Today’s November's wage data showed solid gains, suggesting the economy remains on the recovery path and the virtuous cycle between solid wage growth and inflation is strengthening further.

Wage growth rose firmer than expected but not catching up with inflation rise

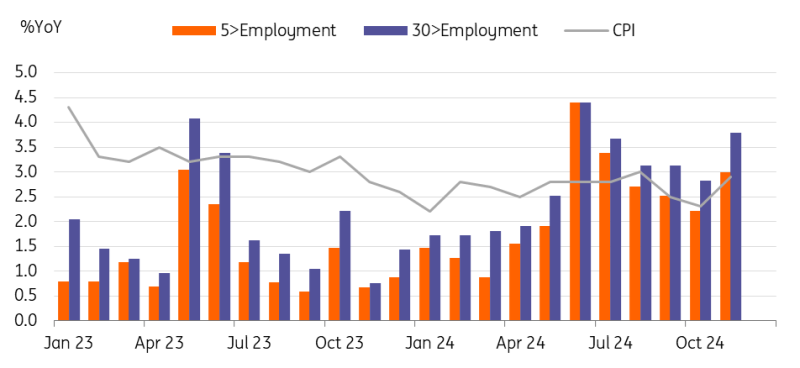

Labour cash earnings growth jumped 3.0% year-on-year in November (vs 2.2% in October, 2.7% market consensus) thanks to a rise in minimum wages and a big bonus gain. However, inflation-adjusted real cash earnings dropped -0.3% in November (-0.4% in October, market consensus -0.6%), which have yet to catch up with rising inflation despite solid nominal wage growth. Inflation accelerated in November and December as the government energy subsidy programme ended. The more important gauge of earnings, the same sample-based cash earnings, the BoJ’s preferred measure, rose even stronger than headline growth at 3.5% (vs 2.8% in October, market consensus), increasing the likelihood of a January hike.

Solid wage gains continued throughout FY24

Source: CEIC

BoJ set to hike in January, but it's a close call

Market expectations for a BoJ rate hike had been leaning towards a March hike rather than a January hike after Governor Ueda's dovish comments in December. At the last BoJ meeting, Governor Ueda cited two factors for a hold. Firstly, growing uncertainty about Trump's policies and secondly, waiting for clearer signs of sustainable wage growth. These all point to a March hike. The preliminary Shunto results will be available in March, and by then Trump's policies will be fairly clear.

But we believe that recent data – including solid consumption, 2% above inflation for a considerable period, and continued healthy wage growth – support a January hike. Also, there have been encouraging signs already that next year’s wage growth will be almost as strong as this year’s from early wage talks of some large companies. With the Fed’s rate cut pace expected to be slowed down, USDJPY is likely to get more upside pressures, resulting in adding more inflationary pressures. Tokyo inflation showed a 3.0% YoY gain in January. Indeed, Trump's policies are a key factor to consider, poses risks to our base case scenario. We maintain our January hike call but will closely monitor Trump's inauguration and his policy development.

Read the original analysis: Strong wage growth raises odds of Bank of Japan rate hike in January

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD holds around 1.0300, with USD still dominating the scene

EUR/USD trades within familiar levels at around the 1.0300 mark, although the US Dollar pushes marginally higher in a quiet, holiday-inspired American session. Focus shifts to US Nonfarm Payrolls on Friday.

GBP/USD rebounds from multi-month lows, trades around 1.2300

GBP/USD trimmed part of its early losses and trades around 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep an eye on comments from central bank officials.

Gold hovers around $2.670, aims higher

Gold extended its weekly recovery and traded at its highest level since mid-December, above $2,670. The bright metal retreated modestly in a quiet American session, with US markets closed amid a National Day of Mourning.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.