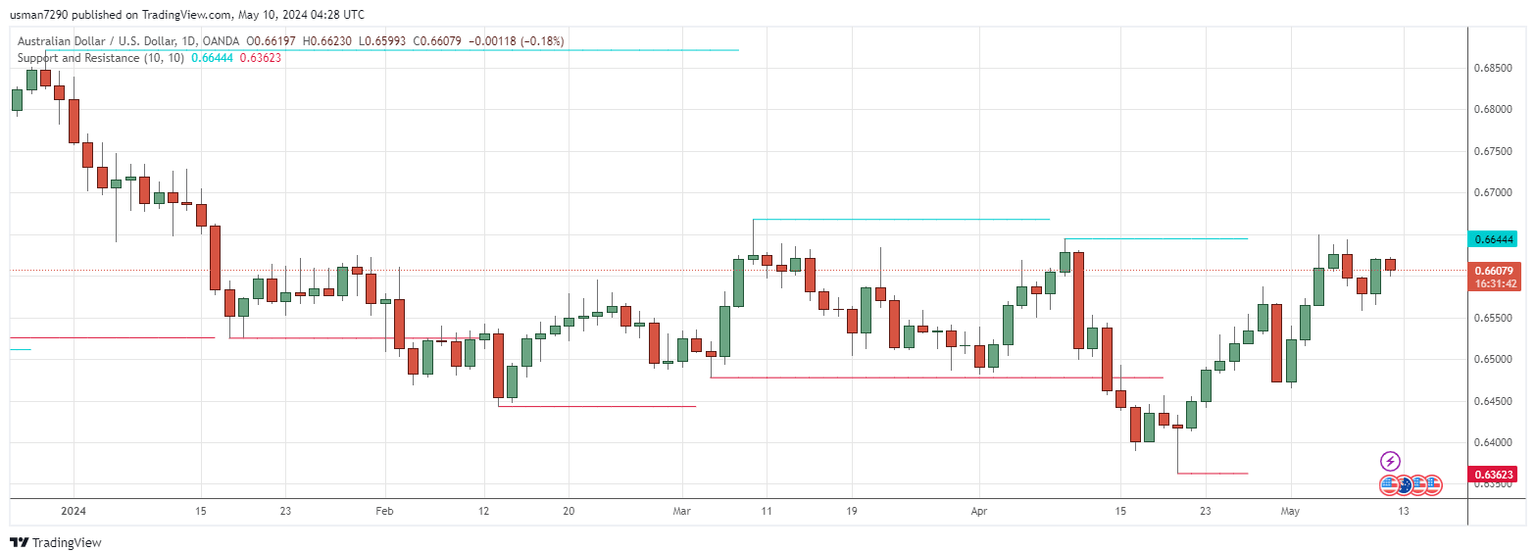

The AUD/USD currency pair showcased a robust rebound on Thursday, pivoting from a crucial support level to hint at a potential upward trend. After touching the trendline support at approximately 0.6563, the pair climbed to around 0.6620, suggesting a bullish breakout from a descending channel on the 60-minute chart. This movement offers a fresh perspective on the currency pair's trajectory, aligning technical indicators with fundamental economic updates.

Technical analysis

From a technical standpoint, the AUD/USD has now surged past the 100-hour moving average, signaling a strong bullish inclination. This recent ascent pushes the pair towards the overbought territory on the 14-hour Relative Strength Index (RSI), a development that traders are closely monitoring. The breakout from the descending channel and the movement above the moving average collectively point to a continuation of the upward trend, provided the momentum sustains.

Fundamental analysis

On the fundamental front, the pair's dynamics are shaped by recent economic indicators from both the U.S. and Australia. In the U.S., the higher-than-expected initial jobless claims at 231k contrast with the continuing claims which slightly outperformed expectations. Australian indicators also paint a mixed picture, with steady interest rates juxtaposed against a dip in Q1 retail sales. These fundamental factors are critical in informing the currency pair's strength and potential future movements, especially with upcoming data like the preliminary Michigan Consumer Sentiment Index likely to sway market sentiments.

Trading idea

For traders, the current technical setup combined with fundamental backdrops opens up various strategic trading ideas. With the AUD/USD poised above the trendline and moving average, bullish traders might eye the next resistance levels at 0.6706 and potentially at 0.6793 as viable targets. Conversely, bearish traders should consider the 0.6542 and 0.6447 levels for potential pullbacks, especially if upcoming economic releases fail to bolster the bullish scenario. This dynamic environment presents multiple avenues for traders to explore, depending on their market outlook and risk appetite.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.