Subtle NVDA earnings hint

S&P 500 tried to break down early in the session, and so did Nasdaq – but the given 5,615 level held, and amid financials leadership (another up day with JPM up is as good as it gets), it‘s the SMH reversal and late session buying that reveal important signs about positioning for NVDA earnings after the close today.

Yeah, I wrote earlier that it‘s maybe just as important as Jackson Hole, and all we can work with, is ongoing positioning ahead of the data release (way less frothy and speculation laden than prior instances, and that gives more upside surprise risk in the resulting price reaction. Revisint my yesterday‘s prediction that needs to be updated with the above mentioned Nasdaq positive surprise (of outperformance).

(…) Tech weakness before Wednesday‘s close, the NVDA uncertainty, is practically the most surefire variable at the moment. So, how will it end? I think with NVDA beat and relief over not too bad guidance – those heavy capex spending where largest players have to keep up with the Joneses no matter what, is the indicator. It has the power to turn the shaky ground looking SMH chart.

The fake breakouts and breakdowns environment of buying supports (5,615 talked above) left out Russell 2000 for now – still consolidating Jackson Hole outperformance called, and sensitively reacting to daily yields move that are ushering in profit taking moves for USD shorts (and more dollar downside is to continue after we get it over and done with).

One more clue apart from my summary published in our channel, comes from VIX.

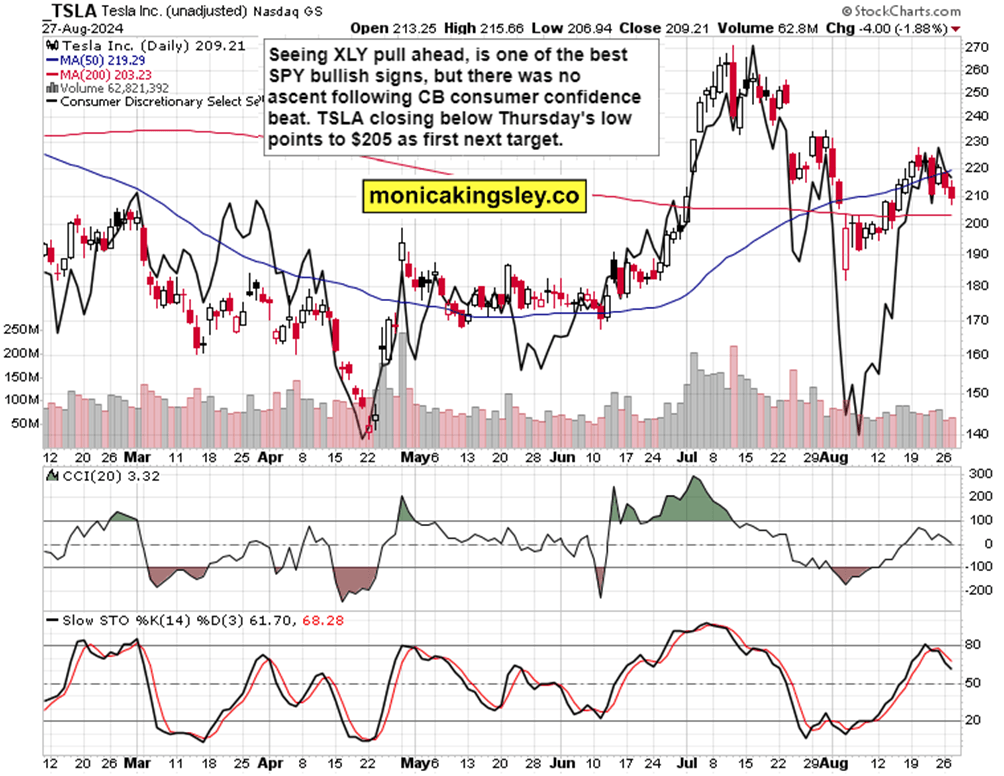

Check also TSLA and discretionaries.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.